Why weakness in Chinese property doesn’t support increasing iron ore prices

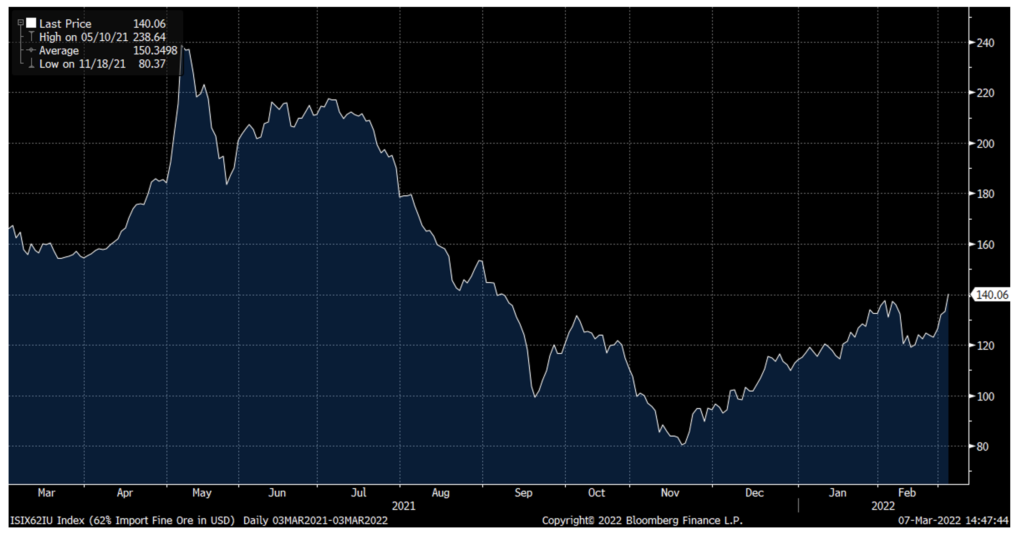

In May 2021, the iron ore price peaked at USD$238/tonne before plunging to USD$80 last November. Since then, the price has rebounded around 75 per cent. But is this rebound warranted? I don’t think so – if you consider the slowdown in Chinese property construction, which accounts for about 42 per cent of Chinese steel demand, and high iron ore inventories at Chinese ports. If fundamentals mean anything, the iron ore price is about to fall again.

Last year I published on the impact of the slowdown in Chinese property construction and the potential impacts on steel and iron ore demands.

To recap from one of those posts:

- China accounts for 78 per cent of total seaborn iron ore imports and is by far the key price driver for the iron ore price.

- China imports 82 per cent of its total iron ore demand so changes in demand will translate directly to changes in demand for imported iron ore.

- Construction of real estate is the largest single part of Chinese steel demand accounting for about 42 per cent of total steel demand.

It is therefore easy to see the Chinese property construction sector plays a significant role in what happens to iron ore prices.

Given the steep recovery in iron ore prices over the last three months from a bottom of $80/tonne to the current level of $140/tonne as we can see in the chart below, I thought it would be interesting to see what is happening to Chinese property companies and the volumes of construction they are achieving.

