What on earth is a covered bond?

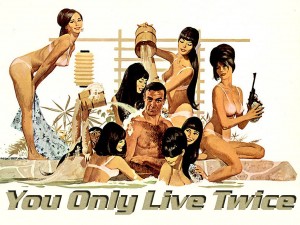

When Sean Connery played James Bond in the 1967 hit, You Only Live Twice one doubts he had this week’s billion dollar covered bond issue of ANZ in mind. Asking the question “what is a covered bond?” reveals an extra life has been given to borrowers at the expense of prudent savers. Its Australia’s own little moral hazard.

moral hazard n.- a situation in which a party insulated from risk behaves differently from how it would behave if it were fully exposed to the risk.

According to the Treasurer, Wayne Swan, legislation the government passed last month will strengthen the local financial system, increase the supply of credit, and provide cheaper, more stable and longer-term funding.

ANZ this week issued $US1.25 billion of five-year covered bonds. CBA is looking to Europe for its issue while Westpac and NAB are said to be eyeing the US debt markets for theirs ahead of increases in wholesale funding costs on their upcoming refinancing.

When banks issue covered bond they pay a lower rate on their funding than if they issued senior unsecured debt. And if as some commentators suggest the banks in aggregate issue $100 billion of this stuff in coming years the savings can amount to more than half a billion in interest expenses.

The lower rate that banks enjoy on covered bonds is partly due to the AAA rating they receive. This AAA rating (which is higher than the AA rating the banks themselves enjoy) is derived from the fact that banks can use their assets (loans presumably) as collateral for issuing the bonds. If the bank goes bust, the bond holder as recourse to those assets.

Interestingly (and here’s why they just might be Triple A), if the assets are worthless the bondholder has recourse to the bank itself. In other words those bond holders get access to your deposit money and those bond holders rank BEFORE you in terms of their right to your money.

Unsurprisingly, the size of the covered bond market is therefore capped. Banks can only issue covered bonds backed by up to 8 per cent of their assets. Based on the majors’ full year results, the ANZ, CBA, WBC and NAB have a collective $2.686 trillion in assets. Eight percent of those assets amounts to $214.9 billion.

Many believe that the issues in Europe are contained to Europe. Someone wriley observed recently however that debt crises are only contained to planet earth. Investors like central banks who are limited to investing in AAA rated securities will no doubt be interested in the paper because our banks are perceived as safe. But what is that assumption based on? We’ll leave that discussion for your comments below.

What I am most interested in is the unilateral decision to allow that which has previously not been permitted; To rank a bond holder ahead of you in terms of rights to your deposits.

On the flip side, the banks argue that the cheaper funding means you can borrow from them more cheaply – assuming they pass it on of course. But like the ladies in James Bond’s bath, its all part of the policy drive in this country to make things cheap. Cheaper cars at the expense of local manufacturing, cheaper flights at the expense of local jobs, cheaper food at the expense of local farmers and cheaper bonds at the expense of your entitlement to your deposit.

Keep prices down and there won’t be an uprising. Have a good weekend.

Posted by Roger Montgomery, Value.able author and Fund Manager, 18 November 2011.

I’d like to get a better understanding of banking in Australia. Can someone recommend a text that explains how money is created in Australia. I’ve read that without debt there would be virtually no money in the modern world. It seems to me that the global credit crunch we are currently seeing is because the money created by banks is insufficient to cover the principal and the interest. This seems to be unconfronted.

For a beginners guide try Edna Carew. For something more advanced texts and papers by my old fried Prof. Ian Harper.

once upon a time, the aus govt was involved in banking(pre CBA).

why doesnt the govt just buy back one of the big four(do it properly and fairly via a takeover)…probably the smallest one…anz or nab.

Then you will have a triple A rated bank that people will rush to with their savings in these troubling times. The banks cost of funding will also be cheaper.

Why doesn’t the government start a sock factory to compete with PBB’s in China ?

because poeple will still buy the chinese socks. But they will put their savings into the sovereign owned and backed bank.

Why wouldn’t they just invest in government bonds ?

Governments running businesses doesn’t work. Britain nationalized heaps of industries in the 50’s and 60’s and it nearly bankrupted the country.

