With records being smashed, should you call time on this bull market?

Anyone with more than 10 years’ investing experience has seen this before – stocks going up with nary a hint of concern nor any willingness to fall. And look around – it’s not just stocks. A whole range of luxury goods are hitting record prices. Property, watches, wine, cars, art, jewellery. Is it time to be cautious? You bet.

Typically, in a bull market, we hear the refrain ‘Buy the Dips’. But even that’s impossible at the moment because… THERE ARE NO DIPS! Each morning, every morning, we wake to the news that the Dow Jones is up a quarter of a per cent…again.

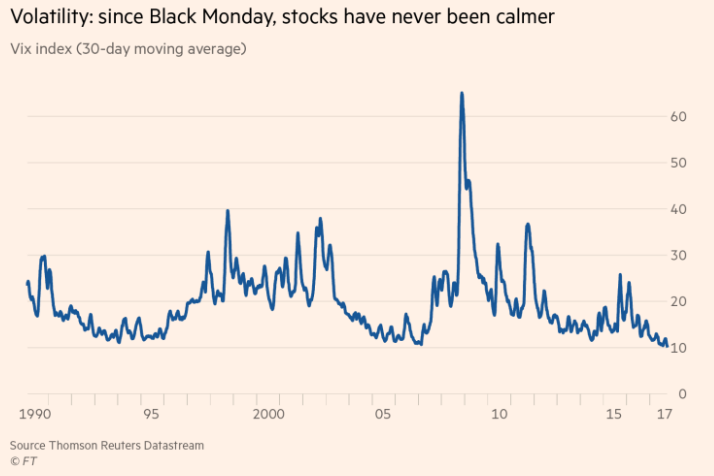

As Figure 1., Figure 2. and Figure 2a. below reveal, since October 2016, the S&P500 has displayed only one-way traffic. The index rises interminably and volatility continues to decline, and that’s despite fake news at Facebook, the incineration of cash at Tesla, Russian intercession in US elections, Chinese debt issues, the threat of nuclear attack or even missiles flying over Japan. Every day the market just keeps going up.

Here’s how Bloomberg has reported the same observation (source: Bloomberg 23/10/2017)

“Earnings-day blowups, leverage warnings in China, Apple’s worst rout since August. Oh, and a sixth straight week of gains for the S&P 500.

We’ve noted previously that more than one-dozen companies on the Nasdaq 100, companies like Netflix, GoDaddy, Yelp and Salesforce, are trading on multiples of more than 200 times. We’ve noted the Bank of International Settlements (BIS/Oxford) observing that there are now more margin loans supporting the US stock market than during the technology boom of 1999/2000 HERE. We have discussed the collective market value of Tesla, Uber and Twitter being US$140 billion and their collective profit being zero. We have summarised Robert Shiller’s warning that record market valuations, record EPS growth and record-low volatility, mimics the conditions prior to almost every one of the 13 bear markets since 1871. And we have mentioned the new adjective, for a profitless Australian start-up with a near billion-dollar market capitalisation, being ‘Pre-Revenue’.

But nothing highlights the weirdness more than a simple picture of the S&P500’s advance.

Figure 1. S&P500 melting up.

At its current level of 2,559.0, the S&P500 has exceeded all forecast made at the start of the year by US analysts surveyed by CNBC. Indeed, at the end of 2016 RBC senior equity strategist Jonathan Golub was the most bullish with a forecast of 2500 points by the end of 2017. At 2554 points today, the S&P500 has now exceeded even the most bullish bull’s expectations. In June Golub raised his forecast to 2,600 points and Morgan Stanley now has an estimate of 2,700.

