Why are we quoting the Montgomery Global Fund on the ASX?

Here are 10 reasons to consider investing in The Montgomery Global Equities Fund (Managed Fund) (ASX: MOGL) an Active Exchange Traded Managed Fund (ETMF).

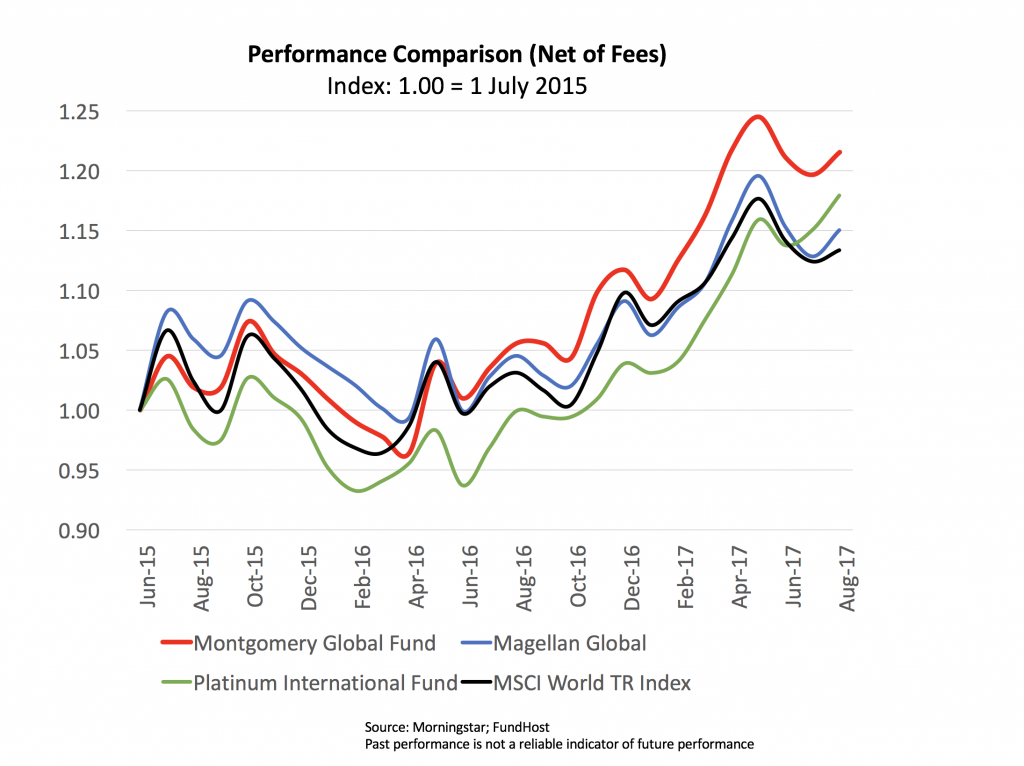

1. Our Montgomery Global Fund investors have benefited from excellent performance since inception.

2. Investors gain exposure to quality global companies with revenue streams unavailable on the ASX. With investments in large and small companies in China, Europe, the UK, the US and Australia, investors also benefit from true global diversification – unlike through much larger funds that concentrate on only the biggest names in the US or Asia.

3. Investors will benefit from regular semi-annual income from a minimum targeted distribution yield of 4.5 per cent per annum. The target distribution is a target only and may not be achieved.

4. MOGL’s portfolio of global companies is very difficult to replicate individually.

5. MOGL is an ETMF offering easy access to impressive global capabilities and the potential to continue to outperform the benchmark, unlike passive ETFs.

6. MOGL can be bought or sold via the ASX exactly same way as buying a share. Easily buy a diversified portfolio of quality global businesses with just one trade.

7. A single stock holding makes administration and tax reporting easy.

8. Investors aren’t required to complete any forms or additional paperwork, and there is no minimum investment requirement.

9. The MOGL Active ETMFs offers increased transparency as with intra-day pricing via the ASX.

10. MOGL can hold cash when the opportunity set is thin. Cash builds as the market becomes more expensive and cash is deployed as the market becomes cheaper. The track record in Point (1) has been delivered with approximately 20 per cent in the safety of cash. Past performance is not a reliable indicator of future performance.

MOGL is coming soon. We have finalised our offer documents and await ASIC and ASX sign-off before their release. Pre-register HERE.

Perpetual Trust Services Limited ACN 000 142 049 AFS Licence No. 236 648 (Perpetual) is the responsible entity of the Montgomery Global Equities Fund (Fund) and has made application to ASIC to register the Fund as a registered managed investment scheme. An application to the ASX, to be quoted under the AQUA rules, has been made and a PDS will be available subject to the ASX’s and ASIC approval.

