Why Private Debt may be superior to bonds

Looking for a higher rate of income? Who isn’t? But are bonds best? For decades investors have been told bonds provide uncorrelated ‘ballast’ for a portfolio of shares whilst generating much-needed regular income. The idea has been that shares offer growth, with bonds also offering diversification and stability.

The sometimes-observed negative correlation between shares and bonds provides the backdrop for the idea that bonds perform well when stocks don’t. And from that single idea, the 60/40 or ‘balanced’ portfolio become lore.

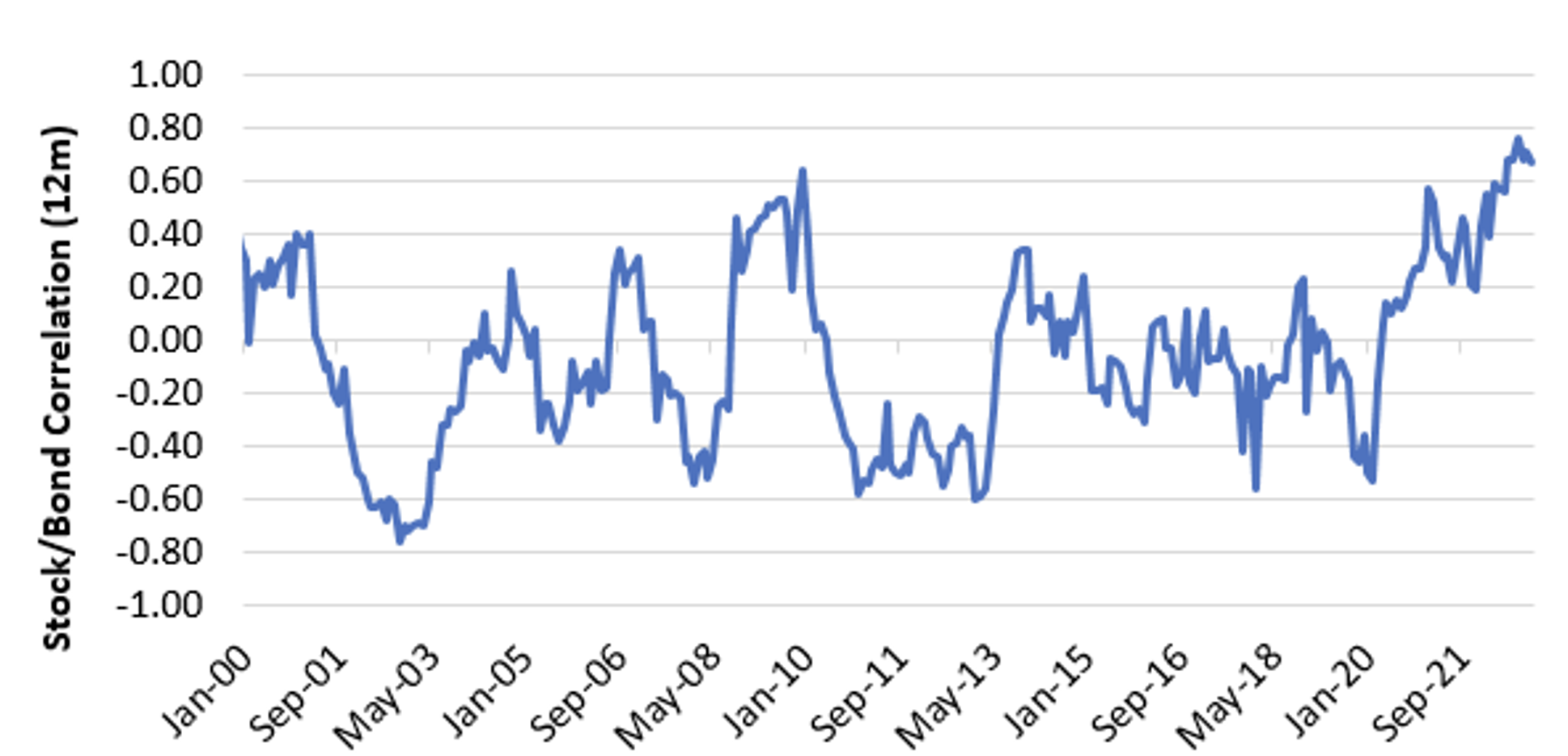

As Figure 1 – produced by UK-based institutional bond brokers Redington – reveals, over the last two decades, the relationship or ‘correlation’ between U.S. equities and bonds has indeed been reasonably low. Twelve-month correlation between the two asset classes has averaged -0.06. Rarely has the correlation been higher than +0.5 and it certainly hasn’t sustained that level of positive correlation.

