Why we are sceptical about Boral’s giant US acquisition

Boral generated rare headlines this week when it announced an agreed bid for rival US building materials company Headwaters Inc for US$2.564bn. Boral called it a “strategically compelling acquisition” with “attractive financial metrics” that will transform the company. But, looking at the history of such take-overs, and the metrics behind the deal, we are not as optimistic.

The acquisition will be funded by a A$450m institutional equity placement, a 1 for 2.22 entitlement issue to existing Boral shareholders, and A$1,629m of new debt/cash utilisation.

The empirical evidence is that the impact of large scale acquisitions on long term shareholder returns tends to be poor, with most acquisitions destroying value for shareholders in the long run. For Boral, this acquisition is a very large one, representing 64% of the company’s pre-deal enterprise value (market capitalisation plus net debt).

There are a number of other concerns we would flag from the deal.

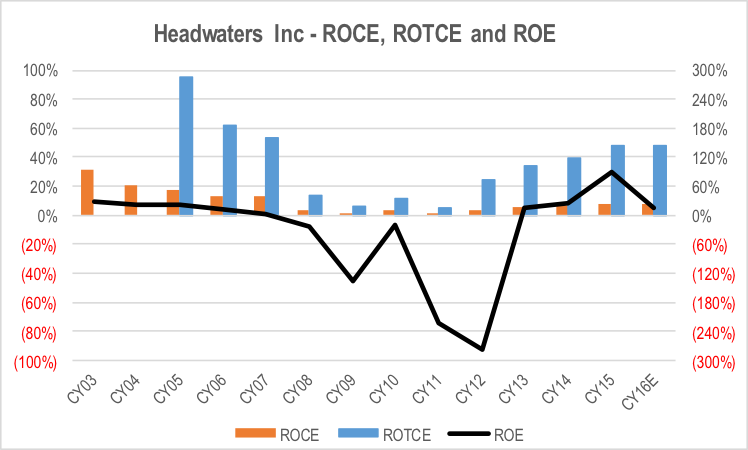

Boral’s bid price equates to an equity value for Headwaters of US$1.8bn. This is 6.1x Headwaters’ book value of equity. To justify this, we would expect the business to generate a very high ROE on a sustainable basis. However, in its most recent 12 month reported result, the ROE was 16.4%, well short of what would normally be required to justify such a high multiple.

Given that ROE is a function of returns generated by businesses at the operating level in combination with financial leverage provided by debt, the current low level of interest rates is likely to be providing a boost to ROE beyond what is a more sustainable level. If we instead look at a measure of returns based on the ungeared business, such as the return on capital employed, we can remove this distortion.

Boral is paying US$2,564m for Headwaters on an enterprise value basis (the value of the equity plus net debt acquired). This compares to the company’s capital employed of US$925m as at 30 September 2016, and tangible capital employed of US$317m. This implies a purchase price of 2.8x capital employed and 8.1x tangible capital employed.

Headwaters is expected to generate a return on capital employed of 8% in CY16 once you add back goodwill impairments from prior periods. It must also be remembered that this is a pre-tax measure of returns. As such it needs to be compared to pre-tax cost of capital (around 12-14%). As such the 8% ROCE is well below the cost of the capital.

If we remove the goodwill and other intangibles paid by Headwaters for acquisitions, the return on tangible capital improves dramatically to 48%. While this return appears to be attractive, it must be remembered that Boral is paying 8.1 times the capital base to generate this return, while the return is only 3.5 to 4 times the pre-tax cost of capital.

The US$2,564m price tag also implies US$2,247m or 88% of the price paid will be goodwill or other intangibles. This is a very large proportion of the price, and one that is usually reserved for only the very highest quality businesses.

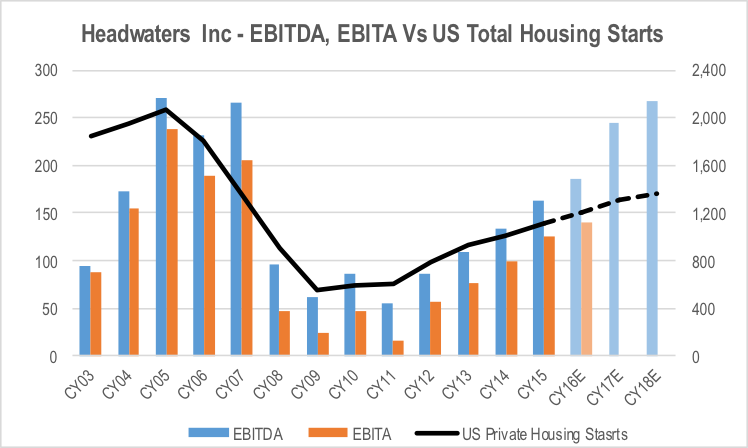

To justify the price being paid, Boral will need to generate significant incremental earnings on top of the existing earnings base of Headwaters. The proponents of the acquisition would point to the US$100m of synergies that Boral has forecast over 4 years, as well as the business’s leverage to the housing construction cycle in the US.