A Product Disclosure Statement (PDS) for the Fund is expected to be released shortly. Copies of the PDS will be available by downloading them from the offer website. Before making any decision to make or hold any investment in the Fund you should consider the PDS in full. You should consider whether this information is appropriate for you and consult your financial or other professional advisor before investing.

Investment in the Fund is subject to risk including possible delays in payment or loss of income and principal invested. Montgomery and Perpetual does not guarantee the performance of the Fund. The forecast distribution yields are predictive in nature and are calculated in accordance with a number of underlying assumptions set out in the PDS. Returns are not guaranteed.

How can 4.5% yield can be maintained from a portfolio of global stocks – most of which will not yield anywhere near 4.5%.

Hi Rob, Think for a moment about an unlisted trust. As no tax is paid directly by the trust (it is paid by the ‘beneficiaries’) all cash interest and dividends received have to be distributed. But that isn’t the only source of ‘income’ for unit holders. The trust also has to distribute all of the net realised capital gains (realised capital gains less realised capital losses). In the Montgomery [Private] Fund for example the distributions have ben as follows;

June 2017

Distribution per unit: 6.1093 cents

Reinvestment price: $1.2126

June 2016

Distribution per unit: 17.2143 cents

Reinvestment price: $1.2534

June 2015

Distribution per unit: 14.6151 cents

Reinvestment price: $1.2553

June 2014

Distribution per unit: 4.4934 cents

Reinvestment price: $1.2346

June 2013

Distribution per unit: 12.8334 cents

Reinvestment price: $1.1854

June 2012

Distribution per unit: 2.8771 cents

Reinvestment price: $1.0263

So you can see that the yield on the stocks in the portfolio isn’t the only source of the distribution.

And in the case of the exchange quoted managed fund, distributions can also be paid out of capital (LIC’s have this feature too).

So I hope that explains it for you.

I have edited your post and deleted some of the offensive language so that you don’t embarrass yourself or feel awkward, self-conscious, or ashamed. Please refrain from it in future.

My understanding, as basic as it is, is that outperformance bonuses will be paid to the management team and at the same time share price will be positively affected so good all round?

Hi Sue,

Just keep in mind the price of the units will track the performance of the portfolio. They aren’t shares in a listed invested company. The structure is not a company at all. It is an Exchange Traded Managed Fund.

Is the fund hedged or not?

Hi Ric,

Montgomery Global, may on occasion, hedge the Fund against movements in the Australian dollar and other currency exchange rates, but the default position is to remain unhedged.

..yes MFG has done very well and it also allows us ‘small fry’ to invest in the Montgomery team’s stockpicking skills

Thanks Simon

…and of course Roger your company can make much more money following the lead of the listed fundies likes those of MFG /Magellan

Hi Simon,

Thanks for sharing your sentiments. We expect we will actually be attracting the same investors who might have considered our unlisted funds. We therefore expect some cannibilisation or our existing funds. So, in point of fact, our motivation is simply to make sure our funds are available in the structures that investors require or prefer.

Hi Roger, exciting stuff. What disadvantages might it have vs the unlisted equivalent?

ETMF’s are a relatively recent innovation so the passage of time to be required to be able to answer that Dave.

Hi Roger

The active ETMF you are about to list on the ASX is a step in the right direction. My preference is for a closed end structure such as a LIC or LIT , but an active ETMF is not that negative that I would not invest in one. The future performance of the Fund is more the issue for me.

One issue that has me and possibly other prospective investors confused is the minimum targeted distribution yield of 4.5% . I raised that issue with David Buckland ( see article 5/9/17 ” The future of Montgomery Global Fund”) Based on his explanation I came away thinking that the 4.5% will always be the minimum distribution and if that income yield is not achieved a “top up” out of Capital ( another way of saying return of your own money) WILL occur to reach that 4.5%.

After reading your comments in Point 3 above I’m not so sure that’s the case. In Point 3 you said that “the target distribution is a TARGET ONLY and MAY NOT be achieved” I take that to mean that every effort will be made to achieve 4.5% and if it’s not achieved then there will be NO “top up” . If my understanding of what you said in Point 3 is correct, then your view on that issue appears to conflict with my understanding of David’s explanation . Will there always be a mandatory ‘top up” if the 4.5% yield is not achieved ? You need to make that point very clear as it appears other readers are also unsure about issues on how the 4.5% yield works. My preference is that there be NO “top up” – If an investor wants their own money back then they can sell units on the ASX when it’s suits them and not have it forced upon them . In my view a mandatory “top up”‘ is negative but understand it may suit others.

Hope the ETMF proves successful for you and your team

As you can imagine Max, it’s not unsual, when lawyers get involved, to make sure every scenario is comprehensively covered and disclaimed.