Will increased migration boost car sales and auto stocks?

The surprising jump in house prices – surprising because it comes amid rising interest rates – has been put down to a lack of supply and accelerating immigration. By the same token, immigration should also lead to a boost in car sales. Could this have a positive effect on the fortunes of companies like AP Eagers (ASX:APE), Carsales (ASX:CAR) and Autosports Group (ASX:ASG)?

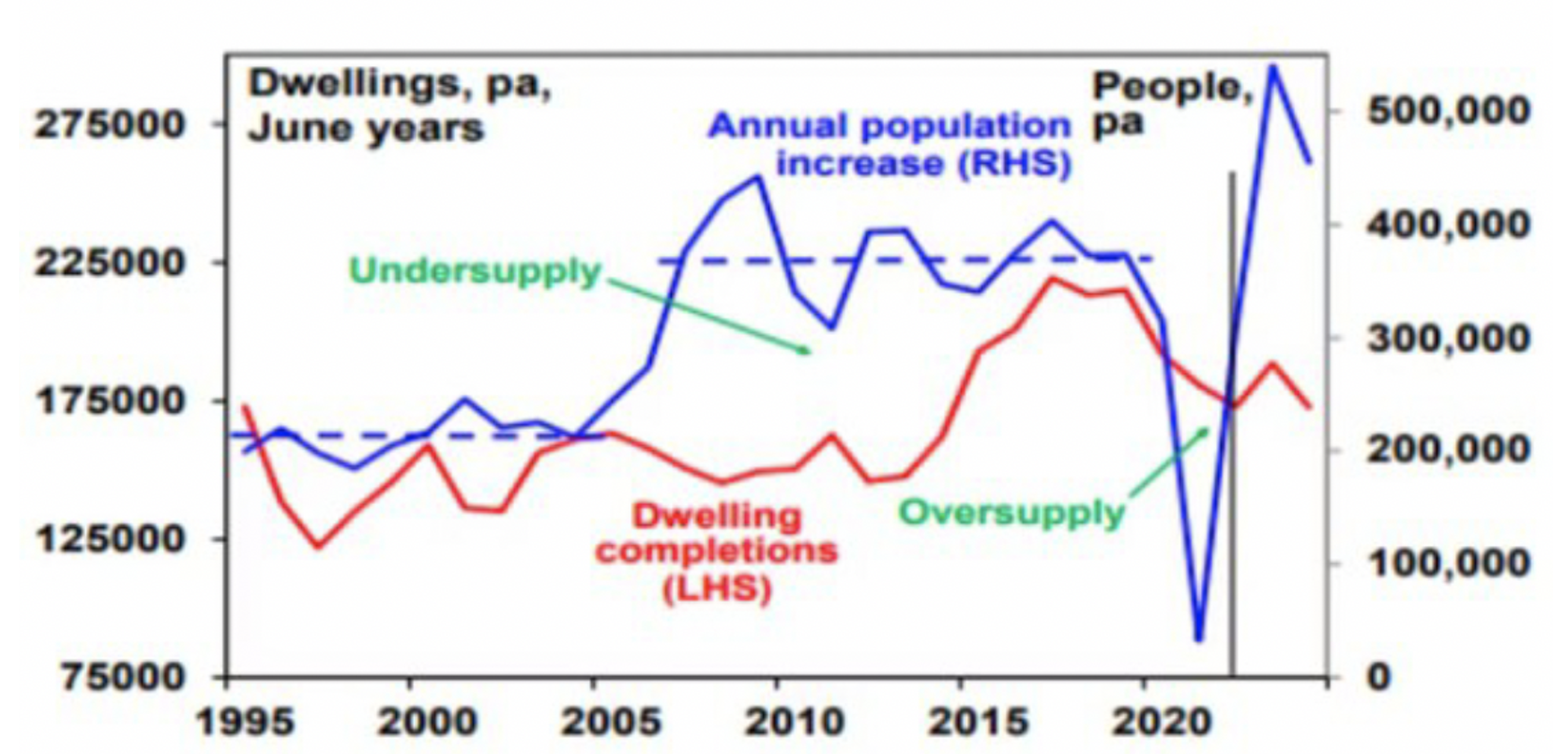

The housing issue will not disappear because, as Figure 1 reveals, the problem is entrenched and systemic.

Figure 1. Housing supply bottleneck is nearly a decade old

Source: AMP Capital

Housing is fast becoming a political hot potato because not all the 400,000 immigrants arriving in Australia annually will be able to find a place to live.

But this is not an article about houses.

One of the other essential requirements for new arrivals is transport, and public transport is inadequate for many people. That means demand for passenger vehicles should also remain buoyed.

Meanwhile, ASX-listed car dealer AP Eagers’ share price is virtually unchanged after two-and-a-half years. Carsales’ and Autosports Group’s share prices are unchanged over almost two years.

And that’s because, for a long-time, supply chain bottlenecks meant car dealers were unable to deliver vehicles without enormous delays. The severe stock shortages caused by global carmakers being unable to source enough semiconductors, also meant traditional sales events, such as end-of-financial-year deals, did not occur.

Supply is now ramping up as manufacturing and logistics finally catch up with the pent-up forward orders. Could this be a buying opportunity?

VFACTs data painted a picture of an encouraging deliveries backdrop. New car deliveries reached 105,684. This was up 12 per cent compared to May 2022 and up 39 per cent compared to April.