Socialism has been tried and it failed. Free market capitalism is the best path to prosperity.

Tom,

Its my opinion the government has a terrible record in banking. Where are the state banks ? Why do you think the Commonwealth was floated ? They would have more chance of success running Brad’s sock factory.

Peter

peter, you may be correct in that govt doesnt know how to run a bank. However the bank that they would buy is not being created and operated by the govt, but by private industry. The govt simply has to purchase it (maybe only 51% at that)and place a few of its own on the board. The only real change in operation I believe they need to make is to remove their trading desks(similar to what anz and cba have done recently) ie remove the bits that really belong in an investment bank.

UBS and CBA have just done exactly that…closed down their proprietary trading desks.

…also want to add…

i originally thought of this a couple of years ago during the height of the GFC (after Lehmans) when many were complaining (and still are to some extent) that banks were no longer borrowing to keep business running.

Governments running businesses doesn’t work.

Britain tried it by nationalizing heaps of industries in the 50’s and 60’s and it very nearly bankrupted the country.

Free market capitalism is the best path to prosperity.

Thanks Larry Kudlow

Hi Guys,

Not interested in starting any debate on this. My personal view is that the laissez-faire approach – the economic and policy environment where transactions between private parties are unconstrained from state intervention – is not a solution. Taken to its zenith we end up with a wealth divide that is incompatible with neighborhood and unsustainable.

Peter,

the CBA ran very successfully for many years as a Government owned business, as has the RBA, it was sold off for ideological not commercial reasons. Several other formerly government owned businesses fall into the same category, eg the former TAA – without Menzies intervention Ansett etc would have been annihilated by TAA in the 60’s; that’s where the two airlines policy and it’s moronic scheduling came from.

As for the state banks, I don’t know all their specifics, but plenty of other financial institutions folded or were acquired around the same time…

Chris

Setting aside the issue of whether the loans become worthless or not, people should remember a financial institution is only one management decision away from destruction in this era of enormous financial leverage in a fractional banking system.

Some recent examples are, Bank of America has nearly imploded from the acquisition of Merrill Lynch and poisonous toxic assets.

MFGlobal’s ex-Goldman Sachs Head Trader/Chairman bet the company on the Euro crisis and lost the lot. In the process $1.2bn of customers assets which should have been segregated in a trust have “disappeared”.

And Australian banks aren’t immune as NAB’s rogue trader incident demonstrated.

For the record, I currently have no banks or financial institutions in my share portfolio. Indirectly, my Mum has 917 WBC which I hope to offload for her when things settle down.

The subsidisation of banking profits via explicit or implicit government guarantees is a form of corporate welfarism that leads to increased risk taking and lower deposit rates putting the assets of the most prudent on the line. Of course the government is a short term beneficiary of higher lending and spending via artificially lowered borrowing costs but who will scream blue-murder when the disruption to market prices (bubbles) and resource allocation comes home to roost.

For a great account of the tie-in between politics and banking in Australia I highly recommend Chris Leithner’s recently released book titled ‘The Evil Princes of Martin Place’.

I would also suggest that there is a big difference between cost cutting in a free market setting and cost cutting achieved by a state abrogating the property rights of depositors. One leads to prosperity and a sound allocation of resources over time and the other does not.

A moral hazard by any other name…

Hi Roger, I’m certainly in the minority I have decided to buy into companies over the last 2 months that appear to me to be good value. I’m a relatively new investor or probably best summed up by saying an inexperience investor but I’m slowly learning, sometimes the hard way.

What I don’t understand at the moment is why people (media and expert brokers) seem to be focused on all the negatives in the world rather than some of the positives. Is the world economy/s in that bad a shape? I would have thought changing Governments in Greece, Italy and Spain is a good thing as this allows people with different ideas a chance to implement change. Some of the news coming out of the USA to me seems positive. I understand there is a lot of uncertainty in the world but aren’t a lot of good message as well? Are we all that fixated with doom and gloom?

Some of the Aust companies I have been following have recently released what I thought was good news or positive results but the markets (peoples) reaction is more focused overseas information.

I would certainly appreciate your thoughts on the above.

Cheers

Fantastic question Bruce,

Shifts in sentiment is the great mystery for those trying to find meaning in short term price moves. The influence attributed to a factor is not constant. Typically inflation is bearish but there are times when the presence of inflation indicates growth and is possibly bullish. What do we make of the commentary I observed prior to the outbreak of the first Gulf War; “the market fell today on fears an invasion is imminent”, followed the next day by the observation; “the market rallied amid confirmation the invasion has begun”? And in attempting to predict these changes in sentiment humans, Keynes observed; ”

“It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.” (Keynes, General Theory of Employment Interest and Money, 1936).

‘Castles in the air’

Bad news sells newspapers

Hi Roger,

Thank you for bringing up this thought provoking subject.I have been thinking about this over the last few months.Given what we are seeing happen and for us to be as risk adverse as possible in what order would the security of our deposits be at our banks.In order from best down would it be number 1 CBA the next Westpac then ANZ then NAB?Also being risk adverse you would keep monies spread over 2 or 3 banks.Or put it this way financially who is the strongest Australian banks.

Great Questin Mick, I am interested in everyone else’s thoughts on this…

Hi Mick,

I agree with your rankings. I would not buy NAB at any price. I have a small holding in CBA,(~ 2%) and would consider Westpac at a much higher MOS than exists today. I don’t understand the Asian regulatory environment well enough to consider ANZ.

Peter A

Hi Peter,

If able, would you care to share your thoughts about steel companies?

If OST – who have a supply of Fe that they sell to China – can’t make steel economically then what chance do they have; hence their move to mining consumables etc. The high AUD is negative as are new govt. taxes. I know some customers have been loyal to local steel makers because the quality of steel they could buy overseas was not as good – or quality was inconsistent – but this has / is changing as the o/s mills improve their technologies. Also if mfr, housing and infrastructure sectors are weak in AU then so is steel. Likewise in China, many steel makers have not made good profits this last year (there’s consolidation amongst the SOE’s taking place) because their input costs are so high and the end user is having problems paying the higher prices for the finished product. As it was put to me by a Chinese colleague, ‘It’s no good when our customers customers can’t afford the price of the finished product.’

Hi Peter,

You would not have even considered to buy NAB back in early 2009 when it trading for less than its book value??

When it has consistently traded around 2 times book value and very rarely close to 1.5 times since as far back as 1997.

The only other bank to have traded at its book value since 1997 was ANZ.

I believe Westpac to be the strongest bank and have purchased shares only twice since 1997 when it has dipped below 1.5 times its book value in early 2009 and again in early August this year.

My fingers are crossed we will see WBC around $15 but if not that is OK too…

Happy Hunting

From the point of view of future prospects, in order, ANZ, CBA, WBC, forget the rest.

Peter

ANZ worries me due to its expansion into the Bubble we know as ASIA. NAB is proof of the problems with expanding into markets you dont understand.

CBA and WBC are the only two imo.

Thanks Matt

Roger,

You are right about confidence. Confidence increases the speed of money. If I give $1 to B and B gives it to C who gives it back to me within a week, then in a month I will have had $4. If each transaction takes a fortnight then in a month I will have had only $2 – I will be half as well off as before. Similarly with banks: if they lend more (and generate more deposits or repayments) then there is effectively more money in the community. If confidence is down they will crimp their lending, the “speed” of money goes down and this can escalate as we have seen over the last 3 years. This seems to have always been a cyclical event. Will a covered bond help confidence? Maybe, but its small beer. I am not sure that we can artificially alter mass confidence. At least three approaches have been advocated. I cannot see how increasing the amount of capital reserved for risk weighted assets really helps (eg Basel III will probably slow things down). Allowing Moral Hazard to take its course would have shortened the duration of the banking crisis but would reap the economic lives of many “innocent”, although perhaps “ignorant” people. As much as I dislike saying it, the Bernanke approach of quantitative easing will possibly be OK, but only if a future Fed reins in the money when inflation starts to hit the fan.

Doesn’t the Federal Government’s Financial Claims Scheme dispel any anxieties relating to the seniority of covered bonds for individuals with deposits of up to $250K per bank and for couples up to $500k per bank?