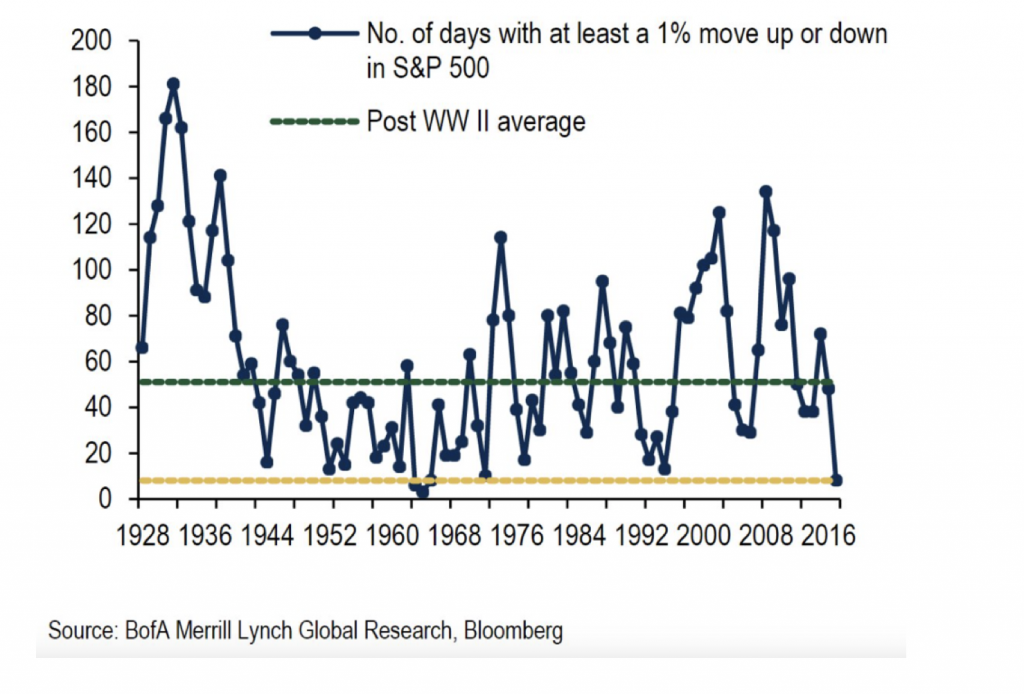

Figure 2. Volatility crashes (number of days S&P500 moves more than 1%)

Figure 2a. VIX volatility

Another curious observation is the rapidity with which the market recovers from major macroeconomic setbacks or catalysts. JP Morgan observed that while the market took 65 days to recover from the 2015, ETF-inspired flash crash, the market took only 5 days to recover from Brexit and just 16 hours to recover from Trump’s victory.

The incessant rises and the absence of meaningful pullbacks has produced a curious, if not welcome, ‘giving up’ by value investors.

Throwing in the towel

In June 2017 Goldman Sachs issued a report entitled, “The death of value?” The report noted the strategy’s declining effectiveness, noting that implementing a value investing approach, that went long the stocks with the lowest valuations and short those with the highest valuations, resulted in a cumulative loss of 15 per cent to investors over the last ten years. Following the release of the report, CNBC proclaimed, “The investment strategy pioneered by Warren Buffett is in crisis”.

(On the point about Buffett’s brand of value Investing today, I refer you to our blog post covering the Interview of Charlie Munger at the Daily Journal Corporation’s March AGM. In an expansive answer to a question about Berkshire recently buying airlines, Exxon and Apple Munger observes: “Do you know why Warren bought Exxon? As a cash substitute! He would never have done that in the old days! That’s a different kind of thinking from the way Warren came up. He’s changed… And I think he’s changed when he buys airlines and he’s changed when he buys Apple.”…“Think about the hootie we’ve done over the years about buying high tech; ‘we just don’t understand it’; ‘It’s not in our circle of competency’; ‘The worst business in the world is airlines’ … and now we appear in the press with… Apple and a bunch of airlines!”…“I think we’re adapting to a business (investing) that has gotten much more difficult. We just have to marry the best person who will have you.”)

Returning to the subject of once-famed value investor throwing in the towel, we reported Jeremy Grantham voicing his concerns about value investing in his first quarter 2017 letter to investors. In the letter he stated, “this time seems very, very different”, and finally succumbed to the idea that the rules of value investing may no longer apply.

Finally, and I will write about this again in the next week, we have seen an increasing frequency of comments, from otherwise moderate market observers, that interest rates and inflation ‘may not emerge again’. If such forecasts prove prescient, lending your money to Argentina (a country that has defaulted several times in the last 90 years) for 100 years at 7.29 per cent – or just a few per cent above the rate at which you would lend money to the US Government – makes perfect sense.

