What a day…

Since the COVID-19 crash, we’ve written a number of posts reflecting our view that a boom in Mergers and Acquisitions would continue, that 2022 has all the hallmarks of another positive year for asset prices – particularly quality equities like those owned in both the Montgomery and Polen Funds –and the search for income would prompt a frenzy of acquisition activity in the infrastructure space and among entities producing steady, reliable and even boring income.

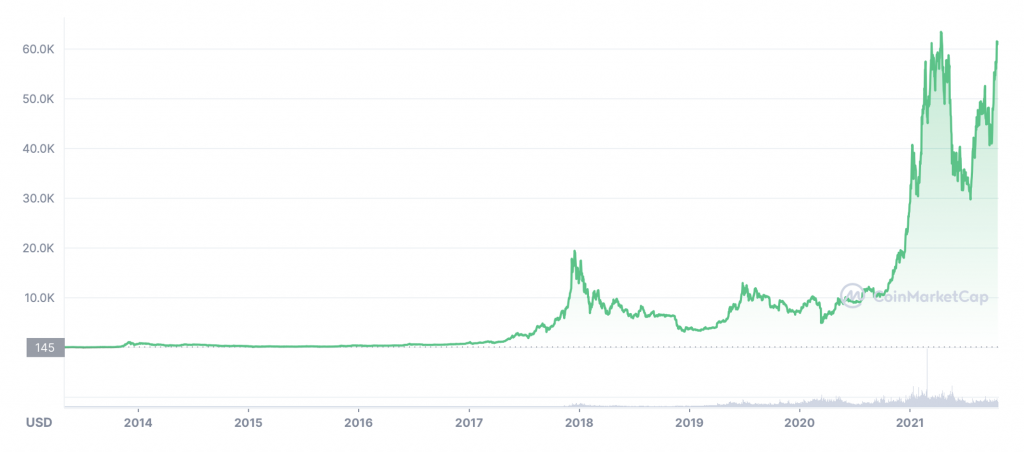

With that in mind, we aren’t surprised to see record prices achieved again in property, low digit number plates (they’ve doubled again to August) and even a near record in Bitcoin.

Figure 1. $USD Bitcoin

Today’s huge news flow seems to be reflecting all of the above themes.

Those low interest rates continue to spur acquisition activity for income producing assets at low capitalisation rates. Brokers are estimating a circa five per cent implied capitalisation rate for The HomeCo Daily Needs REIT (ASX:HDN) offer to acquire Aventus (ASX:AVN). The former has offered $3.82 per share to buy the latter with Brett Blundy said to be voting his 22.6 per cent of AVN in favour of the deal. The offer is more than 40 per cent above AVN’s Net Tangible Assets as at 30 June. Following the 93 per cent scrip and seven per cent cash deal, the new entity will have over $4 billion in assets, a market capitalisation of close to $3.1 billion and is expected to be included in the S&P/ASX200.

Siteminder IPO

Said to be the world’s largest open hotel commerce platform, Siteminder’s IPO launches today with all the stock well and truly spoken for a multiple of times through the cornerstoning process last week and the institutional book build this Wednesday. The company is said to have the hallmarks of Xero (Siteminder has been aided on its growth path by Xero’s former CFO Sankar Narayan). The demand has been so hot, one thinks it should have been priced higher but UBS and the company have settled on 12.5 times revenue (enterprise value to FY21 revenue). One presumes something has been left on the table to ensure a positive ‘pop’ upon listing.

At the $5.06 per share price, $627 million will be raised with $537 million of the offer proceeds paid to selling shareholders, and $90 million raised through the issue of new securities in the company.

Here’s some of the details:

Total number of Securities available under the Offer: 123.9 million Securities

Total number of Securities on issue on Completion of the Offer: 269 million Securities (on an undiluted basis)

Number of Securities to be held by Existing Shareholders on Completion of the Offer: 145 million Securities (excluding any Securities acquired under the Offer)

Market capitalisation at the Offer Price: A$1,363 million

Pro forma net cash (as of 30 June 2021): A$107 million

Enterprise value at the Offer Price: A$1,256 million

Enterprise value/FY21 revenue: 12.5x (calculated as enterprise value at the Offer Price divided by FY21 revenue of A$100.8 million)

Escrow arrangements: At Completion, 23.4 per cent of the Securities on issue (on an undiluted basis) will be subject to voluntary escrow arrangements. Each of the Securities held by the Escrowed Shareholders at Completion of the Offer will be held in escrow until 4:00pm on the trading day after the date on which the Company releases to the ASX its financial results for the financial year ending 30 June 2022.

Positive Flows

Following HUB24 and Netwealth’s recently reported fund inflow growth, Praemium (ASX:PPS) has also reported a strong September quarter with record quarterly net inflows of $1.28 billion in Australia, and beating analyst expectations. Inflows of $407 million were also reported in the International business. The numbers translate to net inflows in Australia up 129 per cent on the previous corresponding period. The flows were split evenly between the Praemium and Powerwrap platforms. As these platforms growth rates inevitably begin to slow, the hymn book usually calls for CEOs to start thinking about acquiring each other. Watch this space.

HUB24

Looks like we spoke too soon. HUB24 (ASX:HUB) is integrating vertically with a bid for Class (ASX:CL1). Class is a Self-Managed Super Fund and Trust administrator as well as an associated document management provider. The bid is 53 per cent above the Volume Weighted Average Price (VWAP), putting CL1 on a PE for FY23 of about 40 times earnings. That compares to HUB which trades at more than 50 times.

Temple & Webster

Temple & Webster (ASX:TPW) provided a trading update and first quarter FY22 result. Sales are 56 per cent higher than for the same period last year (1 July to 15 October).The two-year average growth rate has slowed slightly suggesting September and October slowed, but the two-year average rate is still over 90 per cent. The good news is the company expects first half FY22 EBITDA margin to be ahead of the 2-4 per cent. The 2-4 per cent margin was reaffirmed for the Full Year 2022.

More to come for certain…

The Montgomery Small Companies Fund owns shares in Praemium and HUB24. This article was prepared 18 October 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.