Why these FAANG stocks are not over-priced

Much has been made of the exorbitant share prices of the world’s largest technology companies – Facebook, Apple, Amazon, Microsoft and Google. But, given the quality of their businesses, their market dominance and continuing growth prospects, are they really too expensive?

Together, Apple (PE 37x), Amazon (119x), Facebook (32x), Google (33x) and Microsoft (37x) represent more than a quarter of the market capitalization of the S&P500. At US$6.77 trillion (at the time of writing), their combined market capitalization is equivalent to the total combined GNP of Germany and the UK, and greater than the world’s third highest GNP produced by Japan.

But rather than repeat what has already been said about their stunning share prices, today we ask whether there is in fact a good reason for the support of those prices.

In his 1996 Chairman’s letter, Warren Buffett penned the following for shareholders of Berkshire Hathaway:

“Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards – so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.”

Buy businesses whose earnings rise over the years and so will the market value of the portfolio. That has certainly been true for owners of these five businesses. And if COVID-19 has produced any positive outcomes, it has been for the revenues of many of these businesses.

Buffett’s 1996 instruction was a consolidation of various prior references to a “wonderful” company such as:

“We prefer businesses earning good returns on equity while employing little or no debt.”

Letter to Berkshire Shareholders (1982)

And…

“In business, I look for economic castles protected by unbreachable ‘moats’.”

Letter to Berkshire Shareholders (1995)

In Buffett’s opinion, the highest likelihood of producing a good return on investment, while simultaneously reducing risk, is through the purchase of “wonderful” companies.

As I articulated in my book Value.able in 2010, wonderful companies simply have the following characteristics:

- Bright long-term prospects

- A high rate of return on equity driven by sustainable competitive advantages

- Solid cash flow

- Little or no debt

- First class management

The question we seek to answer today is simply: do the five companies currently dominating the US market satisfy the requirements of a wonderful company?

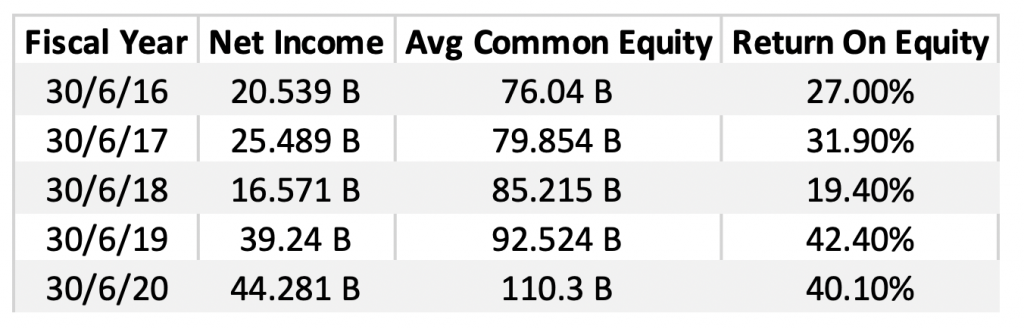

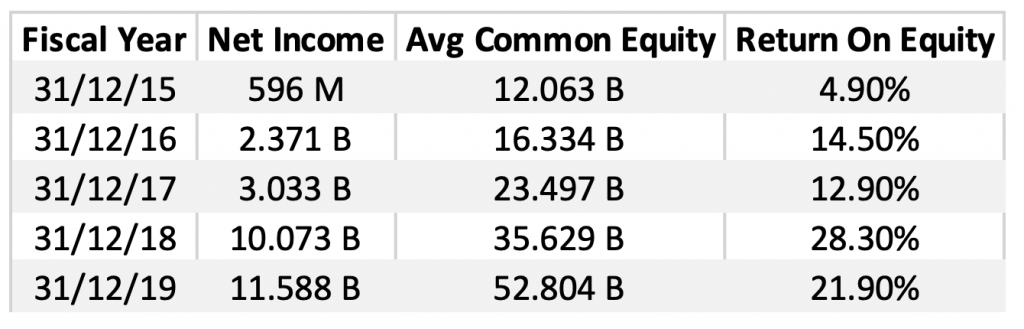

Table 1. reveals Microsoft’s return on equity over the prior five years

Table 1. Microsoft return on equity

In anyone’s language this is an attractive return on equity. Exploring the profitability of the other four companies reveals a similar picture.