There’s only one problem. It only makes sense in a world of relative value. By that we mean, for example, stocks in aggregate are cheap, only when compared to bonds.

Buying a US 10-yr treasury bond that is yielding 2.33 per cent p.a. is the same as paying 43 times earnings with no growth – remember bond coupons are fixed. Therefore, any stock that offers growth, with a PE of less than 43 times, is deemed cheap. But in a world of attractive relative value, the value is ephemeral – especially if interest rates climb.

FOMO versus Fear of Loss

Interest rates close to zero for an extended period of time fuels a migration out of cash and into income-producing assets. Unsurprisingly, in Australia we have seen strong rallies in ‘bond proxy’ stocks in the infrastructure sector, such as those for airports and roads.

Like a plague of locusts, feeding on a field and moving on, investors chasing yield continue to suffer at the hands of classic yield traps such as Seven West Media, David Jones and Myer between 2012 and 2014, Monadelphous and WorleyParsons in 2015, BHP, Woolies and Origin in 2016 and Telstra in 2017, all of whom cut their dividends on migratory yield chasers.

As they suffer burns, or prices move even higher, investors move further up the risk spectrum. Howard Marks described the boom in tech stocks, such as those mentioned earlier, as well as Facebook and Google, as “the pursuit of the new, untrammelled by knowledge of the past”.

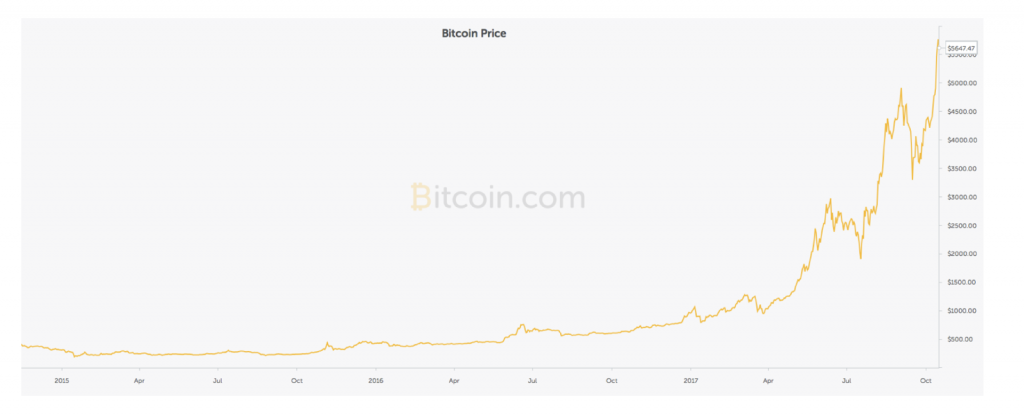

And finally, no commentary on the state of the markets would be complete without a comment on the price of the cryptocurrency Bitcoin. Jamie Dimon says central banks will “crush it”, news reports suggest that exchanges can be hacked and they’re the preserve of cowboys and drug smugglers, while hedge funds who have set up portfolios to trade multiple cryptocurrencies suggest digital currencies have all the characteristics required to be considered ‘money’, including uniformity, divisibility, portability, durability, limited supply and acceptability. Regardless of who is right, the price ascent, shown in Figure 3. is another sign that investors/speculators are willing to risk anything to make a dollar.

And the icing on the cake must be the taxi and Uber drivers asking me whether they should ‘invest’ in Bitcoins!

Figure 3. Bitcoin’s ascent

If interest rates remain low for long enough, as they have, the fear-of-missing-out usurps the fear-of-loss, and rising prices feed on themselves. To some extent that is what appears to be happening now, and the record prices for assets that produce no income ( see luxury goods postscript below) is symptomatic of that.

While conditions remain benign, and volatility, inflation and interest rates low, all of the conditions that I have listed above will be viewed as interesting but otherwise inconsequential. Of course, that view will be revised if current conditions are followed by any kind of asset price ‘dislocation’. Commentators will then observe; ‘all the conditions precedent were evident’.

