Why investors are enjoying this reporting season

So far, reporting season has delivered for many investors. Conducive trading conditions for banks, miners, technology companies and many retailers have resulted in increased dividends and share buybacks, while the overall market has leapt to fresh highs. Of the businesses to report, several have stood out.

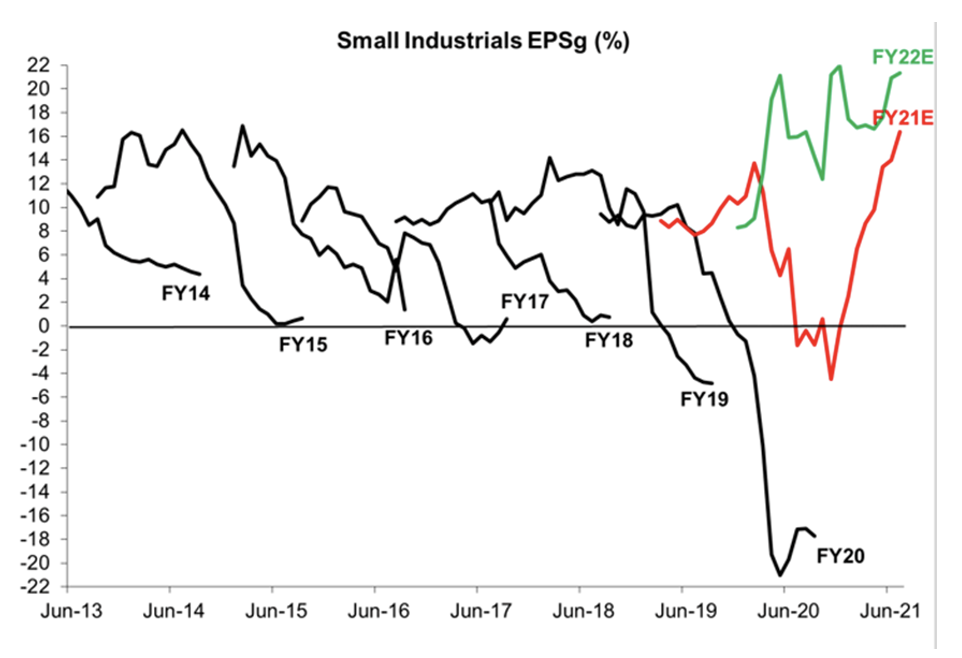

Reporting season appears to have kicked off consistent with expectations that FY21 was solid. Keep in mind FY21 aggregate earnings per share growth had been revised up from circa 15 per cent, following interim earnings in February, to about 30 per cent.

And more companies are beating expectations for the second half of FY21 than missing. Interestingly the share prices of COVID-19 winners are underperforming the COVID-19 losers after results have been posted.

Prior to reporting season kicking off, we suggested the expanding and rolling lockdowns on the east coast of Australia would cause CEOs to pull their heads in and refrain from providing guidance. That is indeed occurring and the lack of guidance is notable.

As we’ve recently noted, amid the lack of guidance, we wouldn’t be surprised to see fund managers concentrate bets on the higher quality companies, those with pricing power, and avoid those with any whiff of having to raise capital (again).

Figure 1. Small Cap Earnings Per Share Growth expectations

Source: Macquarie Equities

Travel stocks

Alliance Aviation (ASX:AQZ), which is held in our Montgomery Small Companies portfolio, delivered on expectations with solid net profit before tax profit growth of 25 per cent to $51.0 million. Despite massive uncertainty in domestic aviation, management provided a clear timeline for the deployment of all 29 Embraer E190 planes by the end of June ‘22. If this happens, the number of planes in operation rises nearly 70 per cent to 67 aircraft and flight hours in FY23 could rise by more than 200 per cent. This could lead to an additional $50 million of Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) putting the stock on a low teen price to earnings (PE). If the market starts to understand this is not a typical airline, the PE could expand alongside confidence in the stability of earnings.

In contrast, some analysts are revising forecasts for Flight Centre (ASX:FLT) ahead of the company reporting on 26 August. Prolonged border closures and the possibility of another capital raise are factoring into analyst thinking. The stock is unlikely to recover until confidence about a return to normal levels of leisure travel returns. And even then, the company is a shadow of its former footprint with a lot more equity having been raised.

More broadly, some analysts have noted that until now fast-recovering US leisure and corporate travel is slowing again with September travel cancellations picking up amid higher Delta COVID-19 cases. Dallas based operator South West Airlines, has noted July sales were down 12 per cent but September sales are now down 15 to 25 per cent.

Nick Scali

We have written about Nick Scali’s (ASX:NCK) result, but it’s worth noting, with the share price near its all-time highs, an analyst has pointed out the first half FY22 revenue estimates, after allowing for the company’s order bank, imply a near one-quarter contraction compared to the previous corresponding period. As we’ve noted before, maybe the economics of enough is hitting growth rates. Perhaps Australians have purchased most of the sofas they need for the time being. With property listings slashed, there will be fewer future sales and that will lead to fewer alterations and additions down the track. Offsetting this of course will be growth in stores and the taking of market share.

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX:CBA) demonstrated the prescience of our increased weighting to the banks last year. The market had been a little too negative about pressure on net interest margins (NIMs) and the banks’ ability to write back provisions as a reopening economy fuelled a boom in spending and property. The CBA’s NIM rose marginally between the first and second half. Costs remain the perennial issue. The 2.4 per cent rise in operating expenses, when compared to the 1.7 per cent increase in operating income, produced negative “jaws.” The stock is more expensive than it has been for some time but it remains the strongest banking franchise in Australia and its commitment to expanding its footprint in business banking is something that should make investors in the National Australia Bank a little nervous.

The Montgomery Funds own shares in Commonwealth Bank. The Montgomery Small Companies Fund owns shares in Alliance Aviation. This article was prepared 16 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.