Why invest in Private Credit through Brett Craig’s Aura High Yield SME Fund

For decades in the U.S. and Europe, private credit investing has been the prized preserve of High Net Worth, Ultra High Net Worth and Family Office investors. Indeed, ‘private debt’, as it’s known in Europe, may eventually become a centrepiece of the portfolio allocation model and no longer a satellite enhancement, and in doing so, will simultaneously highlight its burgeoning role within the financial ecosystem.

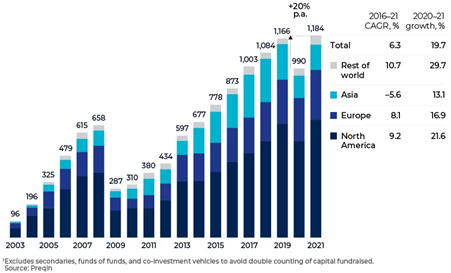

Figure 1. Private Debt is gaining traction as an asset class. US$billion.

Only recently, as major Australian banks follow the path set by their European and U.S. counterparts to focus on lending to the largest corporates and householders, have local investors had the opportunity to participate in this opportunity for diversification, monthly cash income and potentially higher income returns.

Investing a portion of one’s portfolio in a private credit fund represents a strategic move that can yield substantial benefits. As an alternative investment strategy, private credit funds are gaining significant traction in the Australian financial landscape, particularly among those seeking to optimise their portfolio’s returns and durability. These funds offer a unique blend of advantages that traditional investment avenues often fail to provide.

The allure of private credit funds lies in their potential to deliver uncorrelated and higher returns, especially when compared to conventional fixed-income investments. This is primarily because they lend to corporates that are typically underserved by traditional banks or public markets. Consequently, these funds can command higher interest rates, translating into more robust returns for investors.

Moreover, the diversification potential of private credit funds is another compelling reason for their inclusion in a well-rounded investment portfolio. The returns from private credit investments exhibit a low correlation with traditional asset classes such as stocks and bonds – a characteristic that may significantly mitigate portfolio volatility, enhance risk-adjusted returns, and provide a cushion against market uncertainties.

In essence, private credit funds offer a unique investment proposition that combines the potential for high returns, portfolio diversification, and steady income generation. They present an opportunity to tap into a less crowded market segment, offering an investment edge to those who can navigate the nuances.

Those nuances include whether the fund holds thousands of small loans or just a few large loans, whether any ‘lock-up’ periods for investors exist, the average term of the loans, whether the rates charged to borrowers are fixed or floating, the proportion and type of collateral held against the loans, and whether there is exposure to current high risk sectors.

The Aura High Yield SME Fund (for wholesale investors) and the Aura Core Income Fund contain thousands of small loans. At 30 June 2023, the Aura High Yield SME Fund had an average loan size of $101,748 and the Aura Core Income Fund had an average loan size of $125,1262. The Funds have an average term of four months, and exposure to floating rates or short term fixed rates.

Investors might consider the following benefits of investing in a private credit fund for monthly cash income.

Higher Returns: Private credit funds often offer higher returns compared to traditional fixed income investments. This is because they lend to companies that traditional banks are increasingly avoiding due to profitability and heightened regulatory requirements since the Global Financial Crisis.

Diversification: Investing in private credit can provide diversification benefits to an investment portfolio. Private credit returns may have a low correlation with traditional asset classes like stocks and bonds, which can help reduce portfolio volatility and enhance risk-adjusted returns.

By way of example, the well-established European private debt market exhibits attractive risk-adjusted returns (return per unit of risk) compared to similar asset classes. The floating rate feature also provides a natural hedge against rising interest rates, something other asset classes, such as High Yield, do not benefit from. In addition, European high yield has higher defaults and lower recoveries.

We also know from research by UK bond broker Redington, that since 1976, when inflation – averaged over a 2-year period – exceeds four per cent, the correlation between stocks and bonds has never been negative. In other words, bonds don’t offer the much-lauded diversification and stability benefits. Private Credit however may.

Further diversification within the Aura Core Income Fund comes from 7,954 loans across 19 industry sectors. Diversification within the Aura High Yield SME Fund comes from 10,728 loans across the same 19 industries.

Income Generation: Private credit funds typically generate regular income through interest payments, which can be attractive to investors seeking steady cash flow. To 30 June 2023, the Aura High Yield SME Fund has produced 71 consecutive months of positive cash income, including through the COVID-19 Pandemic, with no negative months[1].

Protection Against Inflation: Private credit loans are often structured with floating interest rates, which means the interest income can increase when interest rates rise. This can provide some protection against inflation.

Security and Control: Private credit funds often lend on a secured basis, meaning they have a claim on specific assets of the borrower in the event of default. They also often have strong covenants that give them control over the borrower’s actions. Review the PDS for the Aura Core Income Fund and the IM for the Aura High Yield SME Fund respectively to understand the multiple types of security taken when loans are provided, including directors guarantees and property security.

Less competition: The private credit market is less crowded than public markets, providing more opportunities for skilled managers to find attractive investment opportunities.

Benefit from economic recovery: In a post-recession environment, private credit funds can benefit from the economic recovery as businesses seek financing to capitalise on growth opportunities.

There are multiple reasons to seriously consider an investment in private credit, whose role in portfolios and in the economy is growing in influence. At the same time, it’s important to note that investing in private credit funds also comes with risks, including credit risk, liquidity risk, and manager risk. Therefore, investors should carefully consider their risk tolerance and investment objectives before investing in a private credit fund.

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

* Net returns for the Aura High Yield SME Fund (for wholesale investors only) as at 31 May 2023. Performance assumes reinvestment of distributions since inception in August 2017. Past performance is not a reliable indicator of future performance.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.