Breaking down the data a little more provides an encouraging near-term picture for the likes of Autosports Group, with luxury car deliveries up 31 per cent compared to the same month last year and up 33 per cent compared to the previous month.

At the volume end of the market, Toyota‘s month-on-month deliveries were up 52 per cent (albeit off a depressed prior month for all brands), but remain down 20 per cent in May compared to the same month in 2022.

It is important for dealerships, who run very high fixed costs, to see higher volumes during the June (tax-related) sales season, so the end of the financial year will be important for their full-year results.

The short-term picture seems encouraging and may be spurring some of the major listed players’ directors to buy their own stock.

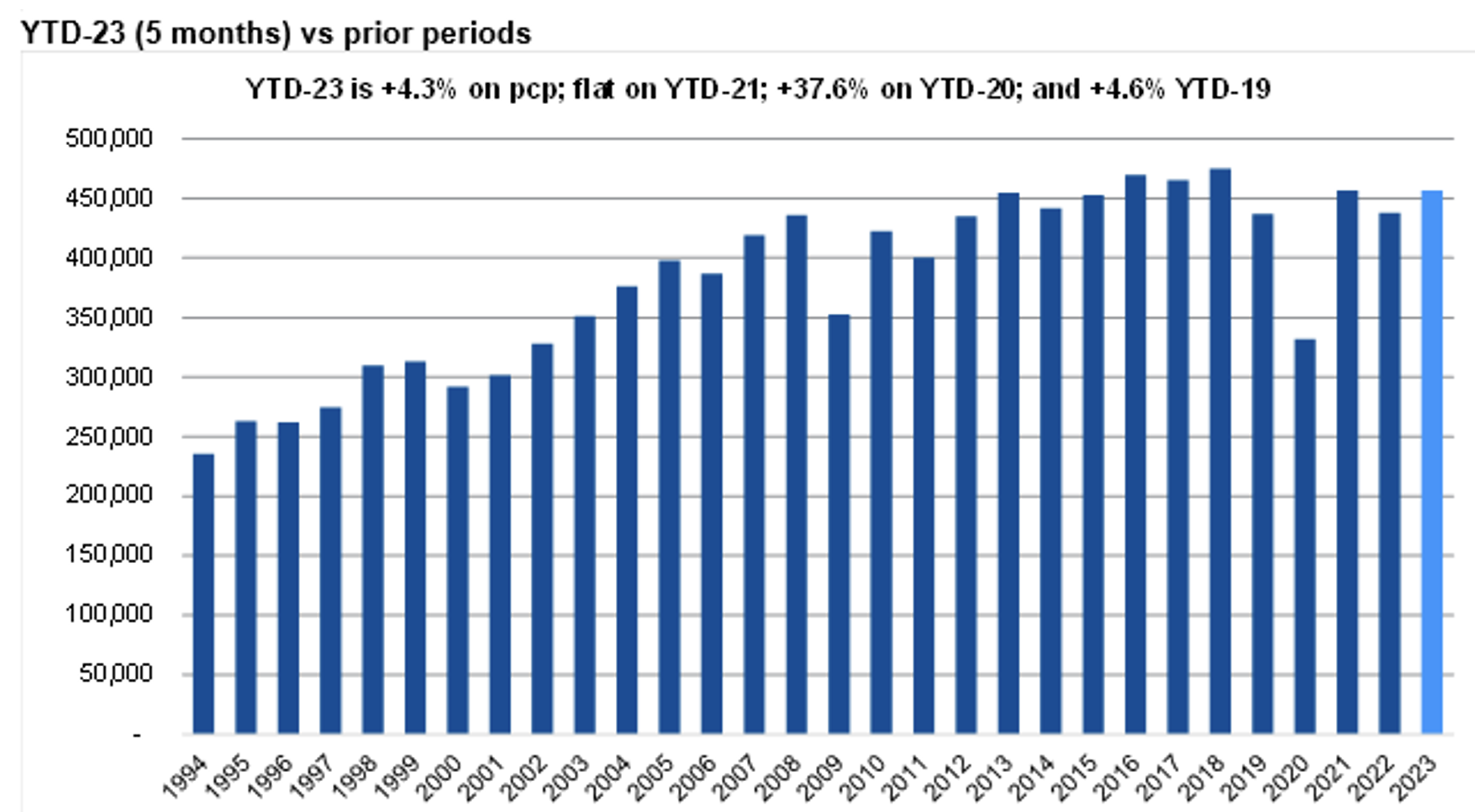

But the long-term picture matters most for investors, and the year-to-date sales data (Figure 2.) depicts a rather mature market.

Figure 2. Carsales year-to-date (first five months of each calendar year)

Source: Morgans

It seems 2023 year-to-date deliveries are about the same as the upper end of a range of sales volumes over the last 15 years. Even if we assume some lingering bottlenecks in the supply chain still hamper deliveries, is it reasonable to assume rapid and sustained annual growth in the volume of cars sold in Australia?

Some investors might suggest migration will assist car sales the same way it’s assisting real estate prices. While migration may be ramping up again and may, in turn, help car sales, it is possible that vendors of second-hand cars benefit more.

Second-hand prices initially rose during the COVID-19 pandemic as competition for second-hand stock increased amid disdain for public transport and a lack of new car supply. Over the last twelve months, second-hand prices declined as deliveries of new vehicles resumed. The recently increasing migration rates might help prices again, but longer-term, those migrants will need a place to live if they are going to remain in Australia and keep rather than dump their cars.