What’s your cost of equity?

There are many questions about the art/science of investment that are unanswerable with any degree of precision (…or even a vague degree). A few immediately spring to mind.

- What is the expected return of a stock?

- How risky is a stock?

- Is now the time to buy?

The list goes on. But one question which is timely to consider is what model should a rational investor be using to discount the firms future earnings/arrive at a valuation? Depending on which model you’re using, this is better known as either the weighted average cost of capital (WACC) or the cost of equity.

Now the former is simply a function of the latter, adjusted for the after tax cost of debt (see here if you’re unfamiliar with this theory). So we’ll focus on cost of equity for this article.

It’s often said that investors shouldn’t overcomplicate estimation of the cost of equity and this is true – we shouldn’t need a doctorate in financial mathematics. However we should have an rational understanding of why we’ve selected a particular rate.

Investors should also recognise that valuation models for stocks are particularly sensitive to cost of equity assumptions and that over/underestimation can produce odd results. What I mean by this is that big mistakes can be made – remember, lower cost of equity assumptions lead to higher valuations and vice versa.

Perhaps the best known means of estimating the cost of equity is the Capital Asset Pricing Model (CAPM). In short, it takes the risk free rate of return and adds to it some risk premium set by the user and adjusted for the volatility of the stocks’ price relative to the volatility of some benchmark index.

Regular readers of this blog will immediately identify its short comings…

- Why should riskiness be defined as share price volatility?

- How would a user set the risk premium?

- Surely this premium would vary widely from user to user? Is that sensible for the same security?

Let’s go back to first principles. As rational investors we’re interested in the claim on assets that the share entitles us to and our valuation of said share is related to the growth (or lack of growth) in earnings that that asset provides.

Hence the real risk exists in the likelihood as to whether this cashflow materialises or not. Hence our cost of equity should be a function of this risk.

Now it appears that the CAPM framework is not all that terrible, (more so it’s application and interpretation via the wider financial community). It makes sense that our cost of equity composition should be the sum of the risk free rate plus some risk premium, perhaps better defined by our assumption that the real risk comes from future cash flow likelihood and not market prices.

Generally speaking, a range for cost of equity of 8-10% (3% or more for the risk free rate and the remainder some estimated risk premium) for firms with strong competitive advantages and bright prospects seems reasonable (credit to Bruce Greenwald). Perhaps 1-3% more could be added for securities with abnormal levels of risk however this is another conversation.

The issue that now arises is what happens when the risk free rate tends toward 0 as what has occurred in the United States and Europe. The above mathematics would suggest that effectively, the cost of equity would then then equate the risk premium.

In a classical model of economies/stock markets, this might not be so bad. After an economic crisis where risk free rates are lowered and stock markets are at lows, we’d hope that models encourage investment at the depressed prices. As markets recover and interest rates begin to climb, models lowering valuation in the face of higher prices would encourage investors to take advantage of the boom times.

In today’s world however, this model doesn’t appear to work. Stock prices overall do appear high and yet risk free rates are at historic lows. Going back to our cost of equity model, low rates suggest that investor’s cost of equity should decline which would naturally drive our valuation of listed businesses to new upwards.

This too isn’t necessarily a bad thing. Our intent is to earn the risk premium (compensation for a risky asset), alpha and the risk free rate (compensation for inflation) and even by paying the higher price in a lower rate world, we’re still doing this if the inflation rate is also low. Albeit, many may think otherwise given the lower nominal rate of return.

The risk however is that over the longer term, risk free rates/inflation may not necessarily stay depressed – they may actually increase. This would effectively increase the cost of equity and lower stock valuations.

At this point, the investor must either accept a lower valuation (in which case, a stock which they once thought was undervalued may actually be overvalued and hence sold or else be content with a lower real return over time).

It’s not hard to see that the outlook for risk free rates is currently bleak – but let’s not make the mistake that outlook is equivalent to a guaranteed outcome. Like Heisenberg’s principle, all predictions are subject to enormous uncertainty.

Clearly there is no perfect answer as to whether an investor should adjust the cost of equity in par with risk free rate movements. There are optimal movements if the investor had certainty on the direction of future risk free rates but none are in this fortunate position.

That being said, specifically for the market of the present, we can assess the outcomes of each decision and act to minimise downside risk amongst the alternatives.

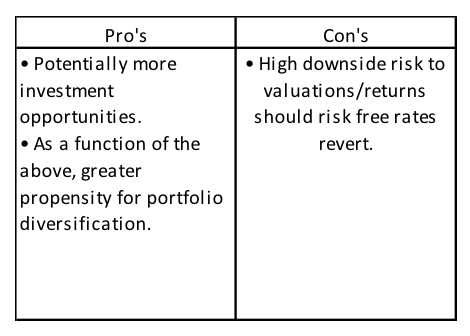

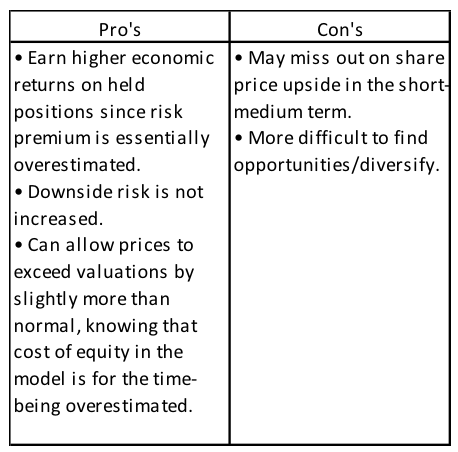

- The investor lowers cost of equity estimate in par with a lower risk free rate.

- The investor maintains cost of equity estimates at relatively normal rates (relative to history).

Presented in this light, holding cost of equity estimates at more normalised rates appears to be a relatively attractive choice (at least to the writer of this article, perhaps other may disagree). Albeit each option has ‘cons’ which do carry a real or implied cost.

Overall, the current economic climate in which investors must operate is odd. Macroeconomic ‘rules’ which were more reliable in the past don’t appear to be as reliable now which hence makes it difficult to form even vague expectations of the future. Utilising a rational cost of equity to model and hence value quality firms with bright prospects is perhaps the best we can do for our portfolios.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Do you use the volatility in cash flow/earnings or share prices as your equity risk premium?

As per the above, it’s a judgement of how volatile future cash flows may be. Naturally you may consider variables such as competitive advantage, industry position, operating leverage, industry catalysts etc.

No mathematical formula for this part unfortunately, just human judgement.

Good Morning Scott

That was an excellent well written article that is very appropriate in these uncertain times.

Current interest rates are in uncharted waters and the general consensus seems to be that they will remain lower for longer, however you still need to exercise caution when deciding on the cost of equity to use in valuing shares because the tide can turn very quickly. What is interesting to note is that despite low interest rates current wholesale funding costs for Banks are rising so every investment has to be assessed individually. What is appropriate for one Business may not be appropriate for another.

The message I take from your article is that a “Margin of Safety” is paramount . This may lead to some short term underperformance but serves you well in the long term. Rule number one is to not lose money and number two is to never forget rule number one.

Cheers

Max

Thanks Max, glad you found it useful!

Hi Scott,

What is your measure for ‘relatively normal’ rates?

Cheers,

Joe

As per the above

“‘Generally speaking, a range for cost of equity of 8-10% (3% or more for the risk free rate and the remainder some estimated risk premium) for firms with strong competitive advantages and bright prospects seems reasonable (credit to Bruce Greenwald). Perhaps 1-3% more could be added for securities with abnormal levels of risk however this is another conversation.”