Good question Mike…Does it? And when the scheme ends?

I believe the Financial Claims Scheme actually guarantees deposits up to $1 million, but as far as i know it ended in October this year.

The $1 million scheme was introduced in 2008 for three years. In September, the government announced that the FCS would be pemanent, guaranteeing $250k per person per ADI. Roger would know that so I’m not sure why he made the comment about when it ends.

..helping others to do the thinking too..see here: http://www.guaranteescheme.gov.au/

Roger,

Although the link you provided does refer to the Financial Claims Scheme, it’s main point of reference is the wholesale scheme. For a full explanation of the FCS, readers of the blog should read http://www.apra.gov.au/crossindustry/fcs/Pages/default.aspx

Well done. Thanks.

Looking at anz results last year, they paid out 2 billion in dividends and if as they say funding cost are high, why the dividends ?

Covered bonds could easily be a cheaper way of raising funds to use to pay dividends at the potential expense of deposit holders. They are looking to raise around 1.25 b – not enough to cover the dividend bill of either of the last 2 years.

I’m no banker but the thought of 8% of assets being used for these issues is frightening to me

David

Roger,

Many thanks for drawing our attention to this. I see from the debate in Parliament that the intention of the legislation is clearly, as you say, to allow the banks to grant priority to these bondholders over depositors.

This breaches a fundamental principle of our banking system. The most basic of the privileges of a banking licence is to be an “authorised deposit-taking institution”, but now, as was said in Parliament, “depositors will lose top spot when it comes to protection of their deposits in banks.”

Of course, as well as increasing risk for depositors, what this has done is also to shift liability onto taxpayers via the deposit guarantee scheme.

Given their past form, you are right to query whether banks will pass on to borrowers the lower rates they are paying. I also doubt they are going to increase the rates they pay depositors to account for their additional risk?

Their seems little hope of this happening unless the media commentators (present company excepted of course) wake up and draw attention to what has been done.

Regards

Gale

Cheaper cars at the expense of local manufacturing, cheaper flights at the expense of local jobs, cheaper food at the expense of local farmers…

First your thinking stop at the border of this country. There is no difference if you stop at the border of this town or council or region or state.

capital go where returns are better.

no welfare state , no warfare state no red tape, no carbon tax, no superanuation no red tape ….

This issue is policy designed to ensure cheaper but not better.

The option still available is Credit Unions – I believe but may be wrong, you still rank first there. But the govt G only covers $250K

SPot on with the $250k.

Hi Roger,

Have a good weekend you say. But I can’t

When I first read about covered bond I thought we had gone mad.

Just because the rest of the world was totally silly does not mean we have to join then.

I really can’t work out how this is massively different to the securitization of housing loans that occurred in the USA and bought them to their knees. Sure they are just being sliced rather than sliced and diced like in the USA but it is the same thing. Sure it is limited to 8% of asset base but without looking it up and off the top of my head guess the equity put in and retained by the 4 amigos would be roughly $160B. So covered bonds would be more than equity.

Merlin would be proud to get a AA rated company issuing AAA rated bond. Just like they did in the USA in 2005 and 2006.

We have learned nothing about pricing risk from 2008.

Oh I forgot. Our housing prices never fall.

Good comment again Ash..

I wonder what percentage of Australians actually own more than one property??

For as long as I remember there was not much value investing going on when it came to property investment. Prices kept climbing, INVESTORS kept buying, and it was never a concern as there was always someone around next year or the year after to pay you more than you paid.

As aussies feel the weight of there huge debt over the last few years, we now see a delevraging of debt occuring in most households.

So like the ending of a pongi system, the game ends. No more easy money. Capital gains will be reduced, if there is any?

In the past we have forgone rental yields because of the capital gains. Will we now start looking closer at the fundamentals such as rental yields, and return on equity.

If this is the case, then the lousy 2% to 3% net rental returns available on most properties in the major cities, will not suffice, so it is inevitable prices will continue to fall.

DO property purchases use a value investing plan??

I do have money sitting in 2 banks that I believe is govt guaranteed..I now wonder how this stands with the new policy??

