“Where will growth come from?”

The increase in corporate debt in the US has mostly been deployed on financial engineering – share buybacks (at expensive multiples) and Mergers & Acquisitions (at expensive multiples). Precious little has been employed for productive use. And given the aggregate US corporate debt has a percentage of GDP at more than 380 per cent and cash flows as measured by EBITDA have been declining since their peak in 2010, it suggests there is little capacity to borrow more to fund growth projects.

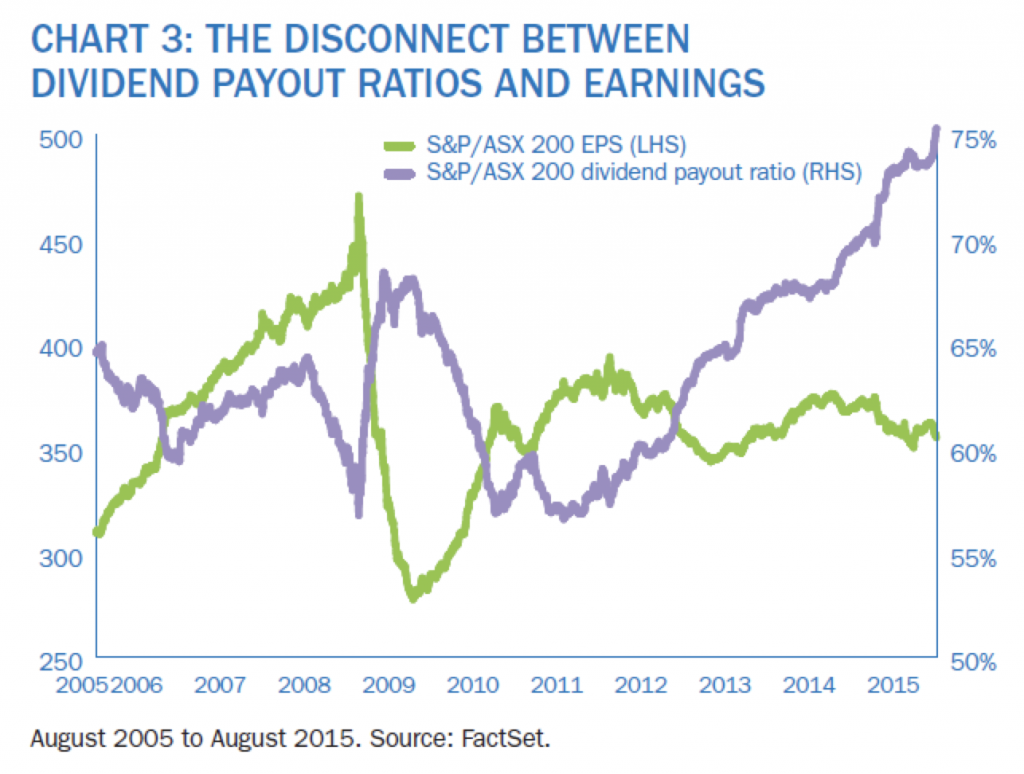

Growth of course can be funded three ways. A company can borrow (increase risk), it can raise fresh capital (dilutive) or it can reinvest retained earnings. The chart shows a significant increase in the payout ratio of Australia’s largest 200 companies since 2010. Even though earnings, as measured by Earnings Per Share, have not grown since 2010, the dividends to shareholders have been increasing. It’s the higher dividends that have been fuelling the higher share prices.

When a company pays most of its earnings out as a dividend, the corollary is there is less retained to grow the equity, the earnings and the business. Higher share prices – the result of investors’ pursuit of attractive yields, are not supported by strong earnings growth. That means the share prices are insufficiently supported by their fundamental driver, earnings growth. If the earnings aren’t growing, the dividends won’t grow further, if there is no growth in the income investors receive, inflation erodes its value and the share price must come back again.

No capacity to borrow and less retained earnings suggests the stock market is in a quagmire. For investors to beat the market they must invest in companies that grow. Here at the blog we write about those companies frequently. Stay tuned.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

fyi typo. meant 200 companies, say 200 countries since 2010

Got it Peter. Thanks.