With house prices softening, can millennials afford to eat avocado again?

Property prices are reported to have softened since our last ‘smashed avocado’ update. However, the price declines have not been enough to ease the burden for people trying to save for a home deposit. Thankfully, there’s good news on the horizon for those wanting to get into the property market AND eat their avocado too.

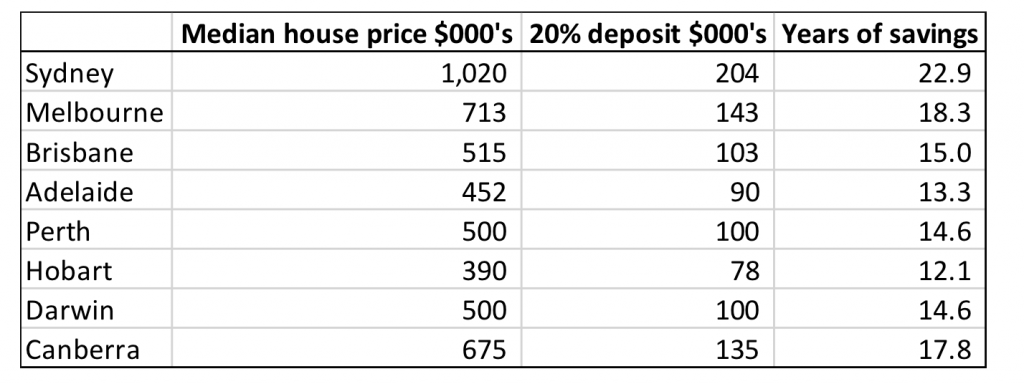

For those keeping track, Australia’s most populous cities still require a good 15 years on a ‘zero-avo’ savings plan. We’ve changed no assumptions here from our last report – the required deposit is 20 per cent of the median house price and the interest rate paid on savings is 5 per cent p.a.

The best place to live for those seeking the earliest return to ‘avo on toast’ is still Hobart. The worst place is Sydney.

However, the house price declines have not led to much of a drop in the duration of saving. This is because the reported declines have not fed through into the ABS data.

There’s also good news! Our next avo-banquet might occur sooner than we think as the high price of avocados is eliciting a supply response. Australian avocado supply for FY2018 is forecast to be 75,000 tonnes – a new high. In addition, the Courier Mail noted back in October that farmers are redirecting farmland from other crops to avocados, which will help drive 2025 forecast production (expected to be over 100,000 tonnes).

Should this marginal supply be enough to push down avocado prices, the end of our fasting may be in reach sooner than we’ve anticipated in the above projections.

As in prior pieces, we highlight that this blog was written tongue in cheek, but we’re sure the message is clear. If the cost of housing is perceived by potential millennial buyers to be too high, the rational consumer will substitute spending towards life’s other pleasures in order to maximise their economic utility.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY