What is the Lindy Effect?

The Lindy effect is a theory on the life expectancy of non-perishable things. The concept is that for certain types of non-perishable things, the remaining life expectancy can be estimated from the amount of time something has already been around, with increasing age implying increasing remaining life expectancy. This clearly doesn’t work for living organisms, whose remaining life expectancy declines the longer they have been around, but it can provide a useful perspective on non-living things like ideas, technologies, businesses, buildings etc. For example, if a book has been in print for 40 years, you might reasonably expect it to be in print for another 40 years.

The idea is based on a simple probabilistic argument that says that, barring any additional evidence, something is halfway through its life span. It’s very simple I know, but at the same time surprisingly powerful, and useful in a wide range of circumstances.

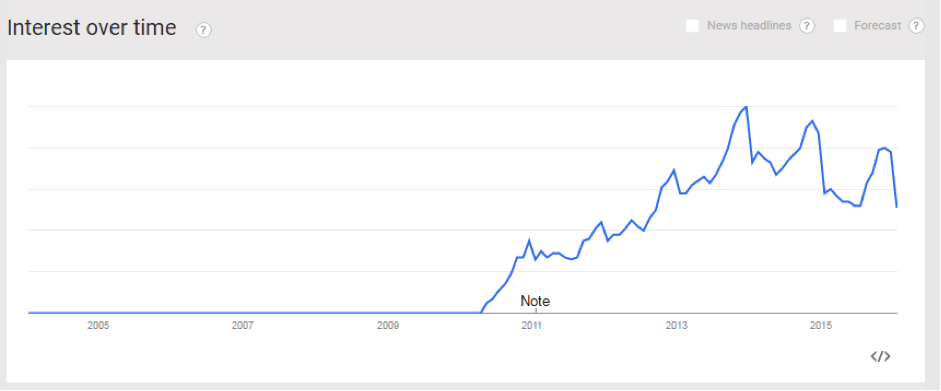

You might find it useful for example, in considering how much time business and economic trends may have yet to run. For example if declines in the resources sector have been in progress since 2011, it is probably reasonable to be sceptical about theories that call for a recovery sometime this quarter.

It might also prompt you to ask questions about the potential longevity of businesses that seem to have appeared out of thin air during the course of the recent IPO boom.

I wonder, for example, how many people had heard of Lovisa before it floated a little over a year ago.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

Tim you posted an article in Oct on the boardroom disruptions at Infomedia. I notice Jonathan Rubinsztein has now been appointed as the new CEO.He appears well credentialed ,hopefully he’ll bring some harmony to the disaffected

board! Any insights appreciated.

He does appear well-credentialed. We intend to meet with him before too long, so watch this space.

Tim: it was good news to see at long last a new leader appointed at IFM, and one with a track record of success in a relevant field. However his CV showed no comment for the decade 2000-2010? Be interested to hear your feedback Tim.

Not sure this theory is useful at all as a predictive measure. For example, if declines in the resource sector began in 2011 and you decided to consider the Lindy Effect in 2013 then you would expect the slump to be over soon. You get a completely different outcome if you use today as the mid-point.

The focus should be on fundamentals.

Thanks for that Evan. I should note that the Lindy effect does not necessarily give you an investable answer to questions of duration. What is does do is give you a useful “baseline” expectation that might apply in the absence of any other information. You can then weigh any other information or insight available to you to vary from that baseline.

As a postscript, I note that in your example above, the baseline estimate for the duration of the slump has changed between 2013 and today because today we know more than we knew in 2013 (ie. that the slump still hasn’t ended).

Lov had a profit downgrade its share price was hammered yesterday