What does China and Sydney Property have in Common?

A couple of very interesting articles in the Australian Financial Review (AFR) recently are worth bringing to your attention given that continuing extremely low levels of volatility suggests nobody is worried about anything at all.

Tony Boyd penned an excellent article about bears bumping up against the ‘Goldilocks’ conditions prevailing in major economies globally.

The article however ended on a cautionary note.

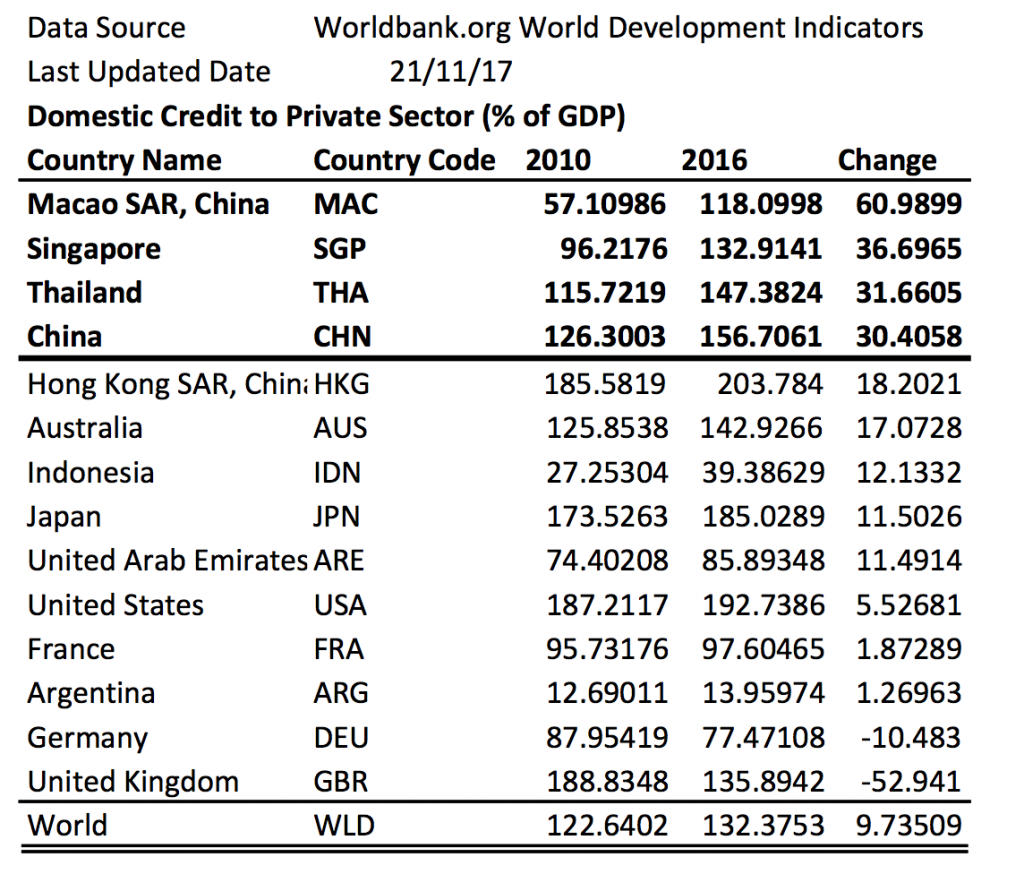

Quoting a Deutsche Bank analyst who was citing “a recent IMF report”[1] the article noted that in 48 global cases of credit booms in which the the credit-to-GDP ratio increased by more than 30 percentage points over a five-year period, “only five cases ended without a major growth slowdown or financial crisis immediately afterwards. The IMF also caveated that these five cases, considering country-specific factors, provided little comfort. If that wasn’t enough, the fund also points out that all credit booms that began when the ratios were above 100 per cent ended badly.”

The following Table extracted from the World Bank’s online database reveals those countries at risk based on their 2010 to 2016 numbers.

Source: The World Bank

The data confirms the AFR article’s point that the Deutsche Bank analyst is concerned about China.

