We don’t need those rates to rise

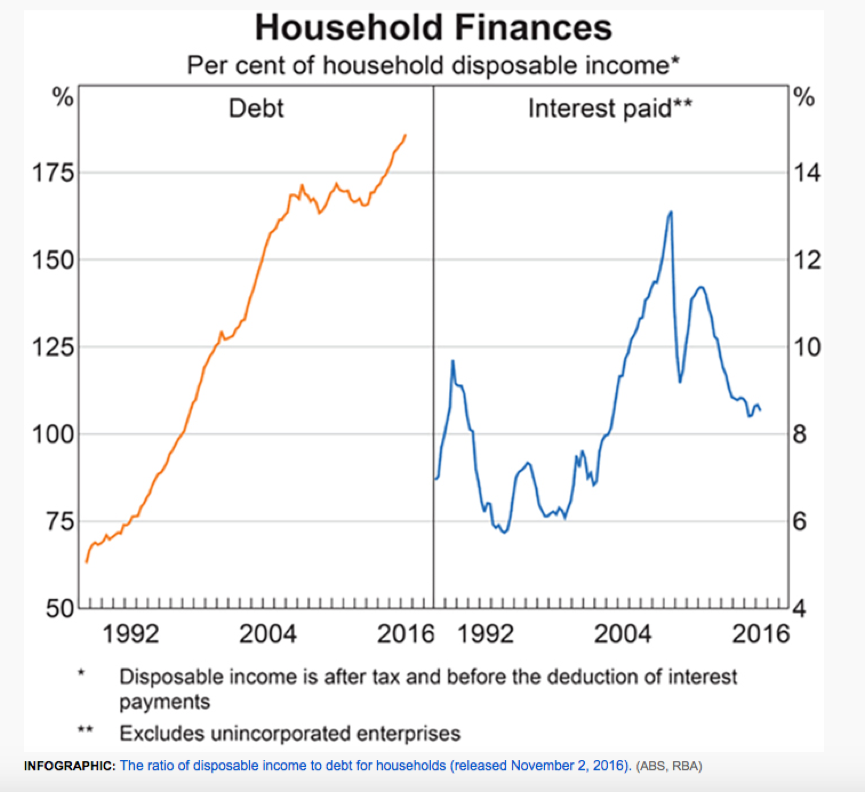

In terms of household debt to disposable income (187 per cent) and household debt to GDP (125 per cent), Australian householders are vying for gold in the debt Olympics. Our love affair with property has been greatly assisted by record low interest rates and this reduction is illustrated below with the “Interest paid to disposable income ratio” declining from 13 per cent to just over 8 per cent over the past decade.

But as we have pointed out, US and Australian ten-year bond yields have jumped from 1.36 per cent to 2.46 per cent (up 1.1 per cent) and from 1.80 per cent to 2.70 per cent (up 0.9 per cent), respectively, since the middle of 2016. In reaction to potentially higher funding costs, our banks have gently tweaked up the mortgage rates and we wonder whether the era of very low cost of credit is coming to an end?

An analysis, based on extensive surveys of 26,000 Australian households, compiled by Digital Finance Analytics, examined how much headroom Australian households have to rising interest rates, taking into account their income, the size of their mortgage, whether they are ahead on their mortgage repayments and other financial commitments.

While the definition between mild stress and severe stress may be controversial, Digital Finance Analytics paints a gloomy picture, where up to 24 per cent of Australian households with a mortgage could be under some sort of stress if interest rates were to jump by one per cent. In addition, those areas of rising unemployment, usually associated with the end of the mining boom or the closure of a significant industry, points to at least a four per cent probability of default.

And it seems there will likely be little relief from wages growth; according to the ABS, Australians’ wages grew by 1.9 per cent in the September 2016 Quarter, year on year, the lowest rate since the data was first collated nearly two decades ago.

And the biggest irony of all is in this all time low interest rate, CPI environment, it’ll be the much vaunted ‘cost of living pressures for working families’ that ends up driving them to the wall. Go figure.

Hi James, in terms of cost of living pressures, I have always thought out ABS statisticians must live in homes where rates, utilities, toll roads, transport, insurance, education and health expenses hardly move.

They’re the main culprits David and they most certainly aren’t eating fresh fruit and vegetables. I wonder if scurvy is common at the ABS?