For as long as the market surmounts all concerns, those concerns can be ignored and thus cease to exist. But when the market reverses (and keep in mind that could be some years away), those concerns will be remembered as harbingers of something dire. They may also represent a lesson lost on those who chose to ignore them completely.

Postscript

No extended bull market is confirmed until early profits are recycled into luxury goods.

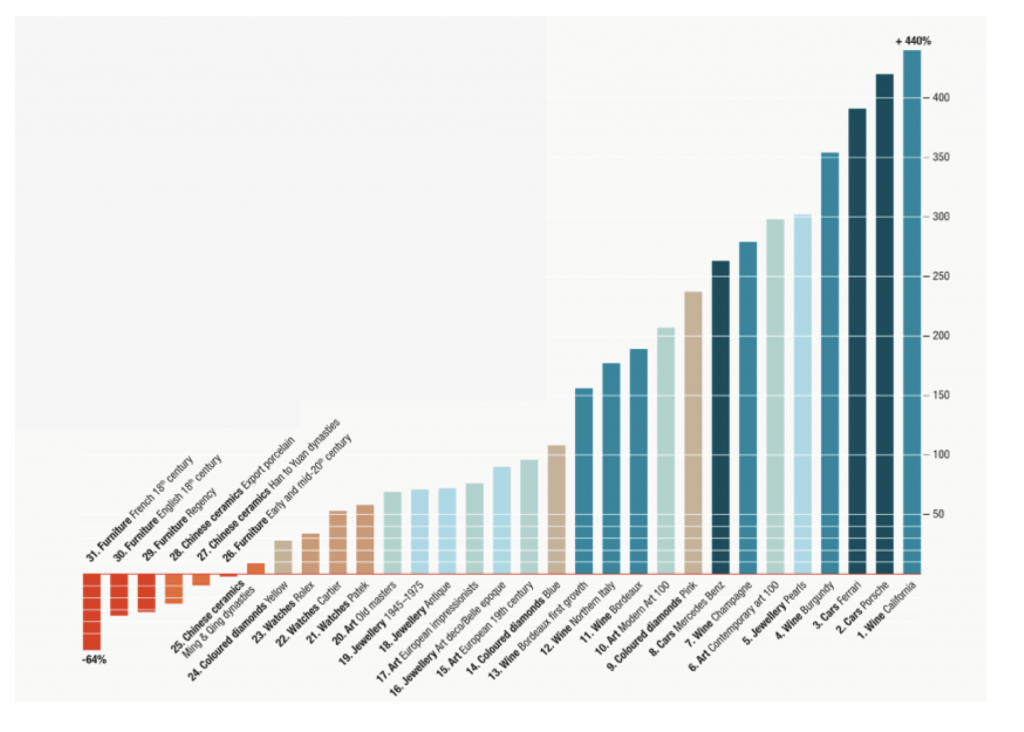

Figure 4. Knight Frank Luxury Investment Index (KFLII) Ten years to Q4 2016

Knight Frank monitors the prices achieved in the collectors’ market for ‘investments of passion’ and notes that, in the collectible vehicles market, 2016 saw multiple records smashed.

A Ferrari 1957 335 Sport became the most expensive car to go under the hammer ever, in euro terms at least, when it was sold in Paris for €32m.

In the US, an historic 1962 Shelby Cobra sold for over US$13 million, making it the most expensive American car to sell at auction.

The priciest British car to ever be sold – A 1955 Jaguar D-type – fetched almost US$22 million.

A new record for a pre-war vehicle was recorded when a 1939 Alfa Romeo 8C Lungo Spider sold for just under US$20 million.

And finally, the previous all-time record for a car sold at auction of US$38m for a 250 GTO was broken by Kidstons when it sold a 1962 Ferrari 250 GTO but the price has not been revealed.

