Why you need to keep an eye on US Treasury Bonds

Many stockmarket investors don’t pay much attention to movements in US Treasury Bonds. But there are some very strong reasons why they should. And one of those is their impact on share prices.

One of the key inputs to valuation is the risk adjusted cost of capital applied in discounting the future cash flow streams, whether it be applied to dividends or the company’s free cash flow. This is effectively the annual return that is required by investors to justify investment in the asset.

The basis for determining the risk adjusted cost of capital begins with the return that can be generated on a risk free basis, and is then scaled up depending on the perceived riskiness of the asset or business being valued.

Given that there are no truly risk free assets, long term government bond rates are generally used as a proxy, with the US 10 year Treasury Bond yield to maturity being the most used in valuations.

But bond markets are just like any other market – the price of bonds is determined by an equilibrium being established between the available supply and demand for the bond at any given point in time. Over the last 10 years, the quantitative easing policies of The Fed and other major central banks have boosted demand relative to the supply that is created by Governments issuing bonds to finance fiscal deficits. The incremental buying by central banks competed for the available supply with natural demand from those seeking income producing assets, driving up bond prices and down yields.

With the Fed having ceased replacing any maturing bonds in its portfolio from last September, this artificial source of demand was removed. As such it is not surprising that bond prices have fallen, which results in higher bond yields, lifting returns for bond purchasers on this very low risk asset class.

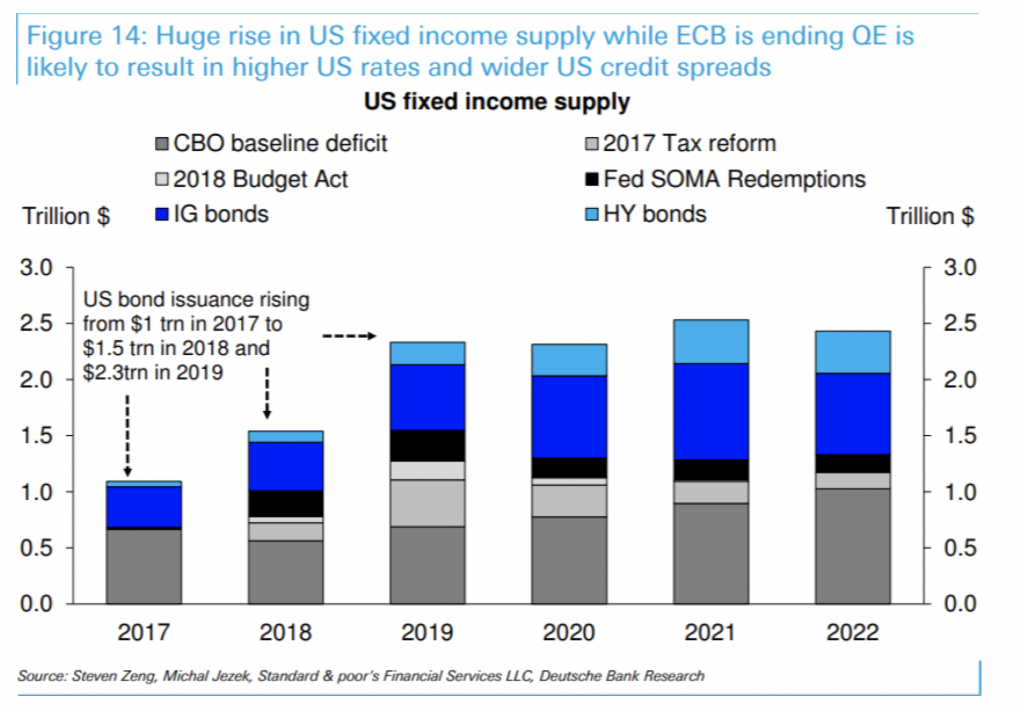

A new report from Deutsche Bank that looks at the risk of debt crisis in the US highlights that the tax plan implemented by the US Government from the start of this year will have a significant impact on bond issuance by the US Treasury. This is due to the increase in the funding requirement for the growing US Government deficit. Issuance of US Government bonds by the US treasury is expected to more than double over the next two years.