Figure 1. U.S. Equities/Bonds correlation

Source: Redington

Because of this relationship, over the last 20 years, the 60/40 portfolio has indeed been a tough strategy to beat.

But Redington have drilled a little deeper and when they examined the data over a longer period, it appears that the negative correlation upon which so much retirement money is based is a more recent phenomenon.

By running the same analysis back to 1976, Redington found the longer-term average correlation is somewhat higher 0.20. Meaningful periods of positive correlation have transpired and there have been many periods where bonds and equity prices have perfectly aligned, meaning equities fall when bonds fall.

Fundamentally this makes sense. As bond prices fall, their yields rise. When bond yields rise, the discount rate used to value assets rises too, and like gravity, asset prices are brought down back to Earth. It’s just the present value of money formula working as it should.

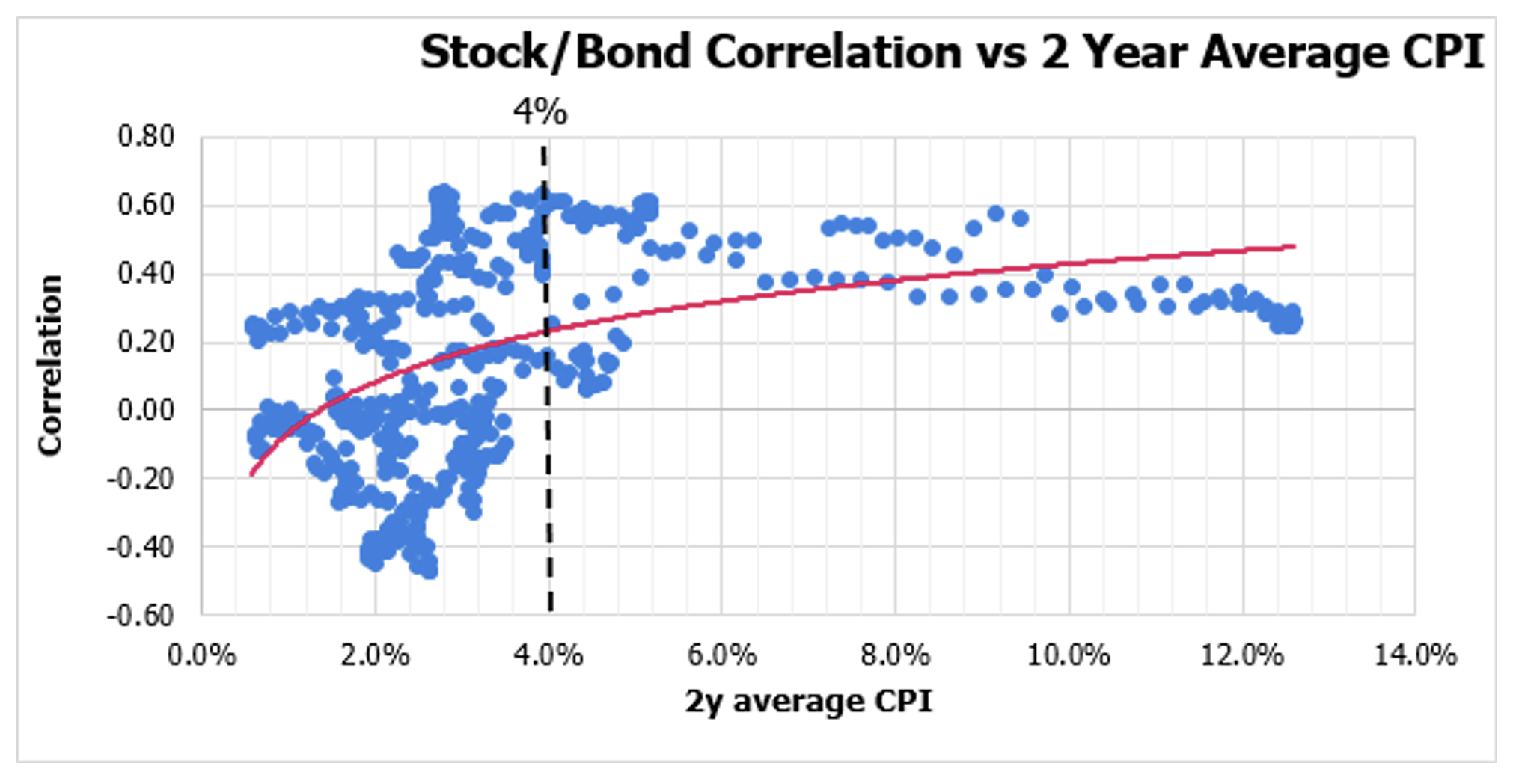

Redington then drilled even deeper, looking at factors such as the level of interest rates, the shape of the yield curve, and the rate of change in inflation, in an attempt to discover possible explanations for these shifts in regimes, from correlated to uncorrelated equity/bond returns.