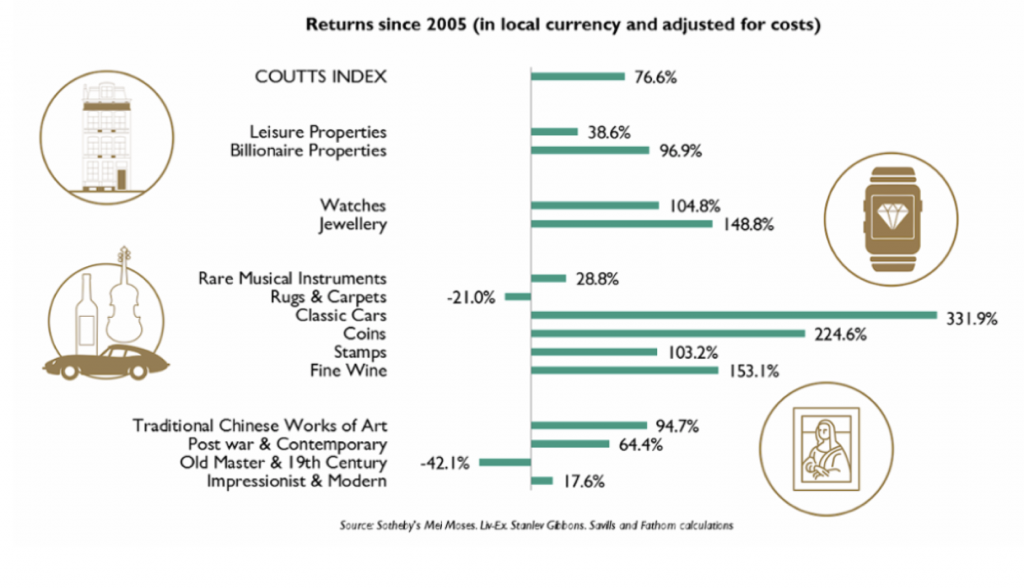

British private bank, Coutts, reveals in their own index of luxury or ‘passion’ assets that cars have gained the most across the index categories since 2005, increasing fourfold over the 12 years to 2017.

Figure 5. Coutts Passion Asset returns for 12 years to 2017.

The year 2016 also saw a vivid blue 14.62-carat diamond called the Oppenheimer Blue sold by Christie’s Geneva for the equivalent of almost US$51 million, making it the most expensive jewel to ever sell at auction.

A rare stainless steel 1941 Patek Philippe chronograph watch broke the record for the most expensive wristwatch sold at auction when it went under the hammer with Phillips Geneva for US$11 million.

In the art world, we have previously written about the early 2017 sale of a painting by Basquiat for US$110 million – a world record for a US artist and for a post-1988 painting.

In 2016, Claude Monet’s iconic Grainstack paintings sold for US$81 million, way above its US$45 milluon estimate. Girls on the Bridge by Edvard Munch, sold by Sotheby’s for US$54 million – up 75 per cent on the US$31 million it fetched in 2008.

And another artist record was smashed when a painting Untitled XXV by the Dutch-American artist Willem de Kooning, was sold by Christie’s for US$66 million.

“Warren bought Exxon….as a cash substitute”

Surely, as you have attested, it is better to lose 2% on cash (opportunity cost / inflation cost etc.) rather than when (not if) the market corrects, to lose 10-20% on equity, even if the company was a wonderful quality one and bought at a discount ?!

You would have to be VERY sure of yourself and your valuation analysis otherwise.

Difficult to be wrong if youre saying there will be a stock crash in the next couple of years ie “…some years away…”. But are you ringing the bell now & loudly? So bottom line is youre suggesting we cut our speculative & high PE stocks, take some profits on winners and sit on more cash than normal for 2 years. Maybe even take a WES yield rather than a term deposit. A say 2 year, warning is tortuous advice (opinion).

Paul, don’t come here for “advice”. We aren’t calling anything. Merely making an observation and sharing them. For you to read all of that into what we have written is to err.

Yes Roger I’ve been seeing it all unfold just like that drated downturn when the last bubble burst so I’m nervous and wondering if its the right time to invest in the MOGL at this time so how do you guys and girls feel, is it the right time to release? Paul

Hey Paul,

We’re no good at predicting market direction so we go about following our process. The result is that we are holding some cash because deep value is not widespread. But in the long run we also know that being invested in high quality businesses returns a better result than holding cash, so we are more than a little invested in the market.

What are your thought when Warren Buffett basically says stock are over value if interest rate normalise and undervalue if interest rate stays the same for the next 10 years?

My thoughts are; he’s right!