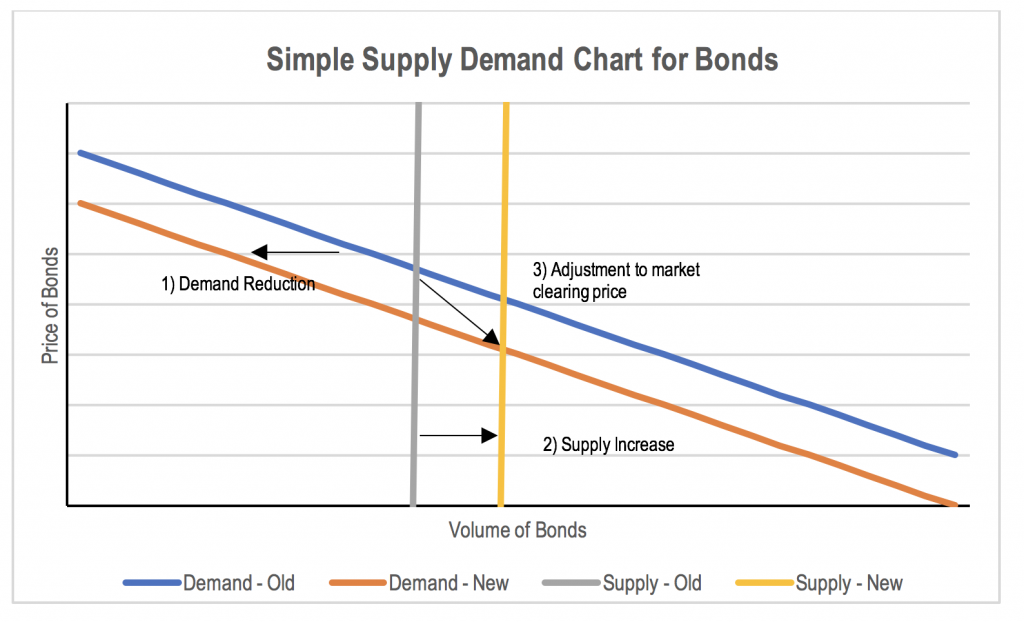

Looking at this in terms of an extremely simplistic microeconomic diagram mapping the impact on the supply and demand of changes in the price and volume of bonds, the retreat from bond purchasing by The Fed represents a left shift in the curve that maps demand for all combinations of price and volume. At the same time, the fiscal stimulus shifts the required supply of bonds to the right (i.e. more volume is required to fund the increased deficit). The supply curve is essentially vertical as the Government needs to fund a given deficit with bond issuance irrespective of the price of the bonds it issues.

Source: MIM

The price of bonds needs to fall sufficiently to attract more capital into this asset class, otherwise there won’t be enough buyers for the amount of bonds the Government needs to sell. The increase in capital required to fund the sale of the additional bonds inevitably comes from other asset classes, resulting in an increase in the rate of return for all assets across the risk curve as investors sell other assets to re-weight their mix of holdings toward bonds. To generate a higher rate of return, prices need to fall for all assets as capital is redistributed back toward risk free assets to make up for the reduction in demand from central banks, and the increase in supply from higher fiscal deficits.

Bond yields (i.e. the return generated from purchasing and holding a bond to maturity) and prices are inversely correlated (as are equities prices and future long term returns).

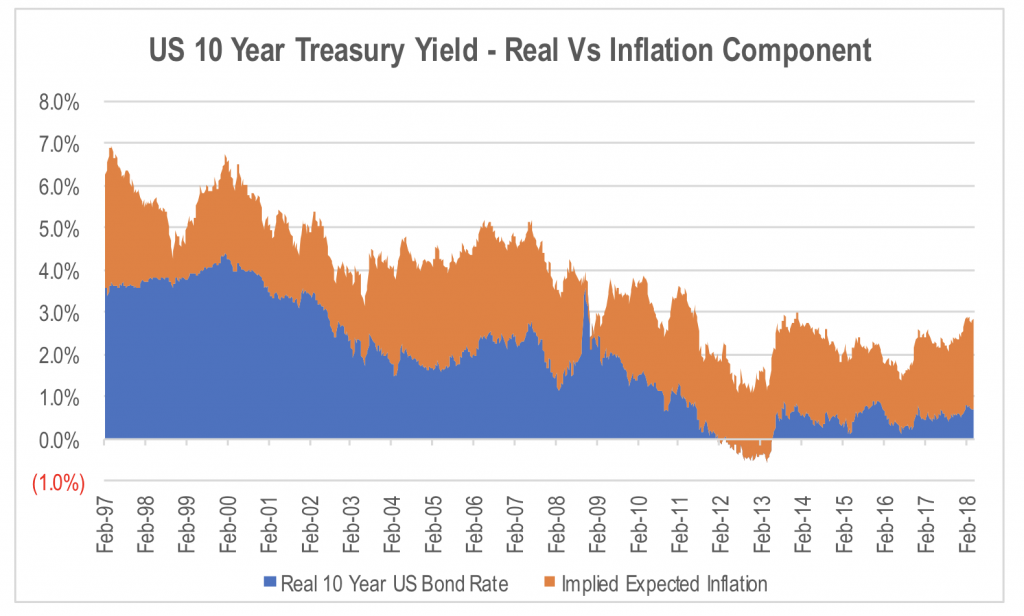

The chart below shows the decline in the US Treasury yield over the last 21 years split between the real yield, as estimated by the Bloomberg Barclays US Inflation Linked Bonds Average Annual Yield, and the level of inflation expectations implied by the 10-year nominal Treasury Bond yield.

Source: Bloomberg

This shows that the real return (i.e. the return excluding inflation) implied by bond prices has declined significantly over the last 20 years. This has an enormous impact on stock prices as it filters through the cost of capital applied to equities. It also says that the recent move up in 10-year Treasury bond yields has been due to a combination of both increases in inflation expectations on the back of economic growth and capacity, as well as an increase in real yields due to a relative shift in the supply and demand for capital.

In contrast, the impact of an increase in inflation expectations has a more muted impact on equity valuations as the impact of the higher cost of capital is offset by higher nominal earnings growth. This is because stocks are real securities while bonds are nominal securities. The degree of the offset to valuation from higher inflation driven earnings growth will depend on the company’s pricing power (i.e. the ability to pass on any acceleration in cost growth) and its return on capital. The return on capital is important because even inflation driven earnings growth needs to be supported by an acceleration in the level of capital investment as the assets being acquired by the company become increasingly more expensive. Therefore, companies with higher capital intensity and requirements (and lower return on capital) are more negatively impacted by an acceleration in inflation.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Lester Green

:

Interesting article Stuart…..thank you. Good to get a perspective on the bond market. Need to brush up on my bond knowledge as it has been all about equities for the last decade.