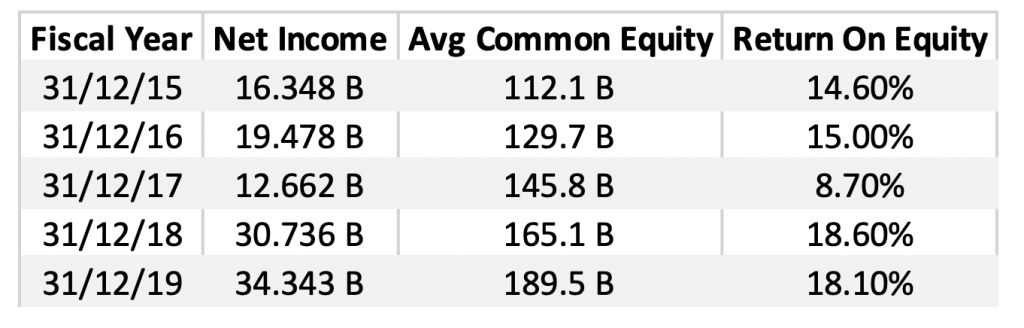

Table 2. Alphabet return on equity

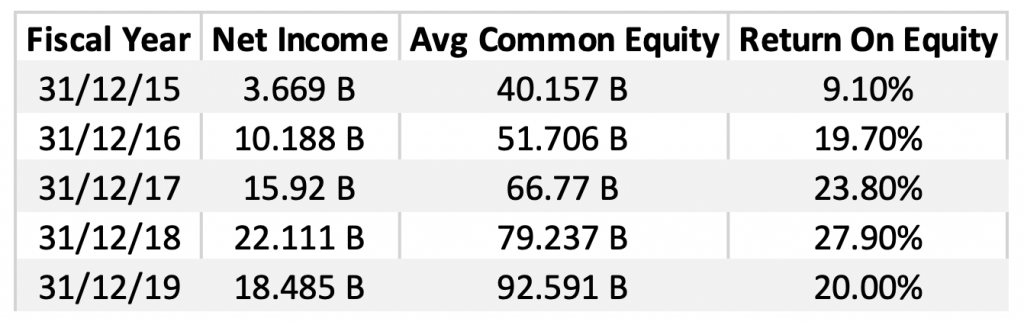

Table 3. Facebook return on equity

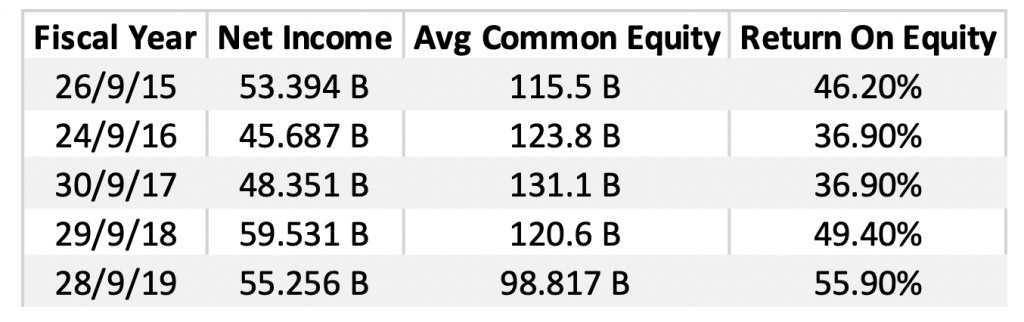

Table 4. Apple Inc return on equity

Table 5. Amazon return on equity

Without exception these companies are generating attractive returns on equity and in most cases the trend is improving. In other words, as these companies grow, they become even more profitable. This is a highly desirable characteristic, especially when it is achieved on relatively modest or no debt.

Google’s debt to equity ratio sits at just 7.8 per cent, Facebook’s is 10 per cent, Microsoft’s ratio is 69.4 per cent while Amazon is 124 per cent and Apple 169 per cent. Given their cash flows, all of these companies have debt levels that are entirely manageable.

The driver of this impressive performance of course is the presence of competitive advantages, without which competitors would be able to chip away at their moats and bring profitability back to far less attractive levels. Very few companies can stay ahead because competitors copy their strategies.

And while ‘network effects’ and ‘flywheels’ are certainly part of the reason these companies stay ahead, it’s difficult to copy a company that uses its vast resources to adapt. Apple is first and foremost a computer company, but it has also pivoted to other areas such as the payment space, which has historically been controlled by banks.

Google was a search engine before building the mobile operating system Android and now dominates that space by market share. And don’t forget Google rendered traditional maps almost extinct by integrating GPS navigation and mapping into its product suite.

Over at Facebook, a sophisticated social networking site became the world’s leading provider of targeted direct advertising, while Jeff Bezos at Amazon turned a book selling site into the world’s largest online merchant platform, as well as one of its largest logistics players, data warehouse providers and media content creators.

There is no question that as these companies have gained scale and entrenched themselves in the daily habits of their customers, they have become more powerful and therefore more profitable. There is therefore little doubt about the quality of these businesses.

Of course, investors must also consider the price. Remember, Buffett did say “purchase, at a rational price”. To that point it’s worth keeping in mind Ben Graham’s instructions:

“Price fluctuations have only one significant meaning for the true investor. They provide them with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to…the operating results of his companies.”

It seems investors are doing precisely that.

The Montgomery Global Funds and Montaka own shares in Facebook, Apple, Microsoft and Google. This article was prepared 05 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Apple you should seek financial advice.

APPLE will suffer major loss in China. Noone would buy iphone when WeChat and TikTok are taken off App store.