Why COVID-19 could deliver more pain for investors

With markets bouncing off their recent lows, it seems many investors are taking comfort from news that China’s COVID-19 outbreak appears to be ending. But I’d advise readers to treat this news with a bit of skepticism. Because, looking at the data, there’s a high chance of more bad news to come.

Investors are also using the China experience – and reports that, after a two-month shutdown, the economy is starting up again – to help inform their own models about when the infection might peak in the US and Australia. For example, most recently, my friend and fellow fund manager, Chris Joye, suggested a mid-April peak.

We’re not so comfortable and think investors should apply caution, especially surrounding the idea that it’s time to go ‘all-in’.

Here’s why we reckon it may be prudent to be ready to take advantage of another leg lower in the market.

First, there are no guarantees that, in the absence of a vaccine, a return to work will not result in a reinfection surge.

Second, it is becoming clearer that we should not take much comfort from apparent Chinese success. Reports are emerging of the various ways in which (China lies) the case data is being ‘managed’. For example, a report from the Washington Post in the last couple of days points to:

- A suspension of testing in Wuhan to coincide with Xi’s visit and facilitate the symbolically important “zero new cases”;

- The non-reporting of asymptomatic cases that have tested positive. This effectively means that a positive test result is not a case unless the Party says it is, and is a critical reporting shortfall given the ability of asymptomatic patients to spread the disease; and

- Suggestions of “cover up” by local governments.

Typical. Why should we expect anything more?