What they discovered is that when inflation – averaged over a 2-year period – exceeds four per cent (like it is now), the correlation between stocks and bonds has never been negative. In other words, bonds don’t offer the much lauded diversification and stability benefits.

Figure 2. Zero observations of negative correlation between stocks and bonds since 1976 when two-year average inflation is above four per cent

Looking backwards the findings mean “as soon as it became clear that developed market inflation was not transitory, it was likely that we would experience a period in which bonds would not provide a safe haven for investors”.

An alternative for income

So, is there another possible solution to the diversification and income needs of investors, when inflation is higher, and bonds don’t provide uncorrelated protection?

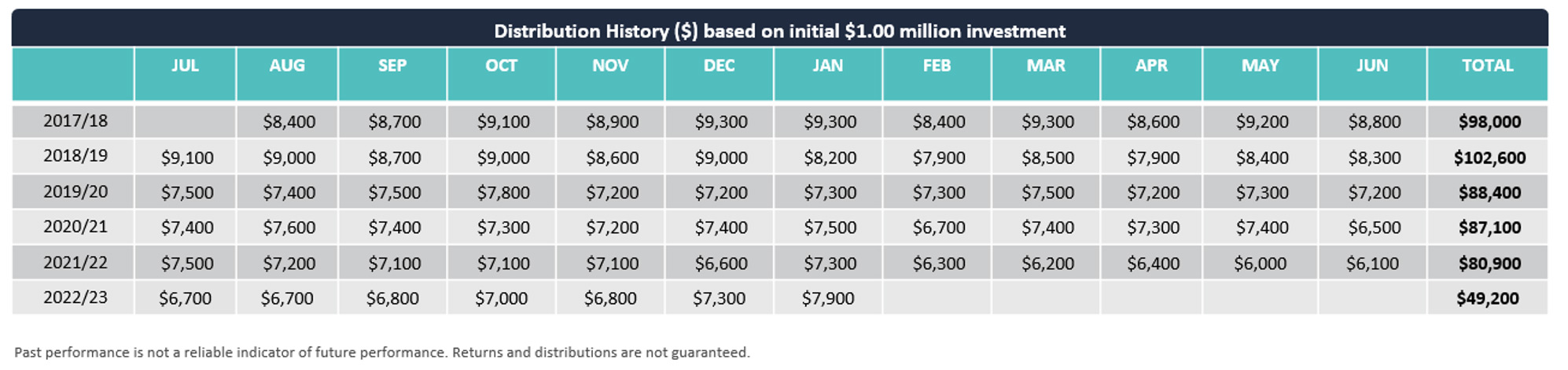

Table 1. Monthly cash income on $1 million from Private Debt

Table 1. shows the income from a hypothetical $1 million investment in the Aura High Yield SME Fund.

The table reveals, lending to corporates over the last five years has produced regular monthly cash income that is variable. So, as interest rates rise, and corporate loans mature, the book of corporate loans is re-priced, and investor income returns rise too.

In Table 1. you can see how as interest rates have risen during 2022 and into 2023, monthly income has also risen to the investor from $6,200 per month in March last year to $7,900 per month in January 2023.

And because the unit price of the Aura High Yield SME Fund has remained stable at $1 over the course of the last five years – even during the COVID pandemic, which triggered heightened volatility in other asset classes – the returns to investors remain uncorrelated.

Income and diversification are important elements of an all-weather portfolio, providing cash and stability through low levels of correlation.

If you haven’t considered the Aura High Yield SME Fund, speak to your adviser about whether an allocation to Private Debt is wise.

If you would like to learn more about the Aura High Yield SME Fund (wholesale clients only), please visit the fund’s web page to learn more: Aura High Yield SME Fund

For retail investors, if you would like to learn more about the Aura Core Income Fund, please visit the fund’s web page to learn more: Aura Core Income Fund

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

Thankyou Roger, for commenting on -BONDS, as they fall and rise. Iam impressed