Why investors shouldn’t fear a Biden victory

As the world anxiously awaits the result of the upcoming US presidential election, many commentators have predicted that a Democrat win will have an adverse effect on stock market returns. But some recent polling suggests that any negative impact will not be that great.

According to FiveThirtyEight – a website focused on opinion poll analysis, politics, economics, and sports blogging, Biden is leading nationally by a polling average of more than 9 per cent. Many might remember that Clinton was ahead of Trump ahead of the last election and actually won the popular vote by about three million votes, but she also attracted a high level of protest voting, which Biden has not attracted so his lead in the polls may be a more reliable indicator of the outcome.

FiveThirtyEight note Joe Biden leads in both national and state polls and add that Trump needs a polling error in his favor if he’s going to win “although the error doesn’t need to be as big as you might think, if you were just looking at national polls”. Using Pennsylvania as an example, which is a state FivethirtyEight’s forecast currently thinks is most likely to decide the election, Biden doesn’t have much extra cushion in polls there. Biden only leads Trump by roughly 5 points in polling averages so a 2016-magnitude polling error could deliver the state to Trump.

FivethirtyEight say Trump still has a meaningful chance of winning the election – a little worse than the chances of rolling a 1 on a six-sided die.

In the most recent aggregation of polls there’s reported to be little evidence of the Presidential race tightening. If anything, Biden is continuing to make gains in the Midwest (reportedly 1.7 points, on average, since the final debate). But if the 2016 election taught the world anything it is that we only know how accurate the polls were after the election is won and lost.

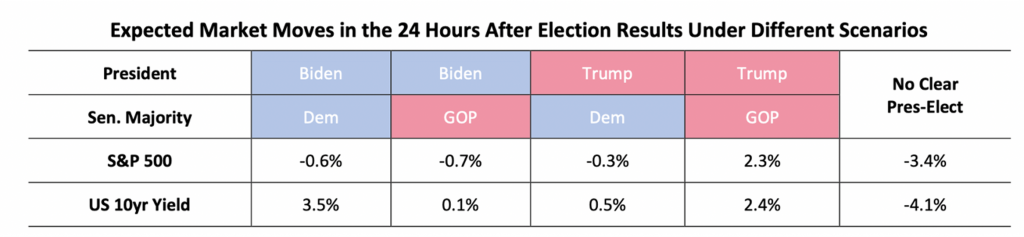

We’ve found at least one bank willing to table surveyed predictions about the market’s expected response to the election results.

Source: Nomura

Nomura’s Singapore-based currency team surveyed their institutional clients and found institutional investors forecast a 2.3 per cent jump in the S&P 500 the day after a Trump victory and with a GOP Senate majority. A Biden win with a Democrat Senate majority is predicted to cause a 0.6 per cent decline. Of course, neither of those will be correct but it is interesting to see that a larger drop is not predicted if Biden wins despite promising to raise corporate and capital gains tax rates, as well as income tax rates for higher income earners. According to Zion Research Group’s blog, Biden’s corporate tax measures and attack on ‘offshoring’ would lower S&P500 earnings by at least 10 per cent.

As the world anxiously awaits the result of the upcoming US presidential election, many commentators have predicted that a Democrat win will have an adverse effect on stock market returns. Is this really the case? Share on X