What happens when a population declines?

The world’s population is at an all-time record high of around 7.4 billion, and the United Nations estimates it will be over 11 billion in the year 2100. But populations aren’t growing everywhere. Detroit’s population is down 65% since peaking in 1950. And Japan’s is expected to drop 33% by 2060. The declines pose a new set of challenges for these communities.

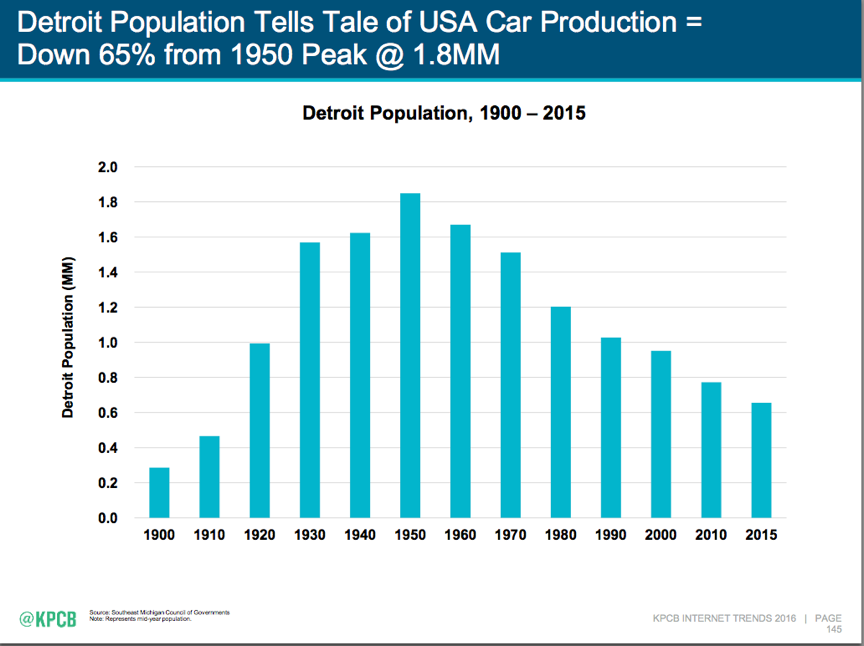

Case Study 1: Detroit, Michigan

Population 1950: 1.83m

Population 2015: 0.65m

Decline: 65% or an average 18,000 people per annum over 65 years.

Resulted in severe urban decay and thousands of empty buildings around the city. Detroit was declared bankrupt by U.S. District Court on December 3, 2013, in light of the city’s $18.5 billion debt and its inability to fully repay its thousands of creditors.

Case Study 2: Japan

Population 2015: 120m

Population 2060: 80m (estimate)

Decline: 33% or an average 890,000 people per annum over 45 years.

“Police and fire-fighters are grappling with the safety hazards of a growing number of vacant buildings. Transportation authorities are discussing which roads and bus lines are worth maintaining and cutting those they can no longer justify. Aging small business owners and farmers are having trouble finding successors to take over their enterprises. Each year the nation is shutting 500 schools”.

July 2016, Los Angeles Times.