What falling car sales tell us about the economy

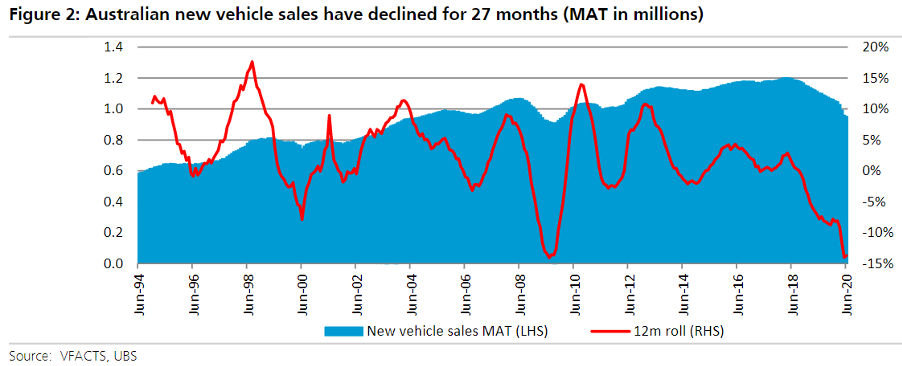

New car sales data is a good indicator of consumer sentiment and of a country’s economic health. So the most recent data from the Federal Chamber of Automotive Industries is a concern. They show that new car sales in Australia fell – for the 27th month in a row.

Published on 3 July, here we dissect the new data for June as it contains some peculiarities. If we start with the general trend, we can see that new car sales have declined for 27 straight months and that the rolling 12-month sales figures are down by around 14 per cent year on year (YoY).

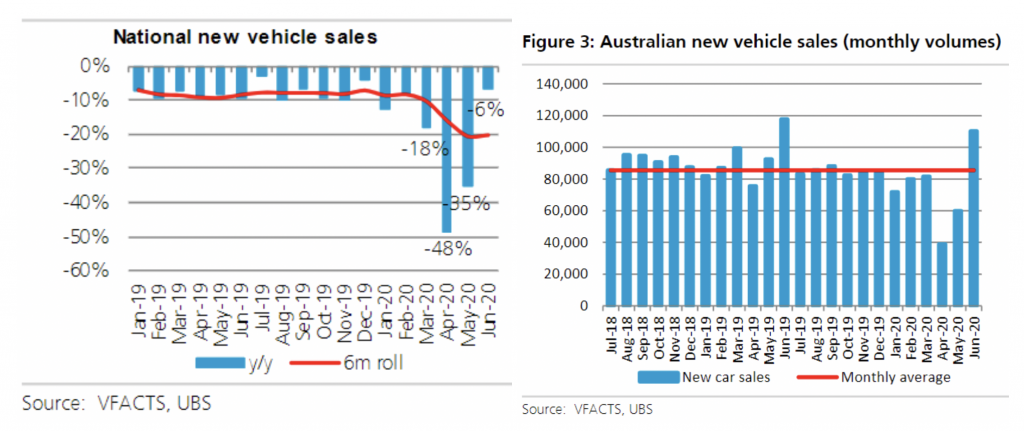

If we look at the months YoY numbers, we can see in June a sharp improvement compared to March-May which saw much steeper declines as lockdown measures prevented people from actually visiting car dealers:

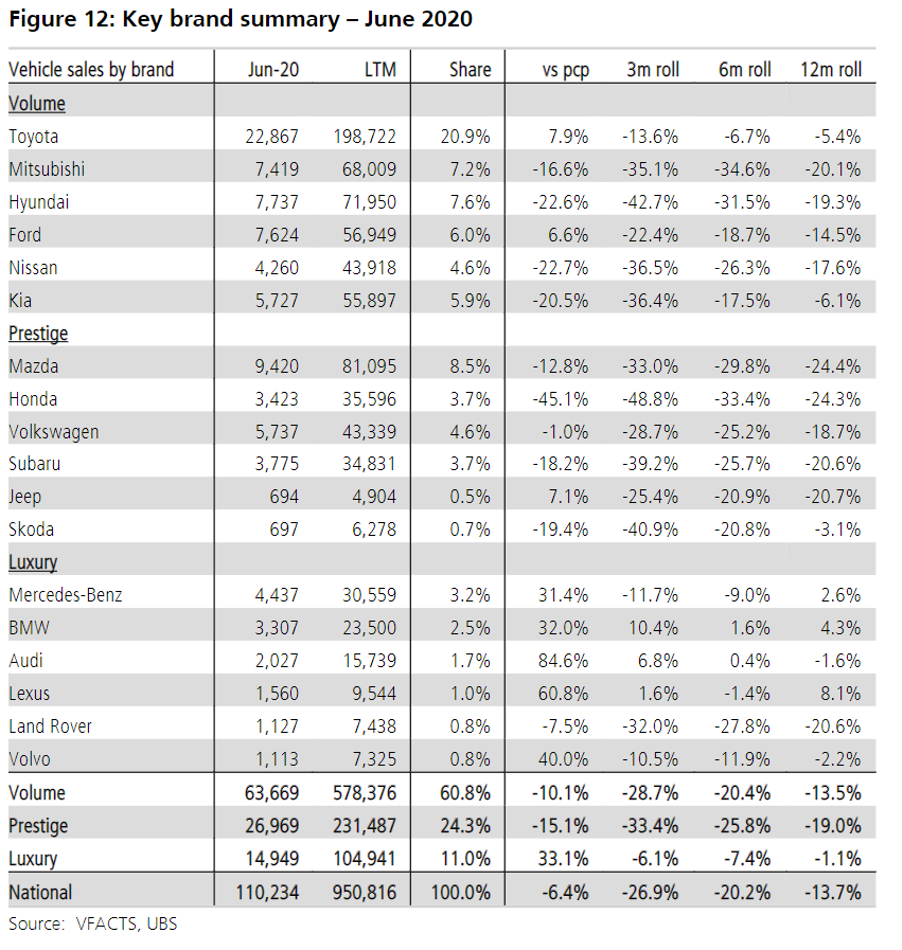

What was interesting though was the breakdown between the different segments where the luxury segment significantly outperformed the Volume and Prestige segments as we can see from this table:

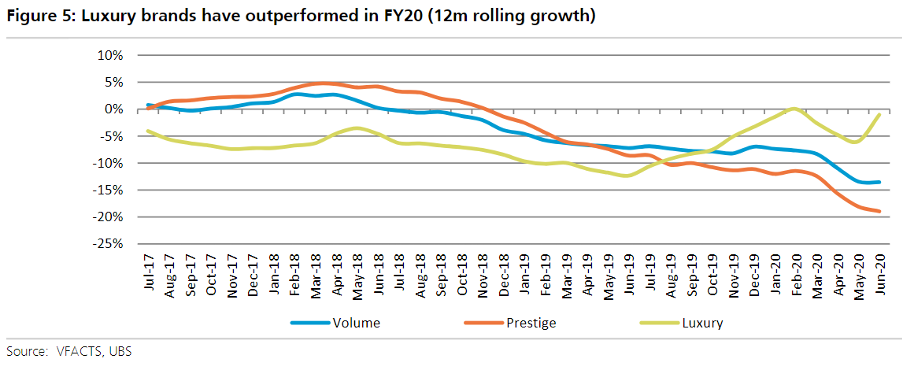

The Luxury segment was actually up 33 per cent YoY in June while the Volume and Prestige segments saw declines of 10 per cent and 15 per cent respectively! The luxury segment has indeed outperformed the other segments for quite some time now as we can see from this chart:

So, what conclusions can we draw from this? What I suggest would be:

- The overall health of Australian consumers is not great with new car sales continuing to be down year on year although we saw an improvement in June. This is not surprising to me given the strains on households from the general level of indebtedness and low wage growth.

- The strong sales in June probably contained some pent-up demand from the previous months when people were in many cases not physically able to go to dealerships.

- It is interesting to see a big difference between the different segments. It seems to me that high income people have basically said that we are not going to be going on an overseas holiday for quite some time so why not upgrade our car so that if we go on a domestic holiday, we have a nice ride to do it in.

The stock implications that I can see are:

- Continued decline in volumes are generally not good news for automotive retailers but the strong sales of Luxury cars should be good for Autosport Group (ASG) as they predominantly sell high-end brands.

- Low new car sales mean that people are keeping their cars for longer. This should lead to increased maintenance needs as the car fleet ages which should be good for a number of companies:

- Bapcor has a very strong position in supplying maintenance parts to mechanics.

- GUD Holdings is a supplier of automotive components including oil and air filters and gaskets etc.

- Super Retail Group own Supercheap Auto which is the market leader in direct to consumer sales of car parts.

- Both Bapcor and Super Retail Group have recently delivered positive trading updates and it will be interesting to see the full year results in a few weeks time.

The Montgomery Small Companies Fund own shares in Bapcor. This article was prepared 07 July with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Bapcor you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

What are your thoughts on SIQ and salary packaging of cars?