Of course a bust in China would have serious ramifications for Australia.

Another risk for Australia was pointed out by Philip Baker who reported on the findings of Maitland MacFarlan, a contractor to the Reserve Bank of New Zealand (RBNZ), who had a forensic look at a range of house price collapses around the world since the late 1980s.

“One reason why investors should be worried about a collapse in house prices is that more than likely there will be a bust.”

He notes ” the cycle of booms followed by busts appears stronger with house prices than with equities”.

“According to the report, almost half of all housing booms end in a bust while only 25 per cent, or less, of sharemarket booms end in tears.

“…when house prices collapse it tends to be a long, drawn-out affair, even if they don’t fall as far as shares do when they crash.

“House price collapses last significantly longer than equity busts” says MacFarlan.

“While house prices may fall by less than equities in a bust, they show a more protracted, U-shaped pattern of downturn and recovery, with downturns lasting around four to six years.”

Baker points out that unfortunately, local investors “get the worst of both worlds in that situation, given the big four banks account for 25 per cent of the S&P ASX 200 index.”

In actual fact, our work suggest the Big Four make up 27 per cent of the market.

Clearly if house prices collapse – they are now officially falling – the banks will have an issue and that means both the stock market and property reduce the number of avenues through which investors can find safety.

Baker also warns of the report’s discovery that “soft landings” in the housing market are rare. “They just don’t happen very often.” Adding “one study of 49 boom and busts showed there were no examples of a “mild’ or “gradual” fall in residential investments.”

Of course the above observations are what Howard Marks refers to as ‘First Order’ observations. It will be the second and third order observations, that investors will need to turn their mind to making, in order to do well in the next few years.

[1] The most recent report I could find on the subject was from 2008

When looking at property prices, look at mortgage debt to GDP rather than private debt to GDP.

On that basis, Australia has even higher levels of mortgage debt compared to rest of the world. While countries like the USA have a higher level of private debt, that is mostly to the corporate/financial sector. Hence Australia has a bigger bubble in property prices driven by accelerating high mortgage debt and the USA has a bigger bubble in equities driven by accelerating high corporate/financial debt. Aussies are leveraging up to buy the same houses on lower and lower yields… Americans are leveraging up to buy the same shares in companies on lower and lower yields…

Change in mortgage debt drives property prices.

The level of mortgage debt increases the sensitivity of property prices to a deceleration in mortgage debt growth.

The level wont cause a crisis in itself, the change in the rate of change will, but when the level is very high, it’s mathematically impossible to keep the rate of change growing at an increasing rate in the long term and small changes in the rate of change is enough to cause a crisis when debt is high. Failure of ‘experts’ to understand exponential functions and the second derivative… sigh.

It is interesting to note that the 2008 US financial crisis which was followed by a 50% correction in house prices started when the rate of growth of private debt decelerated! It did not need to stop growing! It simply had to slow down. It went negative for a few quarters when the crisis was already in full swing and people were liquidating assets left, right and centre. Failure of ‘experts’ to understand feedback loops… Minsky anyone?

Looking at upside vs downside… Given Australia has the highest level of mortgage debt in the world and mortgage debt needs to keep growing at an accelerating rate for prices to rise. Not sure what is going to underpin future mortgage debt growth when interest rates are close to zero, there is no commodity boom in sight, government refuses to run sufficient deficits to stimulate economy and private sector is already leveraged up to the hilt. I’d say there is more downside risk than upside gain.

What is interesting about those that advocate ‘soft landings’ is that there is no history of a soft landing in any asset class after a period of growth fuelled by credit growth ever.