Looking at the synergies, assuming that there is no cost required to liberate these savings, adding US$100m to Headwaters’ EBITA would lift the ROTCE to 82%. This would come closer to justifying the 8.1 times tangible capital being paid for Headwater. However, building materials is a commodity industry with relatively low barriers to entry. Inevitably some of these savings would be competed away. It is hard to identify the barriers to entry into the housing construction materials and fly ash markets that would enable Boral/Headwaters to maintain an extraordinarily high return on tangible capital employed.

I would also note that around a quarter of the estimated US$100m of synergies are expected to come from revenue synergies. History suggests that revenue is negatively impacted by competitors merging rather than it leading to an increase in combined revenue. This is because some customers will look for an alternative supplier.

Given the multiple of earnings and capital employed paid and the forecast level of synergies, Boral will need to deliver further growth to justify the price paid for the business. A further cyclical recovery in the US housing construction market would provide earnings growth.

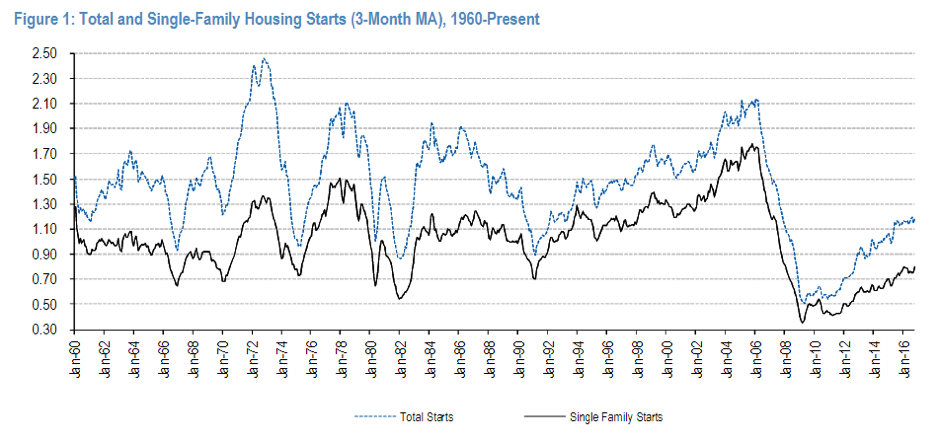

A look at the history of US private housing construction starts data suggests volumes remain well below levels of 10 years ago. However, if we take a longer term view, housing stats aren’t that far from the longer term average. The metrics quoted by management are based on earnings forecasts for the 12 months to 30 September 2017, when total US housing starts are expected to be around 1.3m.

Source: Company, Fannie Mae, Freddie Mac, MBA, National Assoc of Realtors, Conference Board, National Assoc of Homebuilders

Fiscal stimulus under the new regime in the US would provide a temporary boost to demand for fly ash and other products through infrastructure spending, but this is not something that will provide long term benefit. Therefore, it will not have a material impact on the fundamental valuation of the business.

The final flag is the level of gearing in the business. As the chart above shows, EBITDA and EBIT are highly impacted by the economic cycle. Given that degree of operating leverage for changes in economic conditions and, as such, the ability of the company to meet its debt obligations, the company should be targeting a low level of gearing. However, management has suggested that it is targeting a net debt to EBITDA ratio of 2.5x. This is more akin to the gearing ratio of a company with relatively stable earnings.

Following the acquisition, the combined company is expected to have approximately A$2.4bn of net debt. To meet this 2.5x target, the company would need to generate A$950m of EBITDA. Sell side consensus EBITDA forecasts for BLD in FY17 are currently around A$650m. Adding in Headwaters’ US$242.5m forecast brings the total to A$980m. Including the synergies (assuming 100% realisation and retention which is optimistic) increases this figure to A$1.12bn. At this level, net debt to EBITDA would be 2.1x, still a high level of gearing for a company with cyclical earnings.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY