Why should private credit earn a place in your portfolio?

Transcript:

Hi, I’m Roger Montgomery and welcome back to the channel. Today, we’re looking for ways to diversify your portfolio and tap into one of the fastest-growing asset classes globally. If that sounds interesting, this video’s for you.

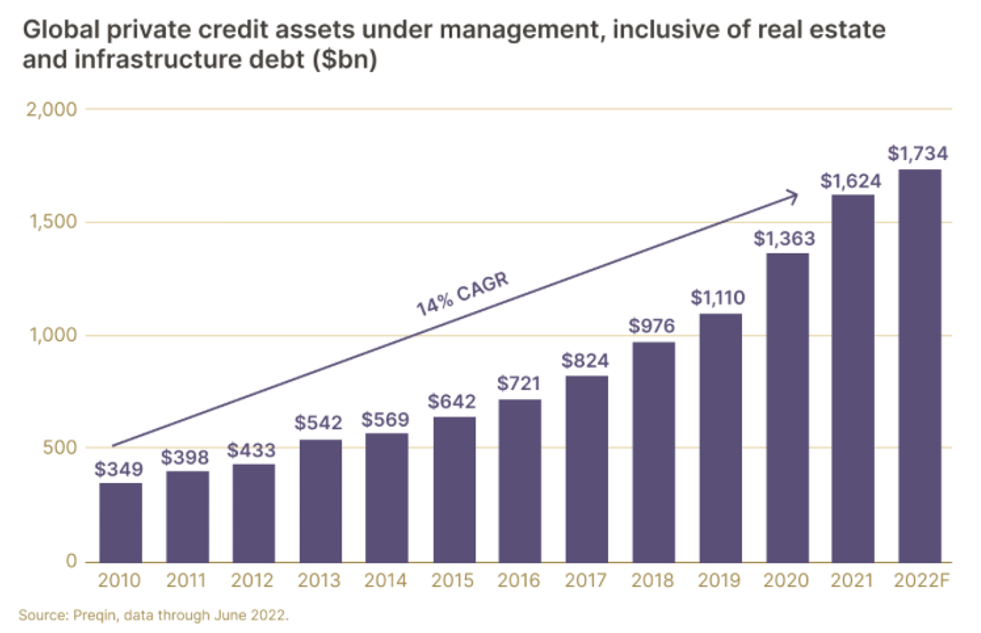

According to Preqin, a leading researcher in alternative assets (that, as an aside was recently purchased by BlackRock for more than 2.5 billion pounds), the global private credit market is projected to nearly double to an astounding US$2.8 trillion by the end of 2028, in just three years time.

Well, traditional banks have been scaling back lending to specific sectors, mainly due to increased regulations following the global financial crisis (GFC). This has left many companies searching for alternative financing solutions, which in the past were funded by family offices, ultra-high-net-worth individuals, and large institutions. But times are changing! This opportunity for lucrative returns is now opening up to direct investors.

But, it’s the compelling uncorrelated returns, low to zero volatility and the opportunity to enhance portfolio return profiles that’s driving demand.

There’s been a lot of talk about the death of the 60/40 portfolio. In short, that means that investors are moving away from a traditional 60/40 stock-to-bond split.

Why? Because recently stocks and bonds have grown highly correlated–meaning that as stocks decrease in value, so have bonds, and vice versa.

That’s significant because in decades prior, when stocks decreased in value, bonds would increase. This is precisely why many investors invest in bonds in the first place – to offset any stock losses during a recession (for example, in 2008, the S&P 500 returned -36.55 per cent. Meanwhile, the 1-year bond rose 20.1 per cent, during that same period).

With stocks and bonds now so correlated, do bonds even diversify your stock portfolio anymore?

