Vale

Bloomberg:

“Walter Schloss, the money manager who earned accolades from Warren Buffett for the steady returns he achieved by applying lessons learned directly from the father of value investing, Benjamin Graham, has died. He was 95.

He died yesterday at his home in Manhattan, according to his son, Edwin. The cause was leukemia.

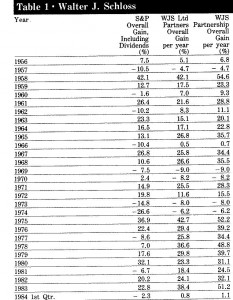

From 1955 to 2002, by Schloss’s estimate, his investments returned 16 percent annually on average after fees, compared with 10 percent for the Standard & Poor’s 500 Index. (SPX) His firm, Walter J. Schloss Associates, became a partnership, Walter & Edwin Schloss Associates, when his son joined him in 1973.

“He was a true fundamentalist,” Edwin Schloss, now retired, said today in an interview. “He did his fundamental analysis and was very concerned that he was buying something at a discount. Margin of safety was always essential.”

Buffett, another Graham disciple, called Schloss a “superinvestor” in a 1984 speech at Columbia Business School. He again saluted Schloss as “one of the good guys of Wall Street” in his 2006 letter to shareholders of his Berkshire Hathaway Inc.

“Following a strategy that involved no real risk — defined as permanent loss of capital — Walter produced results over his 47 partnership years that dramatically surpassed those of the S&P 500,” wrote Buffett (BRK/A), whose stewardship of Berkshire Hathaway (BRK) has made him one of the world’s richest men and most emulated investors. “It’s particularly noteworthy that he built this record by investing in about 1,000 securities, mostly of a lackluster type. A few big winners did not account for his success.”

Biography: While Walter Schloss’s name is not nearly as ubiquitous as Warren Buffett, Schloss was arguably one of the best investors ever. Like Buffett, Schloss was a student of Ben Graham, worked at Graham’s firm with Buffett , and is one of ” Super Investors” mentioned by Buffett in his famous essay The Super Investors of Graham-And-Doddsville.

Here’s a table of Schloss’s returns to 1984.

Walter Schloss was born in 1916. At 18 years old he worked as a Wall Street runner for on Wall Street. While he didn’t attend college he enrolled in several classes given by legendary investor Benjamin Graham. Schloss eventually went to work for the Graham-Newton Partnership. In 1955 Schloss launched his own value fund. He ran the fund until 2000.

Walter Schloss was born in 1916. At 18 years old he worked as a Wall Street runner for on Wall Street. While he didn’t attend college he enrolled in several classes given by legendary investor Benjamin Graham. Schloss eventually went to work for the Graham-Newton Partnership. In 1955 Schloss launched his own value fund. He ran the fund until 2000.

Schloss was reportedly very frugal. In one year, legend has it that his total office expense was $11,000 while his partnership generated a net profit of $19,000,000.

Schloss stopped actively managing other people’s money in 2003 and was a treasurer for the Freedom House a non-profit group devoted to furthering democracy, and human rights.

Over the 45 years Schloss managed his fund he trounced the S&P 500 by producing returns of 15.3% versus 10% for the S&P 500. A $10,000 initial investment in Schloss’s fund would have grown to $12,344,268, compared to an initial investment of $10,000 in the S&P 500 which would have produced $1,173,909.

Farewell and Thank You.

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 21 February 2012.

Here is Walter Schloss’ 1994 outline of how to make money in the stock market.

He hated losing money and mentioned this numerous times in pretty much every interview – margin of safety is so incredibly important!!

1994 Outline of Factors Required to Make Money in the Stock Market

1. Price is the most important factor to use in relation to value

2. Try to establish the value of the company. Remember that a share of stock represents a part of a business and is not just a piece of paper.

3. Use book value as a starting point to try and establish the value of the enterprise. Be sure that debt does not equal 100% of the equity. (Capital and surplus for the common stock).

4. Have patience. Stocks don’t go up immediately.

5. Don’t buy on tips or for a quick move. Let the professionals do that, if they can. Don’t sell on bad news.

6. Don’t be afraid to be a loner but be sure that you are correct in your judgment. You can’t be 100% certain but try to look for the weaknesses in your thinking. Buy on a scale down and sell on a scale up.

7. Have the courage of your convictions once you have made a decision.

8. Have a philosophy of investment and try to follow it. The above is a way that I have found successful.

9. Don’t be in too much of a hurry to sell. If the stock reaches a price that you think is a fair one, then you can sell but often because a stock goes up say 50%, people say sell it and button up your profit. Before selling try to re-evaluate the company again and see where the stock sells in relation to its book value. Be aware of the level of the stock market. Are yields low and P-E rations high. If the stock market historically high. Are people very optimistic etc?

10. When buying a stock, I find it helpful to buy near the low of the past few years. A stock may go as high as 125 and then decline to 60 and you think it attractive. 3 years before the stock sold at 20 which shows that there is some vulnerability in it.

11. Try to buy assets at a discount than to buy earnings. Earning can change dramatically in a short time. Usually assets change slowly. One has to know much more about a company if one buys earnings.

12. Listen to suggestions from people you respect. This does not mean you have to accept them. Remember it’s your money and generally it is harder to keep money than to make it. Once you lose a lot of money, it is hard to make it back.

13. Try not to let your emotions affect your judgment. Fear and greed are probably the worst emotions to have in connection with the purchase and sale of stocks.

14. Remember the work compounding. For example, if you can make 12% a year and reinvest the money back, you will double your money in 6 yrs, taxes excluded. Remember the rule of 72. Your rate of return into 72 will tell you the number of years to double your money.

15. Prefer stock over bonds. Bonds will limit your gains and inflation will reduce your purchasing power.

16. Be careful of leverage. It can go against you.

There’s a great little Bio of Walter Schloss in Bruce Greenwald’s book “Value Investing: from Graham to Buffett and Beyond”.

I’m away from home at the minute so can’t post it.

It would be good to get it up here for everyone to read.

The bit I loved goes something like this:

“Virtually nobody on Wall Street knows who he is. He rarely, if ever, visits companies, and the small office he shares at Tweedy Browne with his son has no computer.”

I think I also recall reading that he paid out nearly all of the years earnings annually so the money he was managing didn’t grow too large.

Sixteen percent a year – on average – for 50 odd years.

I just worked out what that would mean for my family come retirement time (twenty years for me, assuming I make it that far) and the south of France will be getting a long visit!

That’s very sad to hear, it is easy for people like him to be invisible thanks to the larger than life reputation of warren bufett however he deserves to be remembered right up there with him as one of the greats with wb and graham. Unfortunatley I think we can expect to hear more if these sad announcements regarding these value investing pioneers but they will no doubt leave a great legacy to those who are interested in our craft of value investors.

Saddened to hear about Walter’s Schloss’s death. He is to me what Warren Buffet is to most others. Someone I look up too. Alot.

For those interested, do a few quick Google searches on Walter, there are some great resource collections about Walter out there. He was an amazing man with a great story to tell. Putting his client’s first and without all the fanfare.