Reference:

http://www.economicprinciples.org/

http://www.theaustralian.com.au/business/business-spectator/why-the-house-price-bubble-still-hasnt-burst/news-story/049ae04d072666d32d723673d7ebd3d8

http://www.levy.org/pubs/wp74.pdf

How can there be a crash when the vacancy rates are so low, and there is so much demand for properties in Sydney and surrounds

people cannot find properties that is why prices keep going up

this bubble is a myth, there is no bubble it’s actual demand pushing up prices

the treasurer also said that to an overseas audience why would he lie

And if vacancy rates are so low Randall, how can rental guarantees be necessary – as seen in statements such as those in an article by Su-Lin Tan in the AFR on 6 December;

“Since the regulatory changes took place earlier this year…Growland chief executive Ronald Chan said…”Growland is happy to be able to offer an incentive to bring investors back to the residential market, ultimately benefiting Melbourne renters.”

Apartment values, even in Sydney, have fallen between 3 to 5 per cent in the past year, Macland chief executive Leo Jia said.

“Sales are slow, investors have declined, so you can only imagine the developer will have to employ every marketing tactic to sell. Many of them need to just meet presales to get their projects underway, and it’s sometimes down to the last say, ten units.”

As such guarantees have risen across the eastern seaboard, PIA chief executive Justin Wang added. “If it’s more than 4 per cent in Sydney and the property is not in a regional area, which usually gets a higher rental yield, I would be concerned.”

Prices are not always a reflection of an asset’s intrinsic value.

Saying there will be no correction in property prices because the vacancy rates are so low is like saying, there will be no correction in equities because the P/E is so high. Vacancy rates might be low, however, so are yields. Prices have moved ahead of fundamentals. Albeit, I concede that asset classes are priced with the correct risk prima given the low interest rates. Watch out when the yield curve changes!

It is also interesting to note that most crisis were proceeded by a long period of relative stability. The work of Minsky and Keen’s extended work on Minsky’s Financial Instability Hypothesis shows this. “From the perspective of economic theory and policy, this vision of a capitalist economy with finance requires us to go beyond that habit of mind which Keynes described so well, the excessive reliance on the (stable) recent past as a guide to the future. The chaotic dynamics explored in this paper should warn us against accepting a period of relative tranquillity in a capitalist economy as anything other than a lull before the storm.”

It is interesting to note that the 2008 financial crisis was preceded by a period Greenspan called ‘the Great Moderation’. A period of decreasing volatility and falling unemployment. And 1929 was preceded by a similar period, the roaring 20s. The reason? The level of private debt is ignored by the mainstream economists.

Those that take a long period of reducing volatility, rising asset markets, decreasing unemployment, stable inflation and rising economic growth reaching what appears to be a ‘equilibrium’ paving the foundation for perpetual paradise would be wise to take note. It is when things are too calm when things are about to go seriously wrong.

Reference:

http://www.levy.org/pubs/wp74.pdf

http://www.theaustralian.com.au/business/business-spectator/calm-before-a-deathly-debt-storm/news-story/3708f8e508c583cd013d7627635cc7df#ixzz2V7oG1C7R

“the treasurer also said that to an overseas audience why would he lie”

Because we need Chinese money to keep supporting our market, and anyone else’s money from overseas, because they’re the ones who will buy the overpriced property that the locals won’t, that’s why. QED.

Why do you think that people got flown up to QLD to buy properties ‘back in the day’ at vastly overinflated prices that locals wouldn’t pay ?

You honestly think a treasurer with even half a brain (no offence to Morrison) would do a roadshow to international financiers and talk down his own market? What else would you expect him to stay?

What else would you expect him to say? Typo!

Roger,

I think market observers are like the nearby villagers in ‘the boy who cried wolf’. We who examine the markets can really understand why “nobody is worried about anything at all”.

In recent years we have all read about the impending hosing crash or the death of mining and yet these industries keep moving forward. More recently, the arrival of Amazon. I hope that last week’s launch is part of some ingenious master strategy because from my opinion its just another retailer that’s happy to collect the ‘Australia tax’ and I havent event touched on Bitcoin, ETF’s, North Korea or the Presidency of Mr. Trump, which was meant to end in a Depression. Or was it a Recession? I can’t remember which one as both were mentioned so much.

The commentary and data all make sense and now its just the markets that are yet to realise how close we are dancing to the edge. If the issues surrounding Chinese banking system or its debt problem does unwind in the way I believe that it can then we should all be worried.