Where are Aussie SMSFs investing?

If you run your own self-managed super fund (SMSF), have you ever wondered how you stand against other investors in the same boat? Well, a recent report shines a light on where we invest and how much we are putting away. It contains a few surprises.

The report, produced in June by a leading provider* of SMSF administration and accounting software, details some interesting insights on the 140,000 SMSFs using its services. Given this represents around 24 per cent of all SMSFs in Australia, it provides a good proxy for the SMSF market.

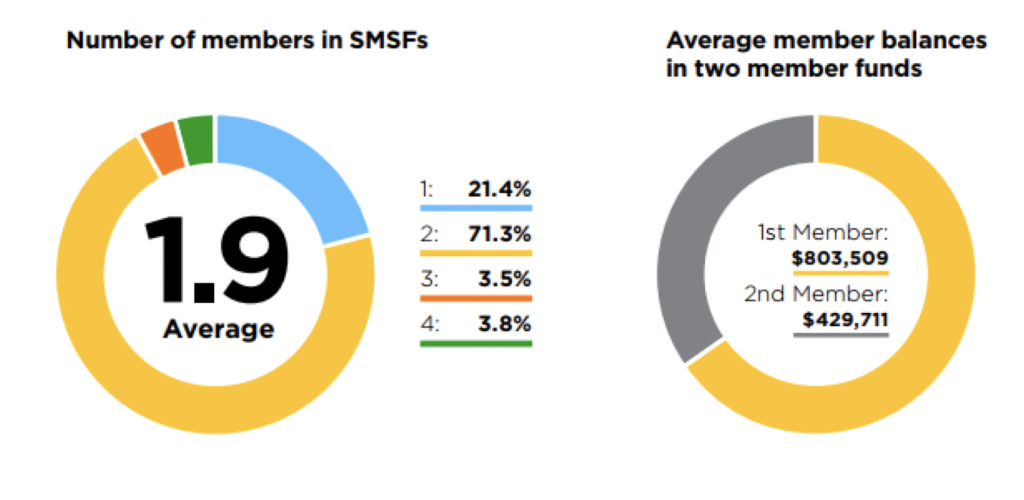

Membership sizes

The average SMSF has just shy of two members in the fund, with the first member having a significantly higher balance ($803,509) than the second member ($429,711). However, with the new transfer balance caps at just $1.6 million per person, I think we could expect that this will even out more over time.