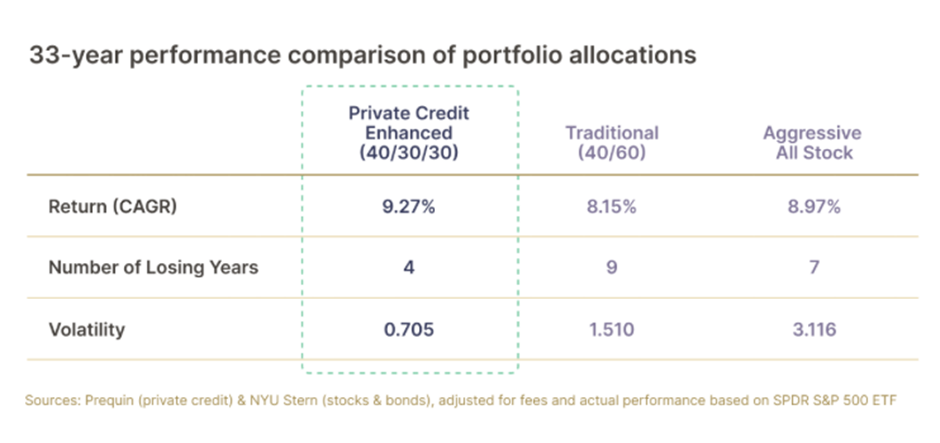

Enter private credit. As this table from Prequin and New York University’s STERN School of Business shows, private credit-enhanced portfolios have outperformed the traditional 60/40 split, as well as more aggressive all-stock portfolios over the last 30+ years.

And that outperformance spans several key metrics. The portfolio with private credit wins on compound annual growth rates, produces fewer years that the combined portfolio loses money, and it wins with lower average annual volatility. In other words, the median private credit-enhanced portfolio can generally expect to produce higher returns with lower volatility and fewer down years than a 60/40 or all-stock portfolio.

So, what exactly is private credit, and why should it earn a place in your portfolio?

Well, here’s another compelling reason.

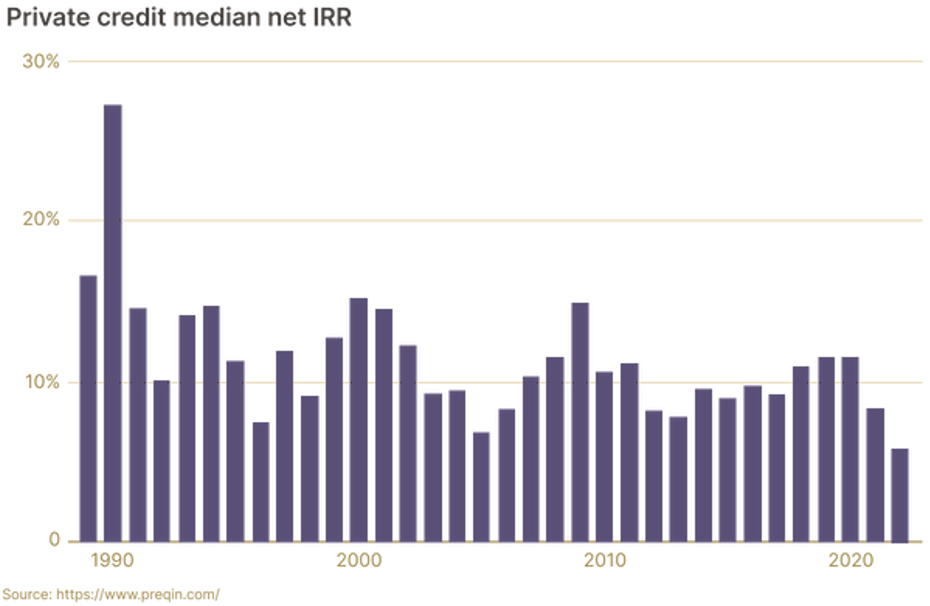

Again, according to Prequin, The median private credit fund manager has not had a single year of negative performance over the last three decades.

Yes, you heard that right. How is this possible? Because like bonds, private credit produces consistent cash flow in the form of yield repayments. As long as portfolios are appropriately diversified, repayments should create positive net returns every single year.

