Why the global LNG price is heading north

Over the last couple of months, international LNG prices have been rocketing up. This is bad news for overseas consumers of our LNG exports and domestic consumers of gas, but could be positive for our gas producers and the Federal Budget, due to higher tax collections. The question is, how long will this run last?

I’ve previously written on the fact that east coast Australian gas prices are amongst the highest in the world, which is rather bizarre given the east coast is also home to one of the largest LNG export facilities in the world. In my opinion, this represents a clear failure of public policy as there should be a domestic reservation policy in place which guarantees access to attractively priced gas to the local economy even if it was eating into the profit margins for the gas exporters. This is the case in Western Australia and domestic gas prices are significantly cheaper than the east coast.

For the last couple of years, international LNG prices have been on a downwards trajectory as a significant oversupply has developed due to increased export capacity primarily in Qatar and USA and this was starting to feed through to lower domestic gas prices.

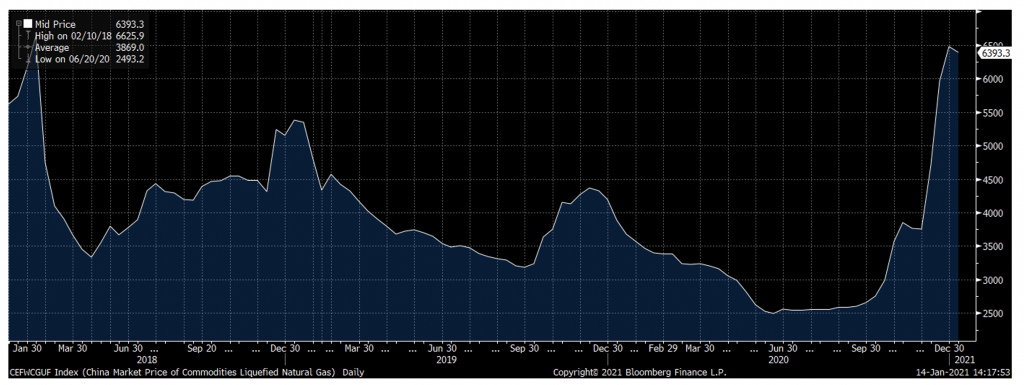

In the last month, we have seen a very sharp increase in international LNG prices with an almost 3x price increase in about one month (the exact increase depends on which market) as can be seen from this chart which shows the index for LNG prices for spot cargoes delivered in China. The chart shows both the downwards trajectory over the last couple of years and also the recent spike in prices which is significantly higher than the normal December/January spike.

There are a few reasons this is happening:

- The oil price has increased from about $40/bl to around $56/bl. LNG is generally priced on the back of the oil price as they are competing fuels.

- This winter seems to be colder than normal in China and Japan which has led to increased energy demand. Chinese LNG import in December rose by 16 per cent from November while Japan’s LNG imports rose by about 7 per cent.

- China has at the same time banned the import of Australian thermal coal, meaning that electricity providers in China have had to increase the amount of gas they burn to satisfy the electricity demand.

- The spot LNG market is quite thin with unpredictable supply of both gas volumes and unemployed ships to transport the gas so when you get a sudden increase in demand, you tend to get quite extreme price movements.

What impact does this have on Australia?

Firstly, depending on how long the spike in demand and high prices continue, it might unfortunately take focus away from the debate on whether there should be a domestic reservation policy as the gas producers can point out that the LNG netback price has increased and domestic gas buyers are no longer paying more than foreign buyers. This is a shame as, macroeconomically, a domestic reservation policy would be very good for the east coast of Australia. It therefore means that east coast Australian domestic and industrial users of natural gas will be stuck paying way too high prices.

Secondly, the spike in LNG prices means that even though Australia’s resource tax collection framework is far from optimal, increased LNG export revenues will offset the lost revenues resulting from China’s thermal coal import ban (let’s see how long that ban lasts if LNG prices stay up here…) so direct tax collection for Australian government should not be impacted much.

Thirdly, it is of course positive for gas producers if they have uncontracted volumes to export.

Fundamentally, I do not believe that anything has really changed in the overall market and I think this is a relatively short-lived spike and prices will quite quickly come down again as it is clear that total world LNG export capacity is in significant surplus which should keep prices low and hopefully lead to lower domestic gas prices on the east coast of Australia.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY