Why REA Group will keep delivering for investors

As I’ve written before, I think REA Group (ASX: REA), is one of Australia’s highest quality businesses. REA’s online portal – realestate.com.au – is the go-to destination for people wanting to buy, sell or rent property, and this has led to massive earnings growth, and turbo-charged REA’s share price. Looking at the metrics of the business, I see no reason why this will not continue.

Back in May, I concluded a blog post about REA Group thus:

“Eventually, Australia’s property market will emerge from its current ‘funk’, interest rates will top out and confidence will return. When that happens, REA’s price rises will combine with a jump in volumes and analysts will be jumping over each other to upgrade their forecasts…We have seen this cycle before and currently have no reason to believe it won’t be repeated.”

With the above-predicted scenario now transpiring (whether the change is cyclical or structural remains to be seen), the share price is up 16 per cent since that blog post was written.

But before we get to that…

Friday 11 August, REA Group will announce its full year results for the year ended 30 June 2023 and the outlook statements could be very positive given recent developments for the company worth highlighting. Oh, and remember, I regard REA Group as one of the top ten quality companies listed on the ASX.

Why?

Simple. The quickest way to amass wealth is to own businesses able to generate high double-digit returns on equity and able to retain a large portion of the returns and reinvestment them in following years at equally high rates of return. The process ensures shareholders equity rises quickly, making the shareholder’s stake in the company more valuable. The share price will eventually follow.

Here’s the thing, though; in order to sustain this rapid wealth accumulation, a high return on equity (ROE) needs to be sustained. And for a high ROE to be sustained, there needs to be a competitive advantage present – something special that isn’t easily replicated or mimicked by a competitor.

Finally, the most valuable competitive advantage of all, and the surest evidence of one, is this; the ability to raise prices without a detrimental impact on unit sales volumes. In other words, if you want the stock market to help you become wealthy, find businesses that can raise their prices without losing customers or sales.

REA Group has been raising prices for years, both directly and by introducing newer and feature-packed enhanced customer options, without losing customers.

In fact, the biggest fear any high ROE business would face is the emergence of a competitor who offers the same product or service for free.

REA Group’s website, Realestate.com.au has been living with that reality for years. At my last count, there were more than 60 websites in Australia inviting house vendors to list their homes for sale…for free! No charge. Even though REA Group charges the highest price, it also has the most listings, the most customers and the most revenue and profit. Customers flock to it despite being the most expensive. And that’s because it has the best user experience, which means it has the most buyers looking for homes. And because it has the most buyers looking, it has the most fee-paying vendors wanting to put their ‘opportunity’ in front of those buyers.

Known as the network effect, REA Group has the most houses for sale listed on its site, because it attracts the most buyers. It has the most buyers because it has the most houses for sale. Indeed, Realestate.com.au boasts 125.1 million average monthly visits, which is 3.3 times more visits than the nearest competitor each month.

And there’s another dynamic, perhaps unique to Australia, that helps REA increase prices without a detrimental impact on unit sales volume. It is this: For a real estate agent, their job of selling a property is made easier by having the property listed on realestate.com.au. Clearly, the agent is incentivised to have their listings on REA Group’s portal. The interesting thing is, the agent doesn’t pay for the property to be listed. The vendor does. So, agents are doing REA Group’s distribution and sales for them. Their incentivised to promote the website to vendors and the price isn’t a disincentive because they’re not paying!

Now you get it.

Recently, a REA/PropTrack report estimated that properties not listed on realestate.com.au in 2022, sold at prices that were, on average, 4.3 per cent less than those that were. As at May this year, the median Sydney house price was estimated to be $1.46 million. That means a Sydney vendor who elects not to list on realestate.com.au is missing out on $58,400 just by choosing to list elsewhere.

Such stats, of course, help to reinforce the company’s competitive advantage.

The big news however has nothing to do with REA’s user experience.

The big news is an increase in listings.

And the reason why a rise in listing is such good news, is that for years listings have been declining. Despite this, REA Group has been able to steadily increase prices ensuring an increase in revenue and earnings.

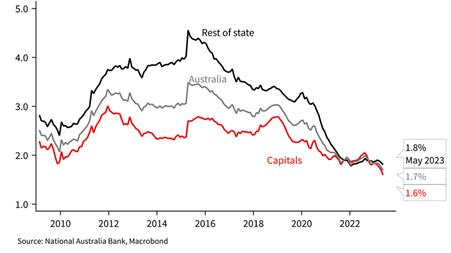

Figure 1. Properties for sale, Total Agent Listings / Property Stock (%)

Source: National Australia Bank, Macrobond

Figure 1., reveals a substantial decline in the proportion of all houses that are for sale at any time since the GFC.

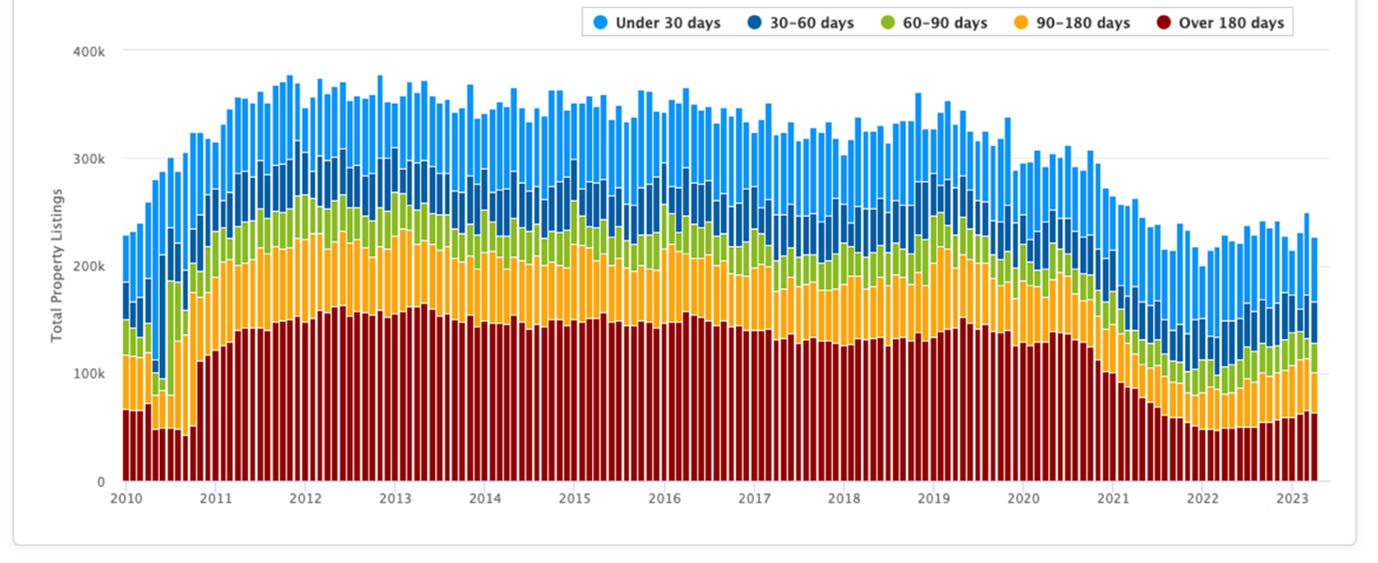

Figure 2., reveals the same information provided by another research house.

