Why government should not water down responsible lending laws

Last year, in direct contradiction to a key recommendation of the Banking Royal Commission, the Federal Government put forward a proposal to ‘relax’ lending standards by the banks. Thankfully, a vote on the legislation has now been put on hold, and I’m hoping the proposal will be shelved completely.

Just the other day, Roger posted an article with his view that Australian property prices will continue to go up. I agree with his reasoning but welcome news to me (despite being a recent property purchaser) might hopefully inject some calm into the market.

Back in September last year, I published a post where I argued that the proposed changes to responsible lending laws and regulations was a bad idea. To recap, the government surprised regulators and commentators by proposing that primary responsibility for overseeing how responsible banks are in their lending would transfer from ASIC under the National Consumer Credit Protection Act (NCCP Act) to APRA under prudential lending rules. As I mentioned, APRA’s rules are significantly less stringent than the NCCP Act and combined with the well established general financial illiteracy amongst the Australian population, in particular when it comes to mortgages, and the more or less implicit government guarantee to the banks I argued that this was a bad idea. These proposed changes were also in direct contradiction of the first recommendation of the Haynes Royal Commission which was:

And the wording in the report recommended that if anything, the regulations surrounding responsible lending, at the time being considered in the court process between ASIC and Westpac, should if anything be tightened rather than loosened:

“If the court processes were to reveal some deficiency in the law’s requirements to make reasonable inquiries about, and verify, the consumer’s financial situation, amending legislation to fill in that gap should be enacted as soon as reasonably practicable.”

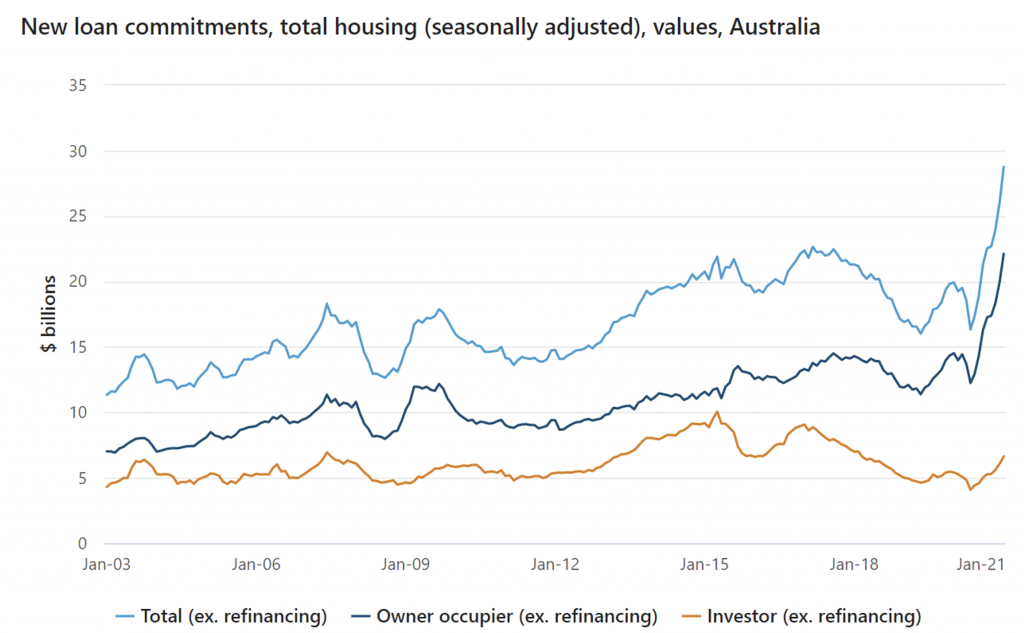

Fast forward to today and we have seen a remarkable recovery in property prices and a steep increase in the amount of new loan commitments in the last six months as the chart below from Australian Bureau of Statistics shows. We can see Owner Occupiers account for the increase which would indicate that credit is indeed not hard to access for people who want to buy a property to live in, which to me is a good sign.

The combination of rising prices and increased loan commitments indicates that there is no need whatsoever to actually go through with relaxing lending standards. Luckily enough of the cross-bench in the senate seems to agree and the government has had to delay the vote on the proposed changes until at least June and hopefully the changes will be shelved completely.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY