What New Zealand’s rate tightening cycle tells us

The Reserve Bank of New Zealand was the first English-speaking Central Bank out of the blocks in their tightening cycle. Commencing in October 2021, the RBNZ has increased its official cash rate on eight separate occasions to 3.50 per cent. Here are my observations on the impacts.

Changes to official cash rates (%)

|

New Zealand Date |

% |

USA

Date |

% |

UK

Date |

% |

Canada

Date |

% |

Australia

Date |

% |

|

2021 |

|

|

|

|

|

|

|

|

|

|

6/10 |

0.50 |

|

|

|

|

|

|

|

|

|

24/10 |

0.75 |

|

|

16/12 |

0.25 |

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

23/2 |

1.00 |

17/3 |

0.25 |

3/2 |

0.50 |

26/1 |

0.25 |

6/4 |

0.35 |

|

13/4 |

1.50 |

5/5 |

0.75 |

17/3 |

0.75 |

2/3 |

0.50 |

8/6 |

0.85 |

|

25/5 |

2.00 |

15/6 |

1.50 |

5/5 |

1.00 |

13/4 |

1.00 |

5/7 |

1.35 |

|

13/7 |

2.50 |

27/7 |

2.25 |

16/6 |

1.25 |

1/6 |

1.50 |

2/8 |

1.85 |

|

17/8 |

3.00 |

21/9 |

3.00 |

4/8 |

1.75 |

14/7 |

2.50 |

6/9 |

2.35 |

|

5/10 |

3.50 |

|

|

22/9 |

2.25 |

8/9 |

3.25 |

4/10 |

2.60 |

Observations include:

- The Real Estate Institute of New Zealand claims the median price for residential property is now $800,000, down 13.5 per cent from the peak in November 2021 of $925,000. With 56 per cent of mortgages either floating or fixed for less than one year increased pain will be felt in 2023;

- GDP growth decelerated to 0.4 per cent annual pace in the June 2022 quarter, down from a one per cent annual pace of growth in the March 2022 quarter. This is much slower than the comparable figures out of the OECD (3.7 per cent) and Australia (3.6 per cent);

- Inflation is running at a 32 year high of 7.3 per cent in the June quarter 2022 over the previous corresponding period, well above the Reserve Bank of New Zealand’s target of two per cent, plus or minus one per cent;

- Unemployment remains near a record low of 3.3 per cent;

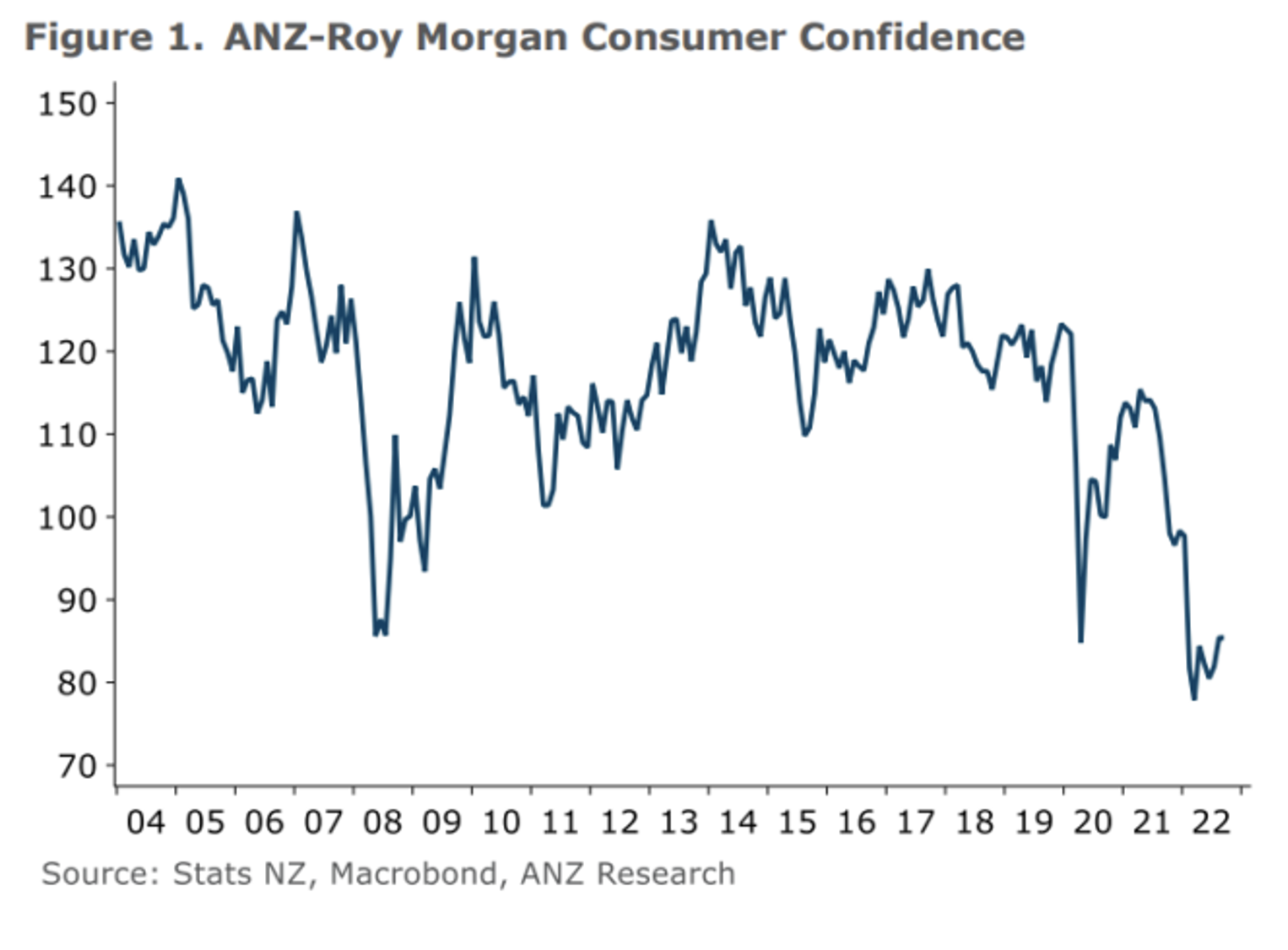

- Over recent months, Consumer Confidence in New Zealand remains lower than during the 2008 Global Financial Crisis – see below; and

- In the twenty months from February 2021, the NZ$/US$ exchange rate has declined by 24 per cent from US$0.74 to US$0.56.

Keep an eye on the data coming out of New Zealand as a lead indicator. The combination of large consumer indebtedness, declining residential prices, and the large jump in cost of living via energy and fuel costs is seeing the tightening interest rate cycle starting to bite.

Central Banks may well consider exhibiting greater restraint in their tightening process and assess the degree of the slowdown in their economies over the foreseeable future.