What to make of the Tesla share price?

Around ten years ago, a small company called Tesla Motors (NASDAQ:TSLA) launched its IPO on the NASDAQ stock exchange, raising a total of US$226.1 million at a (split adjusted) share price of US$3.40. Since that time, shareholders in Tesla have enjoyed spectacular gains, as set out below.

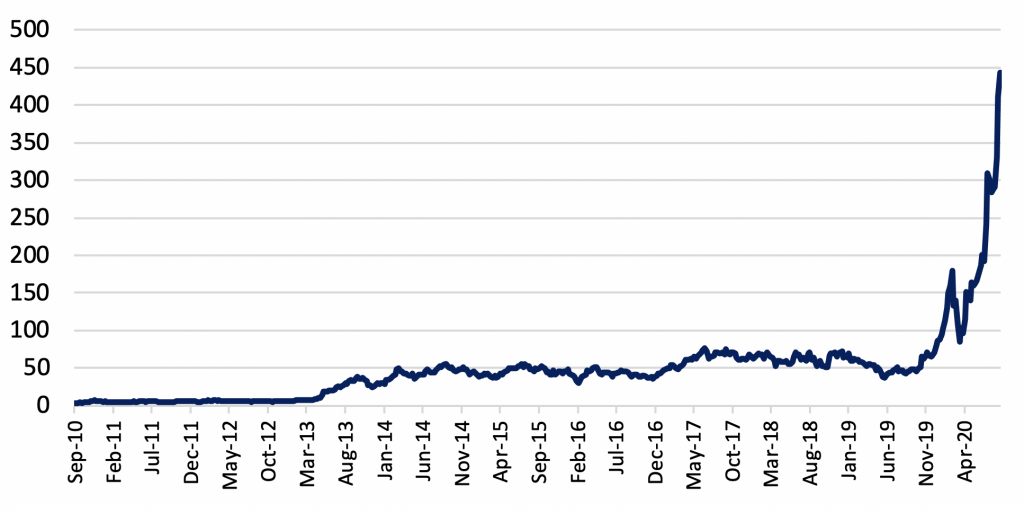

Tesla Share Price

Source: Bloomberg

For much of the last ten years, however, Tesla shares have done little. The spectacular gains accrued in two periods – one in 2013/14 when the shares increased by a factor of around 10x and again in the last 12 months when the shares have once again increased by a factor of around 10x.

Some reasons for the rapid gains in 2013/14 can readily be found. During this period, Tesla transitioned from being essentially a start-up with highly uncertain survival prospects to being a credible auto business, redefining public expectations around electric vehicles with its introduction of the Model S, and in 2013 generating its first quarterly profit. Reflecting this progress, between 1 January 2013 and 1 January 2014, consensus full year earnings forecasts for Tesla were revised up sharply, with 2015 net income forecasts moving from US$247 million to US$432 million and 2016 net income forecasts moving from US$415 million to US$784 million.

A 10x share price gain for a less-than-doubling of earnings expectations may seem excessive, but for a company that had been struggling for survival (and accordingly discounted), an improving financial picture can make a big difference as the discount is unwound.

Tim – I like your work, but this article has not aged well.

Tesla may in fact make a net profit of $15 billion in 2022, not the $5 billion as you have outlined in the article.

The upside is due to structural shift in the market, something you have failed to appreciate. Alongside other advantages tesla has, including finally hitting genuine economies of scale.

I invested my life savings in early 2020, and have not looked back.

Nigel.

Great analysis Tim, and well articulated. Thanks for the read.

Cheers, Bradley.

Great article. Tesla might have a fundamentally different margin profile to other automakers in the next few years, and I think this can help to explain some of the valuation. No other automaker in the world is able to charge USD $8000 for a software upgrade at the moment. I personally believe that the market is pricing in some chance of an autonomous ridesharing monopoly eventuating too.

Agreed Luke, although I think a large part of the valuation remains unexplained.