Who said China is trying to transform its economy?

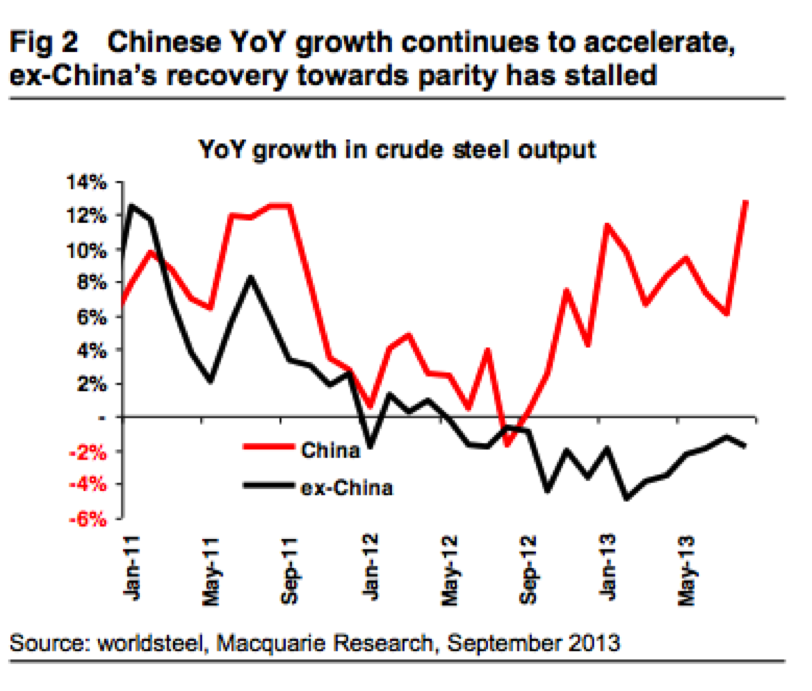

Despite the intention of the authorities, Chinese consumption is not growing as fast as GDP. The release of the August 2013 global crude steel output by Worldsteel demonstrates China’s commitment to Fixed Asset Investment. The obsession with expenditure on low yielding fixed assets continues at pace and is one of the reasons the Shanghai Composite Index is currently 64 per cent below its October 2007 record high.

The table below compares August 2013 crude steel production with the previous corresponding period. China’s steel production grew from 58.7 million tonnes (mt) to 66.3mt, an increase of 7.6mt or 12.9 percent.

Crude steel production from the world (ex-China) declined by 1.8 per cent or 1.2mt, from 65.3mt to 64.1mt. China’s contribution to world crude production increased from 47.4 per cent of world crude steel production to 50.8 per cent.

|

Crude Steel Production (mt) |

August 2012 |

August 2013 |

Change |

|

World |

124.0 |

130.4 |

+5.2% |

|

World, ex-China |

65.26 |

64.08 |

-1.8% |

|

China |

58.70 |

66.28 |

+12.9% |

|

China/ World (%) |

47.4 |

50.8 |

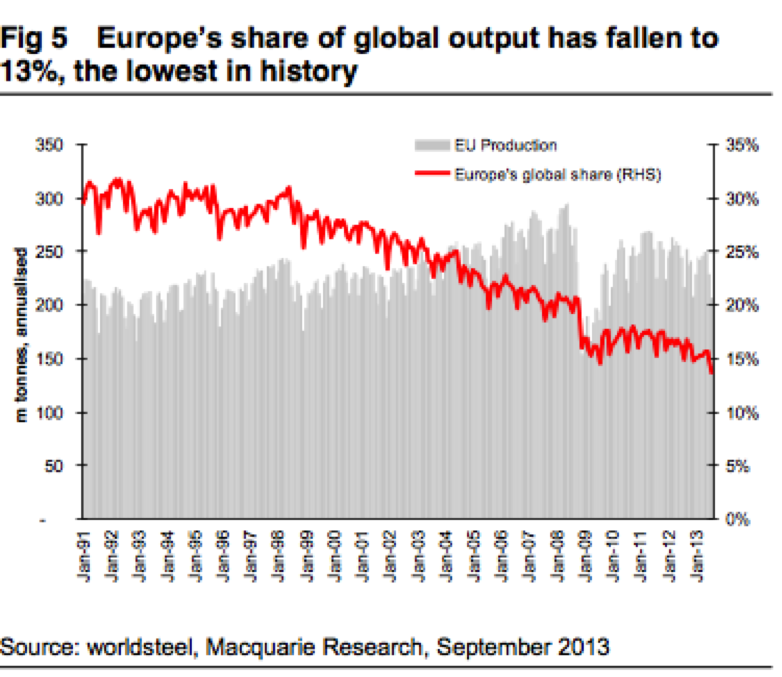

Meanwhile, the disturbing downtrend in European crude steel production continues with Europe’s share of global output declining from 30 per cent in 1990 to its current 13 per cent. The production profile of several Eastern European countries is worrisome, especially given the context that virtually all have unsustainably high gross external debt as a percentage of their GDP and a reasonable chunk of that external debt is due within one year!