Maybe if this mkt sells off soon, I can put it to work before I need to worry about the future of my bank deposits.

Hi Ashley,

The mortgage loans in the USA were, low doc/no doc and non recourse loans. People can just walk away from their house and it becomes the bank’s problem. Totally different here.

Peter

…but the credit score goes with the borrower and they have little chance of getting another mortgage until the original one is paid off.

Hey Peter & Roger,

It is a misconception that USA have no recourse lending on housing in all staes…I don’t know the exact stats but recourse lending is in more than half the us states.

Plus if you look at the stats it is not just low doc stuff that has got in trouble.

If you think our banks were not doing low doc in 2006-2007 then you are kidding yourself.

Plus, full resource lending in the UK and and Japan did not stop there house prices droping.

If you think our housing market is safe then go for it and best of luck.

Not sure Ash as I only spoke to people in Florida. Are you suggesting that in some jurisdictions mortgage loans are non-recourse loans – so when funds recouped from sale are insufficient to cover the outstanding debt, the lender has no recourse to the borrower after foreclosure (in this case I understand the credit rating stays with the borrower, reducing the ability to borrow again), while in others in the US the borrower remains responsible (like Australia)? I believe Florida is the former. Perhaps a few US citizens can clarify?

Yes Roger,

I understand different Laws in different States,

Some with no recourse, some with one recourse( ie you either sue the debtor or forclose on the house but can’tt do both) and others with full resourse.

Isn’t issuing covered bonds not really any more or less unstable than the whole mechanism of fractional reserve banking inherently is in any case? In that, if the bank’s loans don’t get paid off and they go bust, and, having issued covered bonds the bondholders get access to your deposits before you – but if there aren’t any covered bonds and the bank goes bust some people still won’t get access to their deposits, because the banks lent their money out and lost it. In fact, the bank’s loans turning subprime isn’t even required for this scenario – all that’s required is for enough people to want their money at once, since most of the money isn’t available to the bank at all, having been lent out in the form of mortgages and so on.

Marc,

You are right. AT a dinner I attended earlier in the year it was revealed that confidence plays a very very large part of the stability we perceive exists.

Like you said Roger, “if the assets are worthless” secured bondholder will get first preference in the capital structure.

I have and will continue to bet that the odds are in favor of majority of loans not being impaired in Australia across the big 4 and in particular Westpac.

Happy Hunting

Correct: “IF” the assets are worthless.

Some years ago I came across Warren B and Charlie M , then a few more years later I met Roger M ( all in print I am sad to say ). These 3 men I regard as my friends as they helped me into becoming my own sort of value investor. One piece of their advice was to think of the companies I choose to invest in as my own. Think like an owner. In nano pieces I own CBA and WBC. As an owner I think my management team are on my side when they can borrow funds at such tiny interest and hopefully relend at a greater margin than is current. My managements primary responsability is to me the owner and to increase my wealth in an ethical maner. As a shareholder I will be the first cab off the rank if the unthinkable occurs. Too big to fail? Think of the Royal Bank Of Scotland share holders and how much equity was left for them when the pollies steped in to save the bank.

I know I am lucky to no longer have a morgage and keep very little in bank deposits .My funds are in my companies and my risks are higher than in bank deposits and my “required return” is therefore higher than a bank deposit.

I am siding with my banks.

Regards Tony Connellan

Hi Tony,

Just remember what happens to a franchise if management abuse it though…it can go down the toilet with a quick flush.

The banks better not abuse there dominate franchised position and lose one single cent of a depositors money or our investments would go down the drain…the odds of this happening I think are much less than the odds of it occurring though.

If you think about what CocaCola did to its bottlers was very abusive to their entire franchise in the early 2000’s where bottlers worldwide barely earned their cost of capital – thankfully both CEO’s Isdell & now Kent have spent majority of careers on the bottlers side to see both points of view.

Was it Rachel Oakes-Ash (entertainer) that was poached by 2Day FM where she tried to deposit Kerry Packers’s $5.2 million in gold bullion into cash card accounts around Sydney?

I wonder if it is possible to ask bank to convert your cash holdings to gold and withdraw it over the counter?