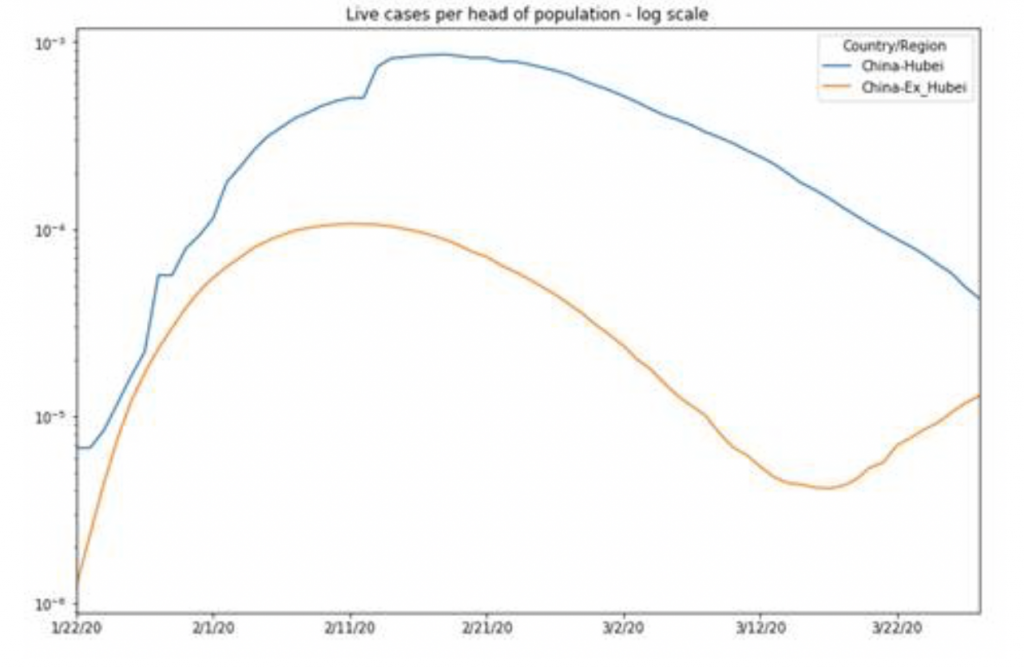

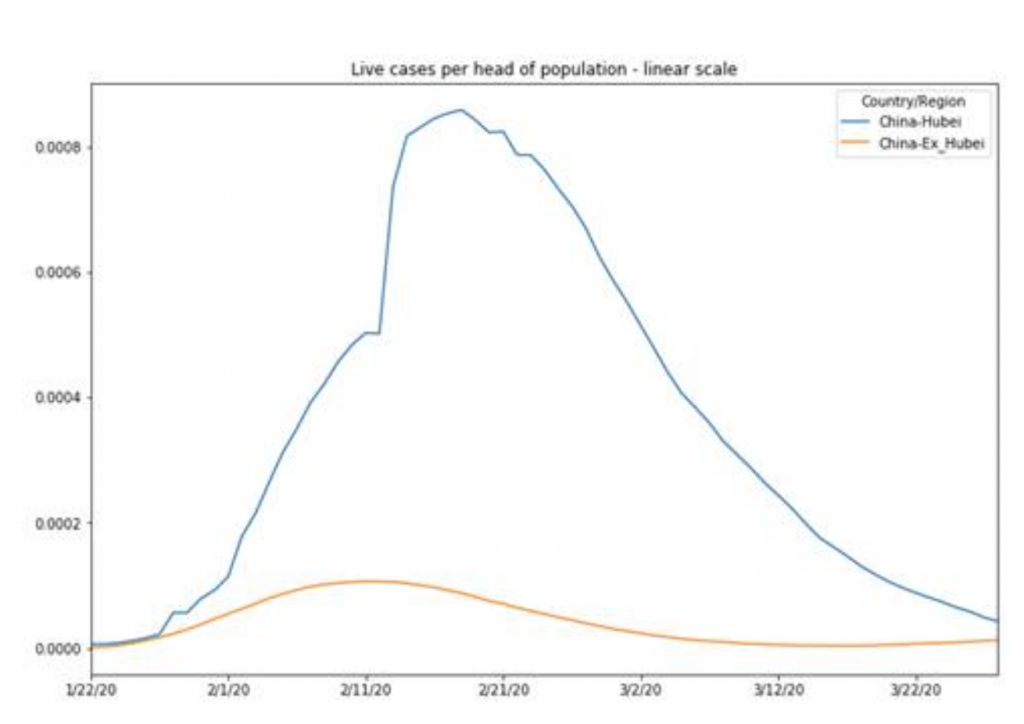

We have been tracking a bounce in live case numbers outside Hubei (Figures 1&2). It shows up clearly in log scale but is not yet obvious in linear.

Figure 1. Live cases per capita – log scale

Figure 2. Live cases per capita – linear scale

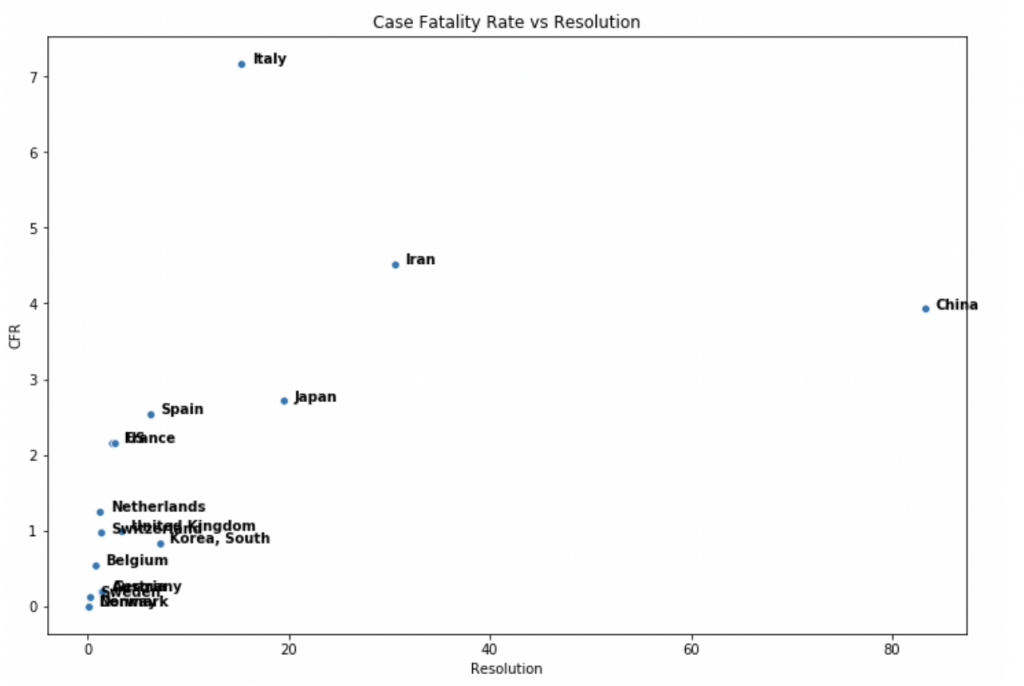

In our client webinar two weeks ago we highlighted the following chart (Figure 3), which plots fatality rates against resolved cases, and showed that the entire data set from China looked suspicious (China is suspiciously over on the right, while the rest of the world is on the left).

Figure 3. Resolved Cases (death + recovery) v Case Fatality Rates

During that webinar we also suggested that any resurgence in China would trigger one of two official responses:

- A resurgence in positive cases wouldn’t be reported at all, or

- A resurgence, and any associated slowing of the economy, would be blamed on the rest of the world.

Meanwhile, we perhaps shouldn’t be too optimistic about America – the land of the free.

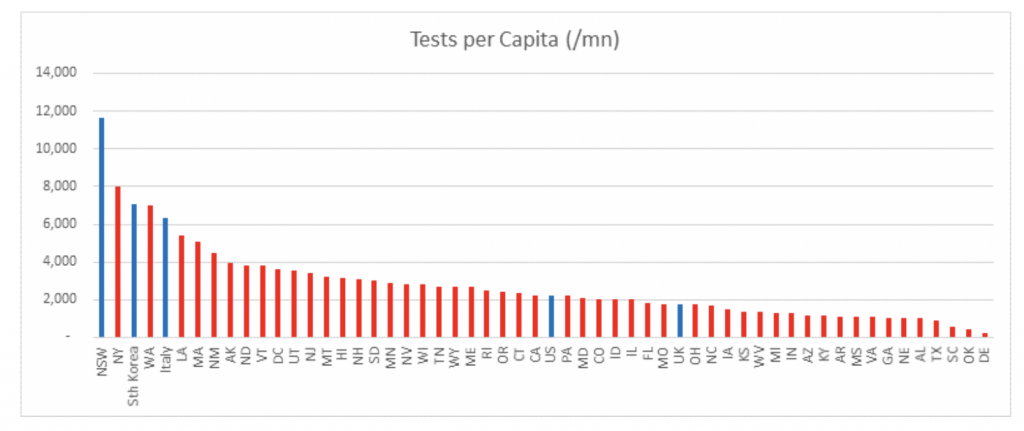

First, you might recall we reported that America was only testing an average of 40 people per day in January and only 92 people per day in February. Our investment thesis was they were going to be shocked when they started testing and markets would crack. That happened. Now have a look at the amount of testing they are conducting (Figure 4.). They still haven’t ramped up as quickly as we have (and we started pretty late).

Figure 4. Tests per capita. You only find when you look

Source: The COVID Tracking Project, Montgomery

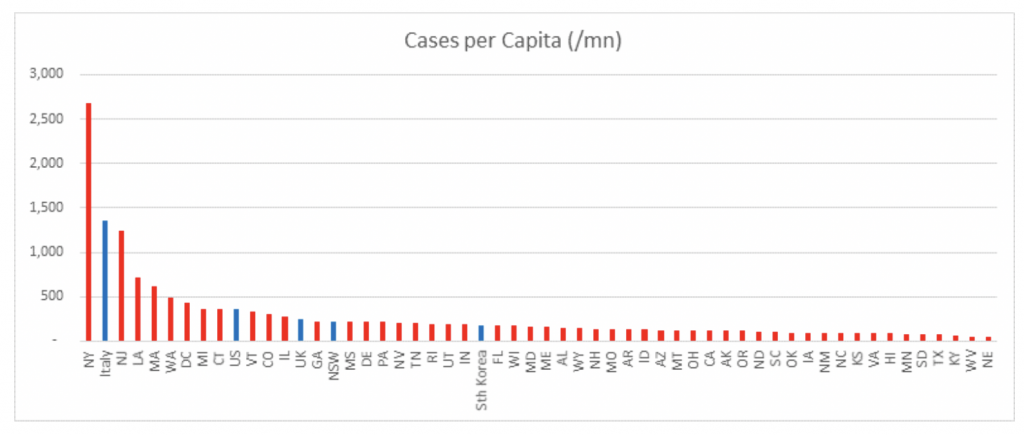

And because the US started so late, even their relatively immature testing rates are already showing a high proportion of cases (see New York in Figure 6). The case detection rate in NY makes Italy look like it has everything under control.

Figure 6. Detection rate shock in the US

Source: The COVID Tracking Project, Montgomery

As we warned here at the blog and also in The Australian, western liberal democracies cannot be as effective as totalitarian dictatorships at locking down their citizens. A lack of control of the population will mean the virus penetrates more deeply into the population and the problem will take longer to resolve.

And here’s the evidence: Over the weekend, Trump told reporters, “We’d like to see NY quarantined because it’s a hotspot, New York, New Jersey, maybe one or two other places, certain parts of Connecticut quarantined.”