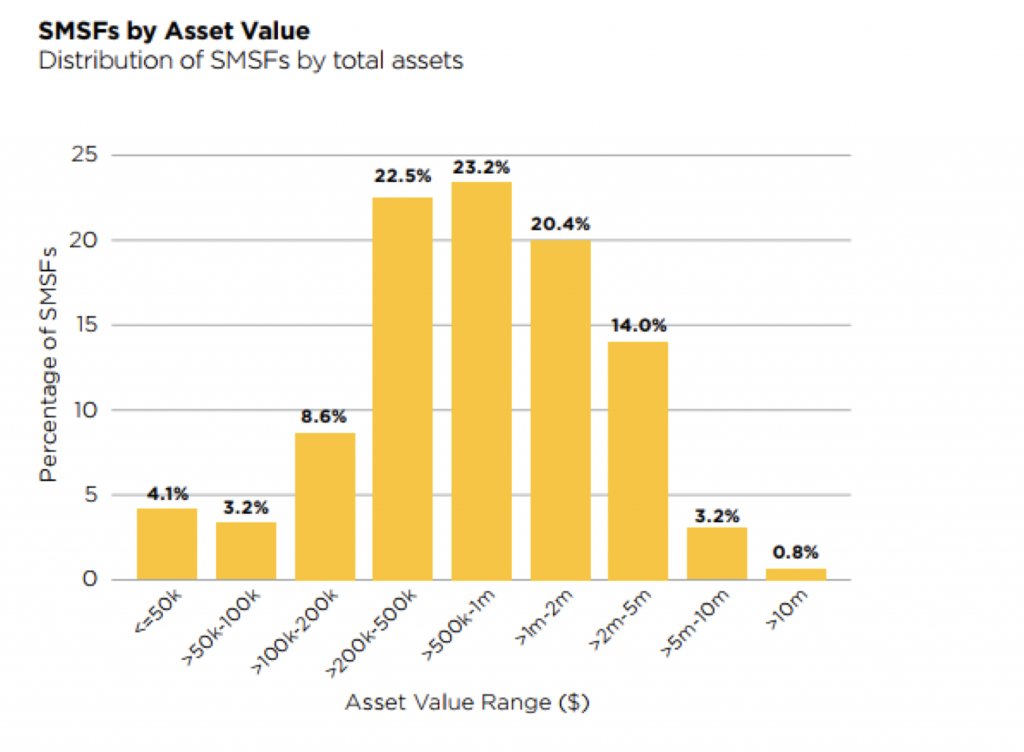

SMSFs by Asset Value

Average assets per member $695,479

Average assets per SMSF $1,319,707

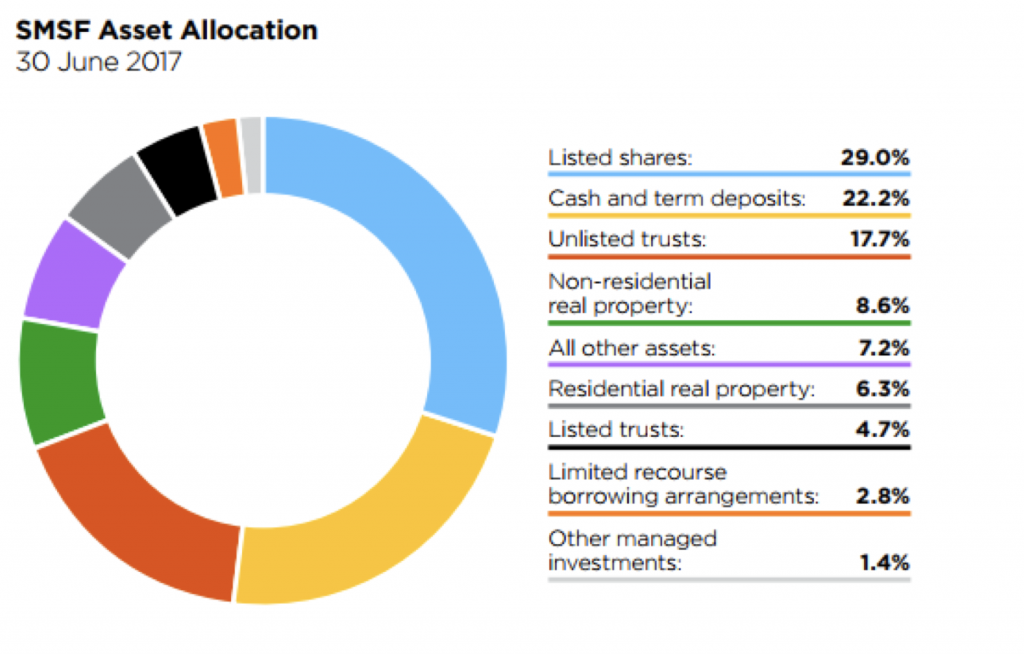

Asset allocation

When it comes to what investments SMSF hold, we can see from the chart below that Listed Shares make up the largest proportion of portfolios with a 29 per cent weight.