And here’s another reason:

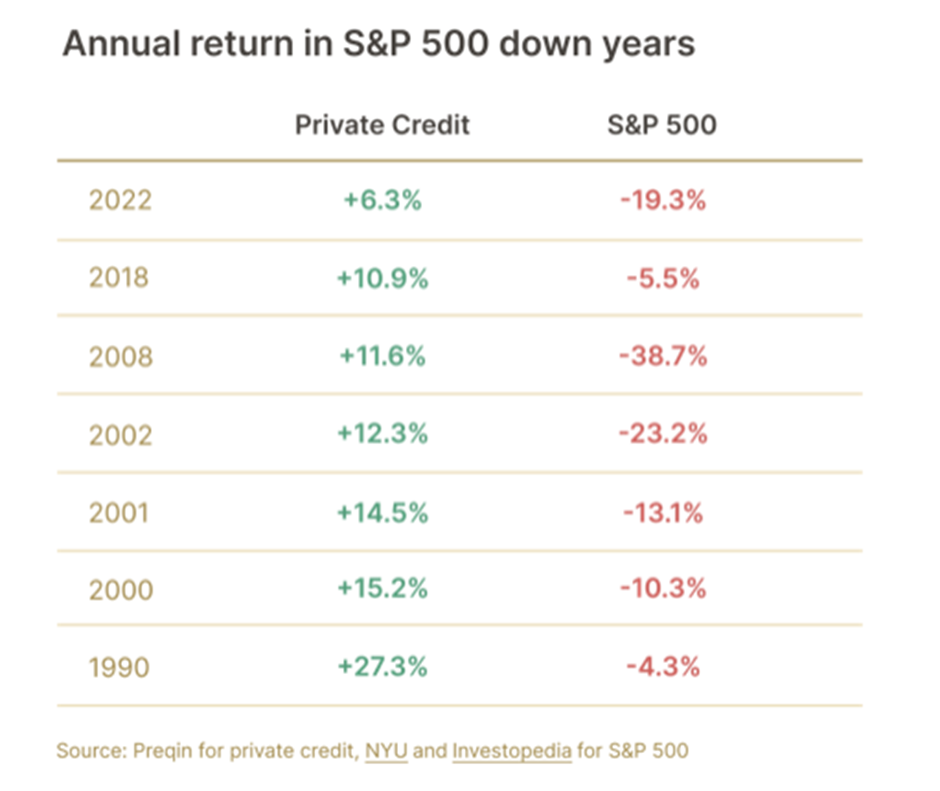

As this table from Prequin, NYU, and Investopedia shows, in every down year for the S&P500 since 1990, Private credit returns havev been positive and the differences dramatic.

Private credit refers to loans provided by non-bank lenders – like credit funds and specialised finance companies – that operate outside the traditional banking sector. These lenders extend credit directly to individuals, businesses, or corporations, often filling niches where conventional banks are either uninterested or constrained – for example, by the increased capital requirements imposed on them after the GFC.

These are the loans the banks made before the GFC, and the loans they would make now if they weren’t restricted by the more onerous capital requirements imposed on them.

These loans are typically secured against assets, and even director’s guarantees. This security offers a level of protection and priority over other financial obligations, meaning if the borrower faces financial difficulties, private credit lenders are first in line to be paid back.

As a defensive, income-generating asset class, private credit isn’t designed for capital appreciation like equities or venture capital. Instead, it’s about stability and consistent income. Yes, the returns can be higher than the stock market without the volatility associated with public markets, but investors profit from the interest payments generated by the fund’s loan portfolio. Due to contractual agreements, these tend to be both predictable and consistent.

Most private credit loans feature floating interest rates, linked to benchmarks such as the Reserve Bank of Australia’s official cash rate. You benefit from a premium or margin over these benchmarks, typically four to eight per cent, depending on the fund’s focus.

With the current Reserve Bank of Australia (RBA) cash rate at 4.35 per cent, you might anticipate income returns between 7.35 per cent and 12.35 per cent, with commensurate risk. Considering the defensive nature and relatively low risk associated with secured private credit, these returns are compelling.

If you’d like to know more about how you can improve returns, reduce volatility and enhance your retirement, email us at investor@montinvest.com or give David Buckland or Rhodri Taylor a call here at Montgomery Investment Management on (02) 8046 5000.