Figure 2. Total property listings

Source: SQM Research

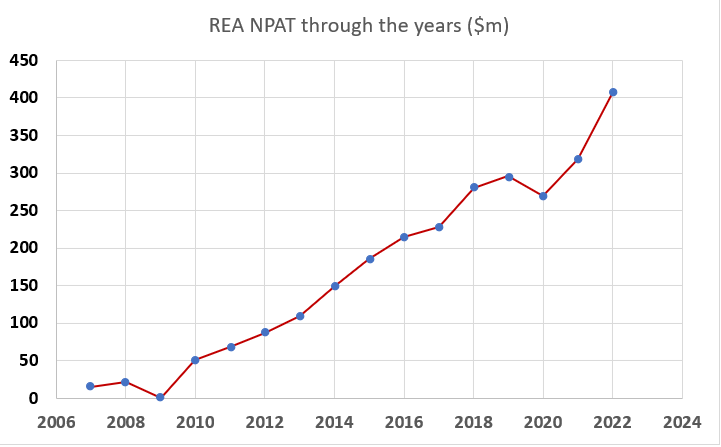

The next chart however (Figure 3.) reveals what, if any, impact these declining listings volumes have been having on REA’s revenue and profits.

Figure 3. REA Earnings 2007-2022

Looking at Figure 3., and remembering the growth in net profit after tax displayed has occurred during a period of stagnant or declining listings, imagine what happens to profits when listings start to pick up and eventually structurally turn.

REA’s key driver for accelerating earnings is not house prices but the volume of listings. REA doesn’t charge a fee based on the value of the property being sold. It charges a rate based on the features and prominence of the ad vendors request. No matter what prices are doing, if listings are solid, REA will do fine. If REA can raise prices AND experience a rise in listings, the impact will be excellent, and something many in the market consistently seem to underestimate.

Back when the company announced its third quarter trading update, it noted in FY24, its ‘buy’ yield growth was expected to grow at least 10 per cent, largely driven by an average 12 per cent price increase in its popular Premiere+ product.

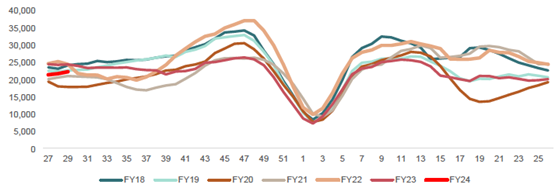

In Sydney, according to REA Group, listings are still declining on a monthly basis, but the rate of decline is slowing. According to REA, Sydney listings declined nine per cent in mid-July, compared to minus 26 per cent in May. And according to Core Logic, for the 4 weeks to 16 Jul 23, listings rose 6 per cent year-on-year.

Figure 4. Capital Cities new listings (4 week rolling, week # of year)

Source: CoreLogic, Barrenjoey

Further analysis suggests the improving listings picture is in no small part due to an increase in investor selling. Anecdotal evidence from conversations with agents suggests that a proportion of the investor properties being sold have not been held for very long and that there is also some distressed selling in Sydney’s outer suburbs.

Those who purchased at the peak of the property market, possibly overextended, and are feeling the pressure of rising interest rates and moving their properties on.

According to one sell-side analyst, investor property listings are now circa 36 per cent of all new listings. This compares to a pre-COVID average of only 24 per cent. Of course, the data may also reflect an unwinding of a materially higher relative level of property speculation when fixed rates fell to less than two per cent after the advent of the Term Funding Facility.

Referring to the earlier PropTrack report that found a $58,400 financial benefit for listing a property for sale on realestate.com.au versus a competitor’s website, economics 101 would suggest there is plenty of room for REA to raise the price of its services and products and still offer its customers a financial benefit. That logic implies a long runway for revenue and earnings growth, through price rises alone, and an even more optimistic outlook if listings continue to pick up.

Valuation

Suppose we assume a six per cent discount rate, which is low but arguably justified for a business of such high quality, a sustainable rate of return on equity of circa 27.5 per cent and an ongoing payout ratio of 53 per cent. In that case, we arrive at a valuation for REA Group’s share of $129.00. Up until March this year, the shares traded below this level. Then, in June, the shares briefly touched $130.00. Today, of course, the market is excited about a turnaround in listings volumes, and this has driven the share price to its current level of $157.66.

Hi Roger

Is there any chance you could share your other nine top quality companies listed on the ASX.

Kind regards

Simon

Hi Simon,

We have written about those companies throughout the 14 years this blog has been running. Just use the blog’s search bar and you will find them by searching for terms like ‘top quality’ etc…