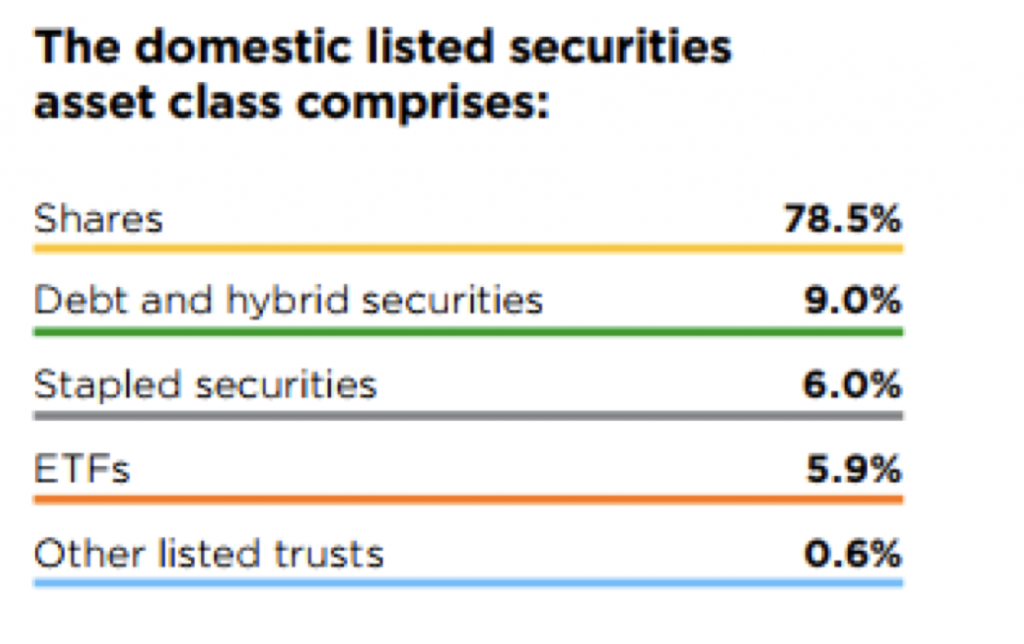

Looking at “Listed Shares” more closely, we can see that it is mostly domestic shares.

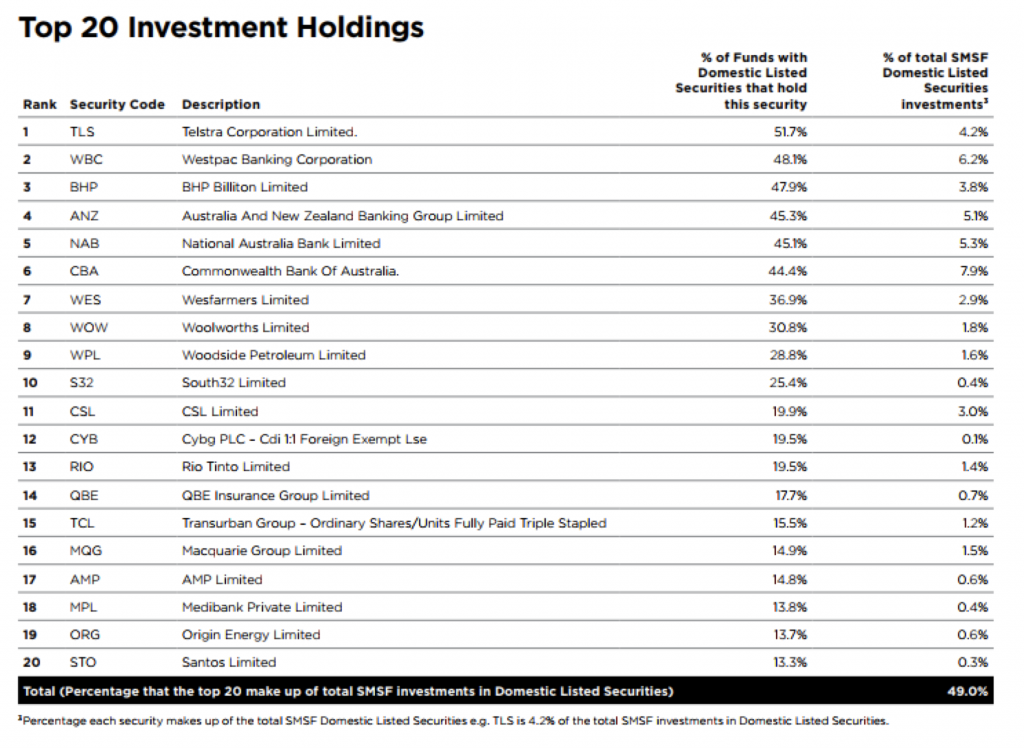

If we then look at which shares make up the Top 20 holdings in this category, we can see it very closely mimics the 20 largest companies listed in Australia. Interestingly, Telstra is the most common domestically listed security that SMSF’s hold. Is this because of the traditionally high and stable yield?

