Where is the value? Let Skaffold keep you posted!

Last week on 2GB I didn’t speak to Ross Greenwood as I normally do. He was off in New York for Channel Nine. Instead I had a terrific chat with my friend and former fund manager Matthew Kidman.

As usual we didn’t have a great deal of time but I asked Matthew whether he was seeing much value and his reply was telling. Like me, it seems to Matthew that value was getting thin on the ground, particularly among the higher quality companies.

There is still a few pockets of value and we named a few stocks. Matthew mentioned that he also predicted that the market would now strengthen and stocks that are fairly valued may continue to rally well beyond fair value.

I am less able to predict stocks and their short term price direction. To reduce risk what we do is simply analyse those companies that come into value as their prices, values and quality scores change.

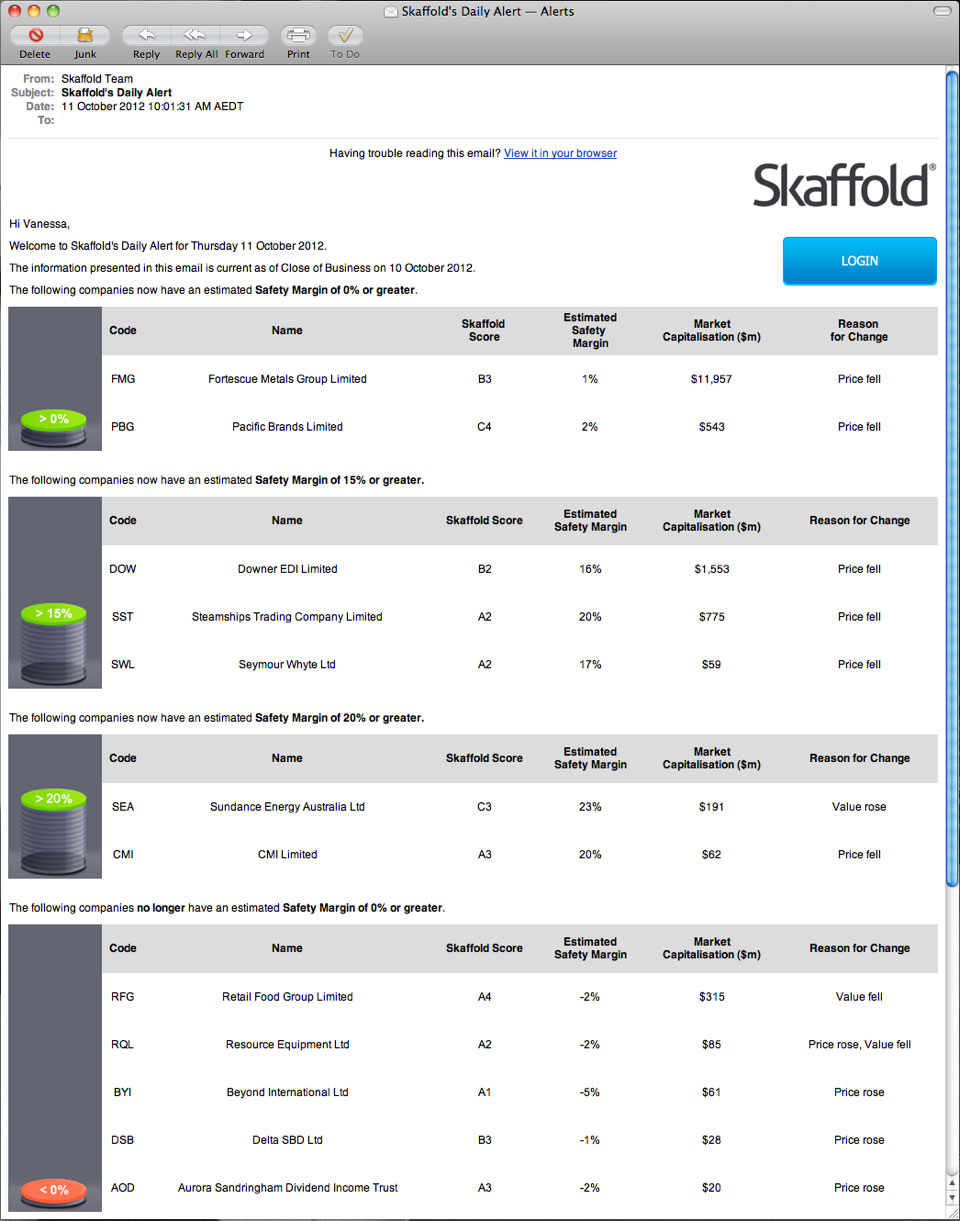

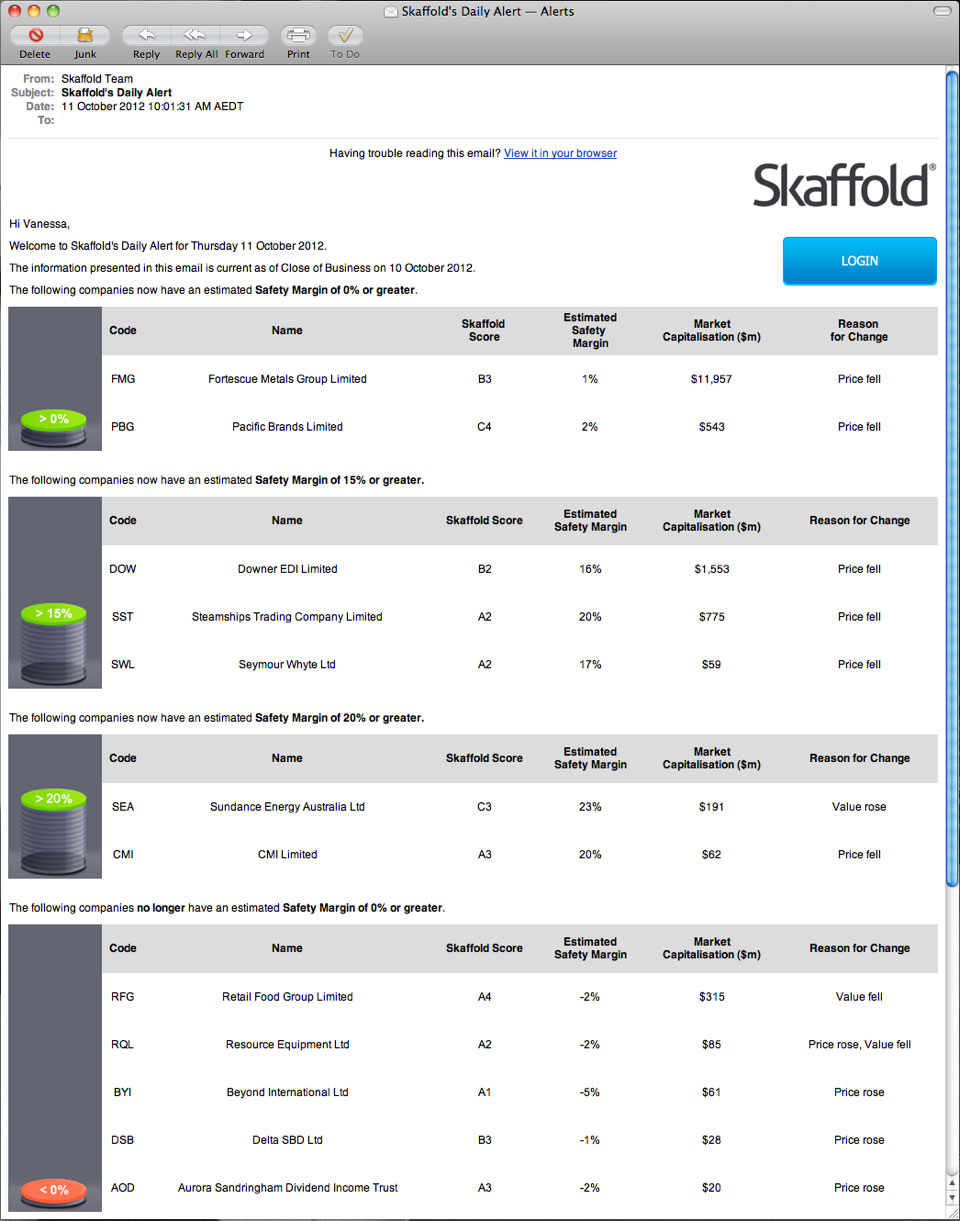

I am often asked how we go about doing that. Of course, and as you know, we use Skaffold.com but what you may not know is that Skaffold generates these wonderful auto-generated emails that list companies that I should focus my research team’s attention on.

Have a look at the image and you will see that a daily does of this information goes a long way to helping sort out what we need to spend time on.

I cannot tell whether the market will go up or down next but if we continue to build a portfolio of extraordinary businesses trading at a discount to value and businesses whose values are rising, we reckon we’ll do ok in the long run.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi Roger,

I note in today’s (25 October) Eureka and also overnight on Skaffold, that WBC has been re-rated from an A1 to an A4 company. A BIG call – from top investment grade quality to not investment grade at all in one fell swoop.

I rang the Skaffold team to try and find out what was the driver of this re-rating. Apparently it was due to the launch of Interim data earlier this week. The interim report being used to source the data was issued on 31 March this year. The really helpful Skaffold people I spoke to indicated that Return on Assets, Cost to Income and ROE ratios had all deteriorated, along with “Bad Debts”.

I looked through that report as well as my lack of financial and accounting skills would allow and could find nothing like the doom and gloom that caused the re-rating. In fact CEO Gail Kelly stated : “A strong balance sheet has been a hallmark of the Westpac Group over recent years. I am pleased to say we continued to strengthen our position with increased capital, an improved funding profile and excellent asset quality. On efficiency, we continue to be the leading Australian bank, with our cost to income ratio significantly better than our peers.”

As an avid (daily) user of Skaffold, I enjoy the timeliness and rigour of the data it provides. However, this experience has given me pause – if such a negative re-rating of so important a stock as WBC is to occur, would it not be good to include some sort of explanation of what has changed to cause that? Should we also endeavour to use data more current than 7 months old and why make such a BIG call 2 weeks out from the announcement of the results for the whole year anyway?

What is your own view? Do you think WBC has really slipped so far? If so, could you comment as to your views on why that may have happened?

Best regards

ALl the inputs Skaffold uses to make that assessment have deteriorated. Perhaps there is some seasonality but over the last rolling 12 months, it is what it is. I am glad I have access to this information.

Hi Roger

Pls pass on big “thank you” to Russel and Jerome for “Reporting Season Standouts”.

If you listen/read in between lines/comments you really get to understand Skaffold, and what it can do.

Being a skaffold member is worth every cent.Looking forward to March 2013

report.

Cheers