What is the machine teaching us?

Alert readers will recall that in June this year we set out to explore the merits of applying machine learning technology to stock selection. We went through a process of “training” a learning algorithm called a Support Vector Machine (SVM) to pick stocks, and then in mid-June we asked it to nominate a top 20 and a bottom 20 from the ASX200.

The plan is to monitor the performance of the portfolios over a 12 month period and see what the learning algorithm can teach us. You can revisit the story here.

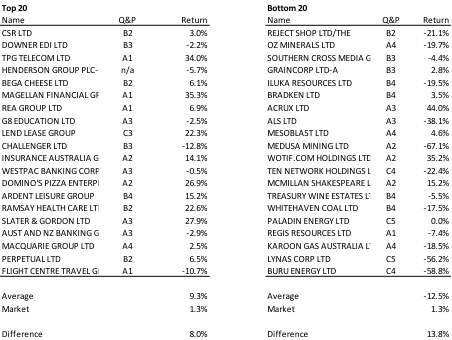

Nearly six months down the track, the machine is feeling pleased with itself. The top 20 portfolio it identified has beaten the market by a sizeable margin, and the bottom 20 portfolio has lagged the market by an even larger margin. Up to 3 December, the performance looks as follows:

Needless to say, that’s a fairly solid start. It’s still early days, and we certainly don’t expect that the machine will sustain these sorts of numbers over long time periods, but the early indications are certainly positive.

To be honest, we wouldn’t mind too much if the SVM stepped on a landmine or two in the months ahead. At the moment is feels like the machine is gazing coolly over the research desk at our analysts with their puny human brains, and wondering why it takes them so long to get their analysis done.

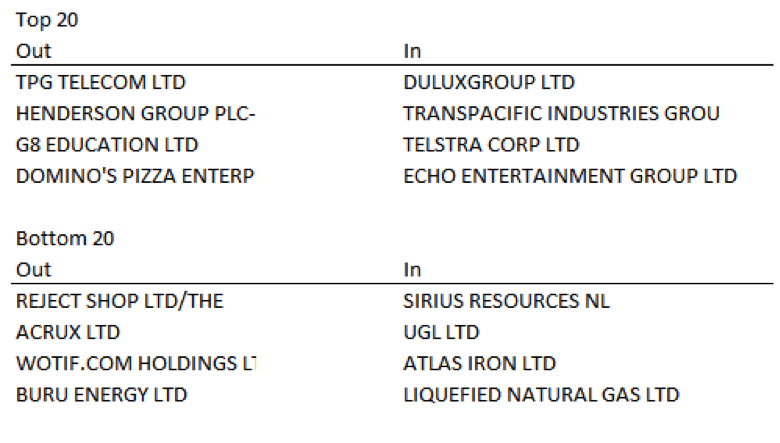

Having said that, it has become apparent that, in the interests of fairness, some rebalancing of the SVM portfolio would be appropriate. Several of the bottom 20 companies have now departed the index (or in the case of WTF been taken over), and some of the top 20 will be getting expensive.

With that in mind, we have refreshed the analysis, and identified which of these holdings the machine would now like to replace, subject to a turnover limit of 20%.

The changes are as follows:

Once again, there are a couple of interesting thoughts in there. To us, Telstra looks expensive at the current price, but we acknowledge that it is a very solid business with improving performance, and that certainly counts for something, at least in the short to medium term. Transpacific is another addition that is not really our cup of tea, but the machine is not here to make tea. For that we’ll need a kettle.

The additions to the bottom 20 are less contentious. None of these are stocks that we would be comfortable owning at the moment, and a skewing of the bottom 20 portfolio to resources is hard to argue with.

We’ll leave it there for now and revisit performance a bit further down the track. In the meantime, we’ll get back to analysing companies the slow way.

Time for that cup of tea.

Thanks for the update Tim. The results seem encouraging.

I was previously a tabcorp shareholder and felt so strongly that they were wasting one of ther best assets (Star City) that i wrote a letter to the CEO at the time outlining what they need to do better. Just call me Andrew Ichan.

Even though i never got a reply, i would like to think that they took notice as a lot of the ideas i presented can now be seen in the finished refurbishment and the result based on my visit a couple of weeks a go was an entertainment precinct that at 10pm on a Saturday night was absolutley packed to the rafters. My wife commented that it reminded her of vegas which i took as a complement for a casino.

I think the end result will be a more diversified recenue stream that should reduce the impact on the premium players who can cause fluctuations in the win rate.

My big concern is that in the future Echo will likely need to share their markets with Crown but Crown doesn’t have to worry about sharing their markewts with Echo. Also, Crown tends to build better properties from the start. If only Echo had when i was a shareholder what they do now and things might have been different as there would have been less arguement around a premium venue in the Sydney.