When bad news is good news

After the very sharp sell-off in the share market, the recent rally is indicative of a mood where bad news is good news. Specifically, the recognised slowdown in the English-speaking economies likely means the various Central Banks will not be required to increase official cash rates by the amount that most forecasters had assumed.

To reiterate, due to the tax via the increased prices for food, fuel, electricity and gas, combined with downward pressure on house prices from rising interest rates, plus the indebtedness of the Western world consumer, I am not nearly as pessimistic as most market commentators on the belated Central Bank tightening regime.

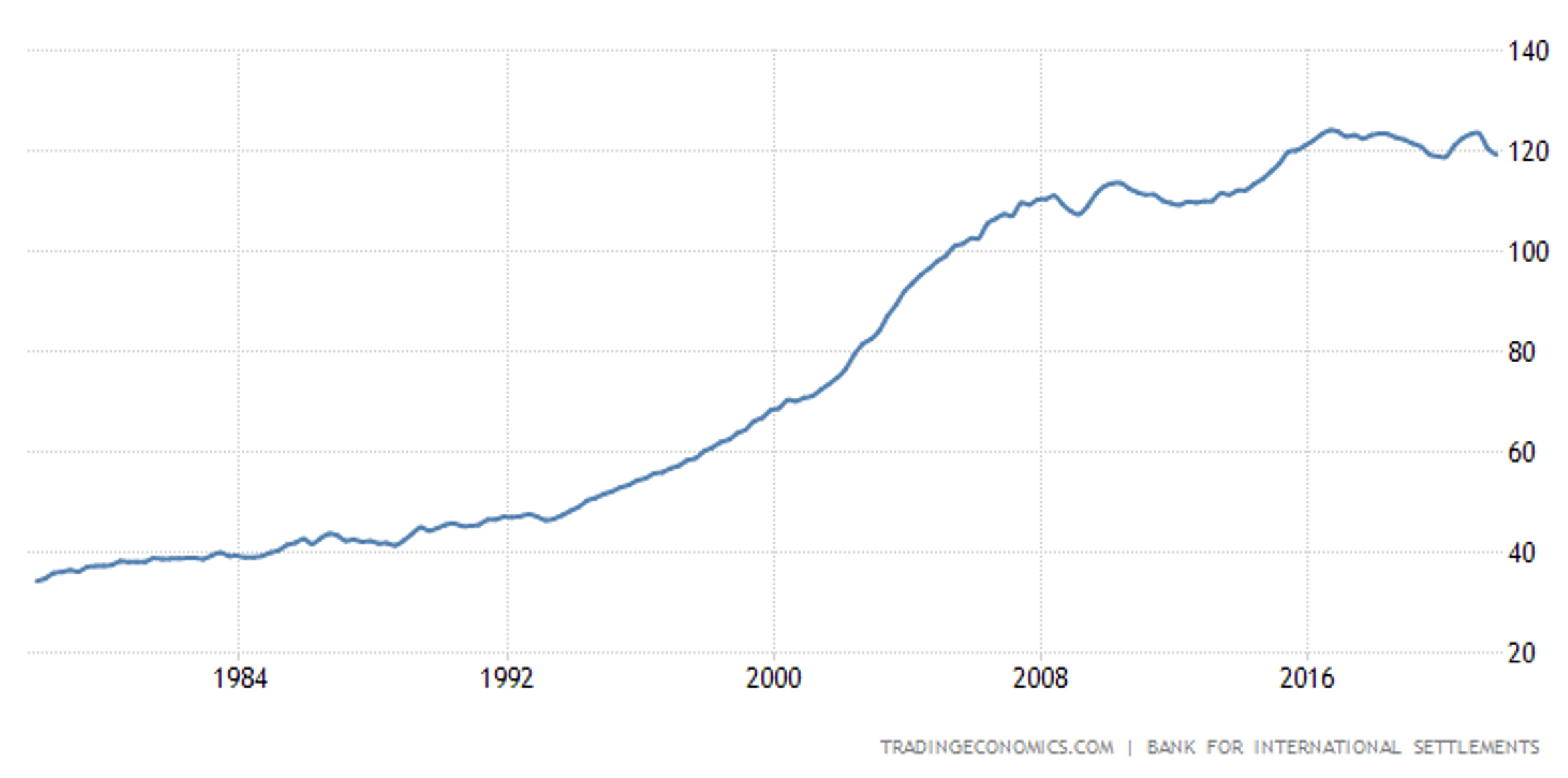

Australia’s household debt to GDP ratio

And to summarise where we see the current environment:

- While they maintain a 2-3 per cent inflation target – most Central Banks are late in their tightening cycle. They cannot risk cooling down economic activity too much within their levered systems without causing too much consequential pain.

- The US S&P 500 Index has declined 23 per cent and this is discounting some fears of recession. Nevertheless, bottom-up analysts have yet to meaningfully move on the potential earnings downgrade cycle, given the severity of the slowdown, for Fiscal 2023.

- 81 per cent of stocks listed on the NYSE are down more than 20 per cent from their 52-week highs, meaning we have experienced a broad-based sell-off. Many highly priced quality companies and smaller companies generally have been hit much harder.

- The US Federal Reserve is likely to raise rates by 0.5 per cent at their next meeting in late-July 2022 to 2.0 per cent, and I expect another 0.25 per cent tightening thereafter.

- Markets rely on liquidity and a change in the rhetoric on monetary policy from the US Federal Reserve is probably needed before we can be confident ‘the bottom’ is near.

- Some commentors are looking for upcoming weakness in the hiring plans by small businesses – and that is expected to lead the unemployment rate by four months.

- Keep a close eye on “Doctor Copper” – a key indicator of global industrial activity. After rallying from US$2.10/lb during the COVID-19 lows of March 2020 to US$5.00/lb in March 2022, the Copper price has since declined by 25 per cent to US$3.74/lb.

- As with the Global Financial Crisis, stimulus from China will help offset some of the slowing we expect in Europe and the US and could assist with a pull-up effect for Australia.

You can read my previous article here: The size of the hangover usually corresponds with the size of the party