But unfortunately, and predictably, the plan was immediately criticised by the 56th Governor of New York State, Andrew M. Cuomo, who said it was a “preposterous” idea and counter-productive toward the president’s goals of restarting the economy. On CNN, Cuomo added: “It would be chaos and mayhem,” and “If you start walling off areas all across the country, it would just be totally bizarre, counterproductive, anti-American, antisocial.”

There you go, Americans should be free to get infected if they want to.

With the above in mind, we believe it could be premature to believe case peaks are just around the corner and, even if they are, a surprise resurgence could produce another leg lower in equity markets. We’ll continue to keep you up to date here at the blog with our latest thoughts and insights, so be sure to subscribe.

Such good info here Roger!! Thank you!!

Thanks for the encouraging words Tiago.

Agree Roger. The USA is following the same numerical trajectory as Spain, which is going to end up worse than Italy.

Good to hear from you Jim. A shame we can’t catch up in person for a while. This very convenient summary shows US on a similar path to Italy. https://www.bbc.com/news/av/world-us-canada-52066105/coronavirus-us-death-rates-v-china-italy-and-south-korea

Excellent work here Roger two points…

1)

“As we warned here at the blog and also in The Australian, western liberal democracies cannot be as effective as totalitarian dictatorships at locking down their citizens. A lack of control of the population will mean the virus penetrates more deeply into the population and the problem will take longer to resolve.”

‘Social democracies’ if they are true social democracies should be better at managing these type of problems because people work to together to understand and overcome problems – people trust experts because these experts are viewed as legitimate . With ‘totalitarian’ regimes the instinct is obfuscate and cover up problems and they motivated by public relations management. Why this important is that it becomes easy to praise authoritarian responses as effective when they in fact they are not. The poor responses of Western nations is the result of social democracies that are not functioning well being reactive and more interested in public relations management and associated existence of an expert class who the public and politicians mistrust. Who, and how, are is the legitimacy of public experts decided? So far I have found unorthodox – but still knowledgeable – commentators far more enlightening, and about a month ahead ,of public authorities. 4 corners last night did not inspire me that the authorities are using their initiative or even using a basic level of common sense. Good grief!

2) My view is that in retrospect the crisis that unfolds will be remembered more as a failure of health care than as a public health issue. I think conservative commentators like Peter Hitchens are misunderstanding the actual problem that is at hand and this relates to their tendency to engage in a utilitarian arguments about pro versus cons not recognizing that if the health system and other care systems fail this will become a moral crisis that may well cause an epistemological rupture. I am loathe to quote Peter Garrett here but – ‘your dream world is just about to end’.

Really useful observations John. The serious of Covid19 and the consequent pressure on health care systems is precisely why we have to lock down rather than permit herd immunity. Once a vaccine is developed, we will return to a world that finds the path of least resistance. The least resistance exists in the structures already in place. In other words no change.

Thanks Roger. But what about all the government stimulus and support measures being put in place. Will they not be somewhat supportive of confidence and prices?

Temporarily yes Rick, but their impact declines the longer the crisis continues.

As anticipated a brilliant summary Roger, and you predicited and published many of these scenarios before they became factual.

We now know the problem we face, but what effect short and long term will this have on economies, government budgets and coffers, share markets, small and big businesses, and people worldwide,and how will China be viewed and tempered economically and socially in the future?

Governments responses to this virus will be seen and judged as too soon or too late, not enough or too much.

Peoples responses to this virus will be remembered with a mixture of emotions, but we will recover

its what humans do, i only wish i had substantial cash available to invest in share prices not seen for a long while.

Thanks Garry. Like a separation, the parties will go through the gamut of emotions first. Eventually, I suspect the world will view China very differently. Sadly however we will continue to tolerate their appalling world view and trade with them. It will be seen as necessary for the west’s economic recovery.

As always Rog magnificent analysis…….I am interested why this and prior analysis didn’t lead you guys to sell into cash as soon as it was pretty obvious that things would get far worse than initially expected……30 to 40 % cash holdings that have been the mainstay during a long run up in overvalued markets could and should have quickly moved to 60-70% very early in the Corona Shock phase and would have resulted in a stack more powder for redeployment into these A1 type companies………having had great respect for your approach and discipline over the years and waiting with baited breath for a downturn so that you can fully bloom when others are failing I just feel you guys could have ratcheted up cash holdings earlier and truly showed us all something different from your investment peers? No disrespect Rog but I would be interested in the reasoning if there is one please because it seems a significant opportunity lost for the likes of you guys?

Thankyou

Richard Vidal

Hi Richard, The mandate for the Montgomery Fund permits 30% cash. We reduced risk further by reducing the beta of the equity holdings. Hope that makes sense.