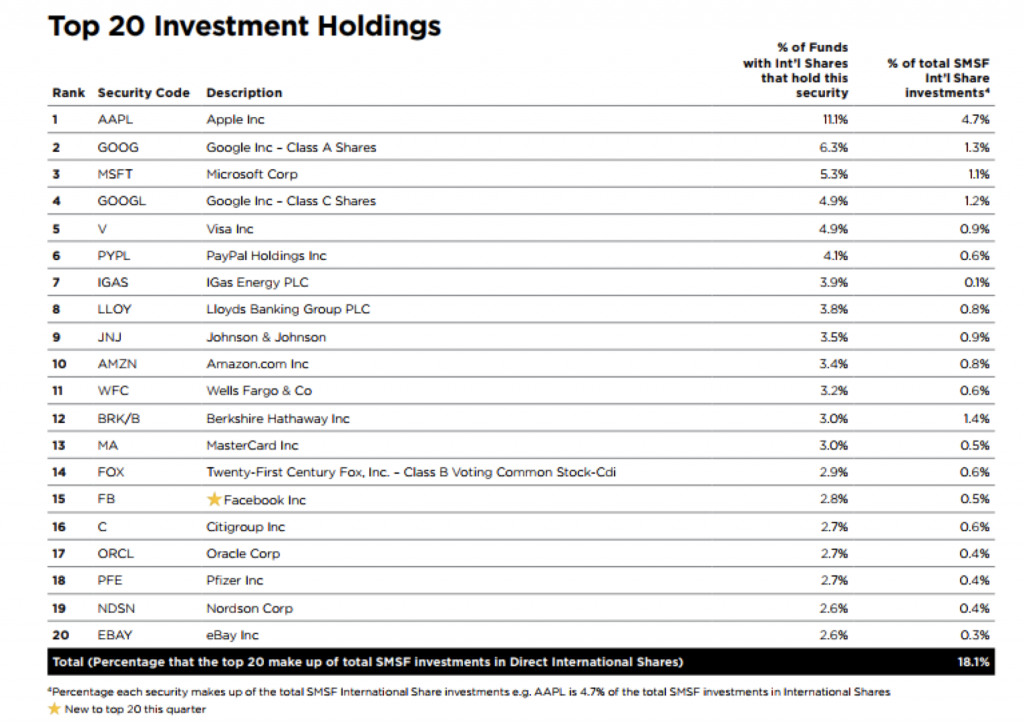

It is a different picture though when we look at the direct international securities held by SMSFs. In fact, these make up only 1.1 per cent of all SMSF assets. Data shows that it is much more common for global equity exposure to be accessed through unlisted managed funds, ETFs, LICs and Exchange Traded Managed Funds (ETMF). This is one reason why we here at Montgomery have decided to replicate the successful, actively managed Montgomery Global Fund (unlisted managed fund) and launch it in another version being an ETMF which will be called Montgomery Global Equities Fund (ASX: MOGL). Out of interest the top 20 directly held international stocks are shown below. Technology based companies make up 61 per cent of these assets!

If you would like more information on our soon to list Montgomery Global Equites Fund (ASX: MOGL) pre-register your interest here.

*Class Super is now used by over 1,100 accounting, financial planning and specialist administration businesses to administer over 140,000 SMSFs, 24 per cent of the estimated 596,516 SMSFs in Australia as at 30 June 2017.

Carlos

:

It is commonly stated that only 1% of SMSF funds are in international equities.

I am sceptical of this and suspect it is because we don’t much buy direct international equities, but use ASX listed global ETFs and LICs ( are these really Domestic shares????) as well as unlisted managed funds. My Netwealth account classifies global ETFs and LICs under the category of Australian shares, which is erroneous in my view.

Thus in my case I have zero direct global shares but about 40% via ETFs, LICs and unlisted funds.