Source: Bloomberg

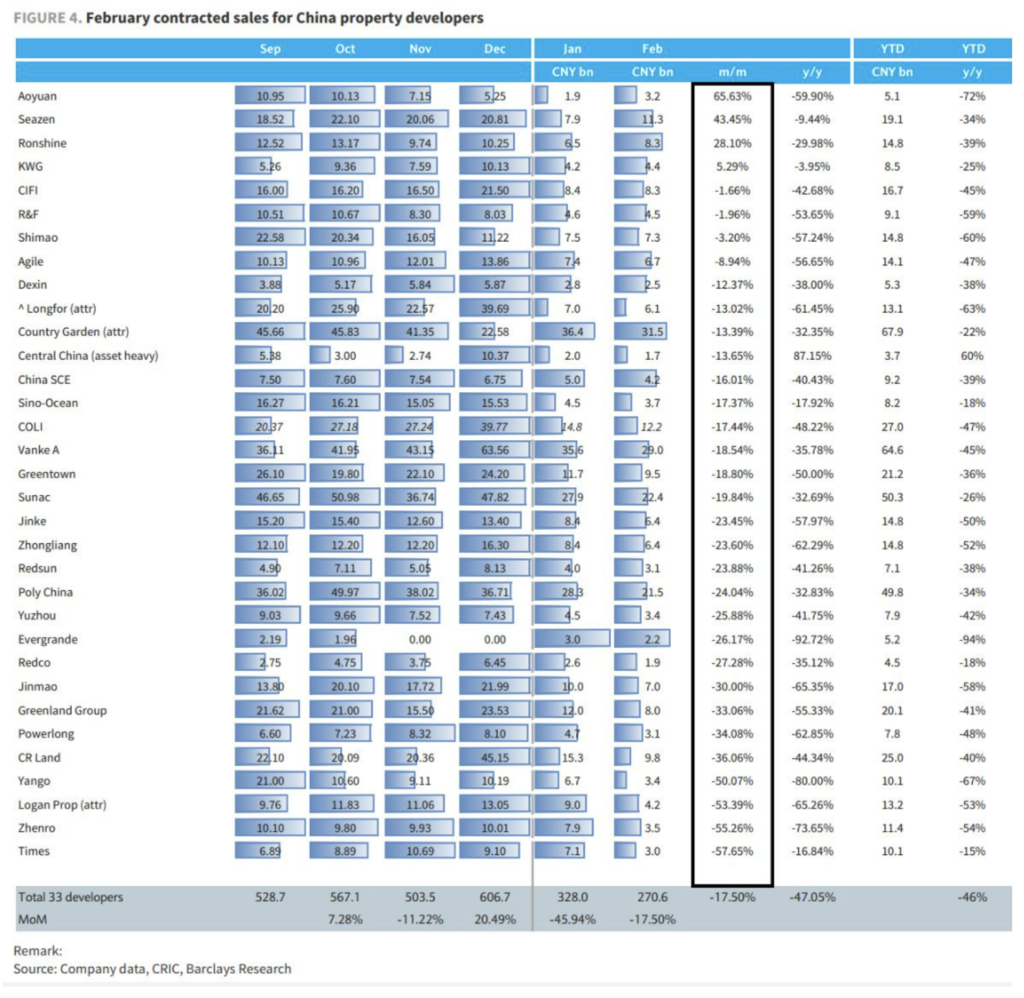

Barclays helpfully produces a report on the sales of major property developers and, looking at the February data, you are seeing numbers that are in quite stark contrast to what the iron ore price chart above would suggest:

In total, February sales saw a sharp decline both sequentially (-17.5 per cent compared to January) and on a year-on-year basis with a decline of 47 per cent. January and February in total are down 46 per cent compared to the same two months last year so the major property developers are in effect seeing their current revenues halve compared to last year.

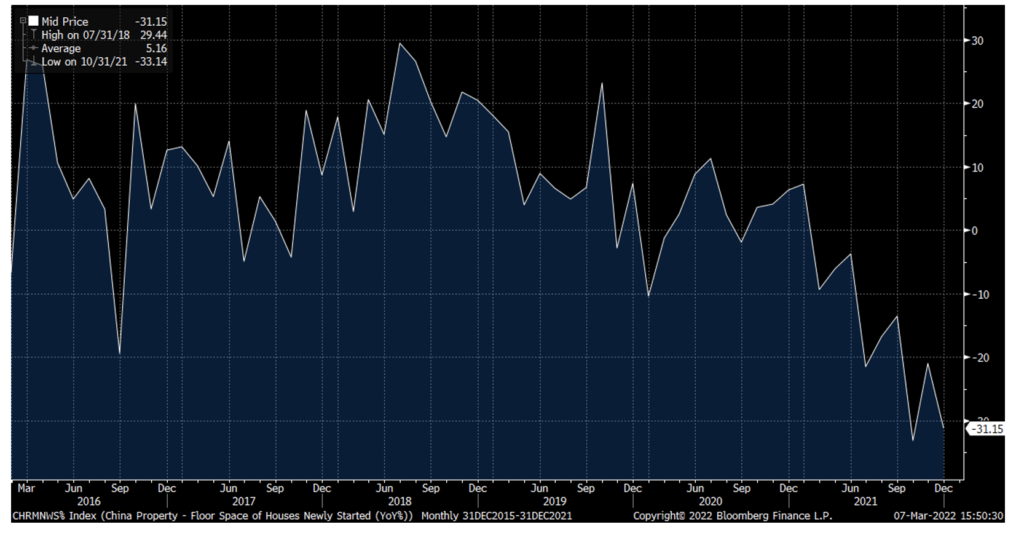

This downturn in sales is of course also impacting the property developers’ willingness and ability to start new projects and this is showing through in the statistics on new houses starts which is currently dropping by about 30 per cent YoY according to data from Bloomberg which we can see in this chart:

Source: Bloomberg

We can also see that the market is not valuing the prospects for the Chinese property developers highly as this chart showing the yield on the sector’s outstanding bonds, which is now approaching 50 per cent or, in other words, the debt is trading at close to 50 per cent on its face value:

All this paints a pretty bleak picture for steel demand from a sector that accounts for over 25 per cent of the total demand for seaborn iron ore and does not really fit with the strong recovery in iron ore prices…

Now granted, we do have the situation in Ukraine and Russia, which are both quite big iron ore exporters (Ukraine is the number 5 exporter accounting for 3 per cent of total world exports and Russia is the number 8 exporter accounting for 1.4 per cent of total world exports) but at least in my opinion, the bounce in iron ore prices is not warranted.

You can read my previous articles on this topic:

Why Chinese property worries affect us all

The 3 red lines that could bring iron ore prices back to earth

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Ricky and thanks for your comment.

You are most likely right in that the developed world will see increased capex over coming years as supply chains are rejigged. I am though not sure that this will be as steel intensive as the housing and infrastructure buildout in China that has been the driver for the last decades.

I agree the Chinese property market is in structural decline. However, I think iron ore has a strong medium term outlook.

For decades, capex spending has been concentrated in developing countries like China. However – this trend is now unwinding.

Developed countries are about to begin an enormous capex spend as they re-onshore factories, rebuild their housing stock for hybrid working and continue investing in infrastructure / renewables.