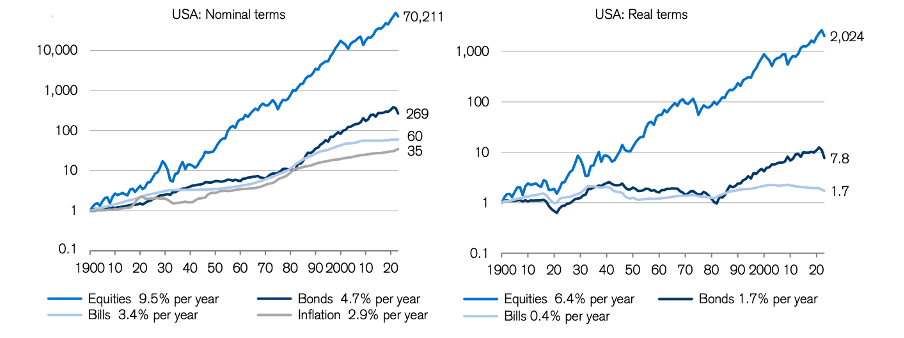

USA – turning $1 into $70,000 over 123 years – that’s 9.5% p.a.

Cantering through the Credit Suisse Returns Yearbook 2023, released about one month ago by the now defunct 166 year old bank, I came across some interesting data I wanted to share with you.

- Golden ages, by definition, are exceptions. Over the 40 years to the end of 2021, the world bond index recorded an annualised real return of 6.3 per cent, not far below the 7.4 per cent from world equities. Those 40 years were a golden age for bonds, just as the 1980s and the 1990s were a golden age for equities. However, the real return from world bonds in calendar 2022 was negative 27 per cent.

- According to Elroy Dimson, Paul Marsh and Mike Staunton, from the London Business School, the 123 year period from 1900-2022, the U.S. equities market produced a compound annual average return of 9.5 per cent, or 6.4 per cent in real returns (assuming an average inflation rate of around 3.0 per cent). In nominal terms, and assuming reinvestment of dividends and nil tax, that is the same as turning $1 into $70,000 over 123 years.

- Whilst equities were the best performing asset class (in nominal terms, U.S. bonds did 4.7 per cent per annum and U.S. bills did 3.4 per cent per annum), it was also the most volatile asset class with a standard deviation approaching 20 per cent. This means the expected range of annual returns vary between positive 29.5 per cent and negative 11.5 per cent 68 per cent of the time. Further, the expected range of annual returns vary between 49.5 per cent and negative 31.5 per cent 95 per cent of the time.

- Whilst the returns for Australian equities is a little better than for the U.S. – 0.3 per cent per annum in real terms – and with a lower standard deviation of 17.4 per cent, let us not forget that equities generally are volatile – for example, Australia still produced a negative 42.5 per return in 2008 and a positive 51.5 per cent return in 1983.

- A common factor among the best performing long-run real equity returns is that, as a generalisation, they tend to be resource-rich and/or New World countries with a good rule of law and corporate governance. The worst performing countries tend to be afflicted by international or civil wars, poor rule of law and corporate governance and often very high inflationary periods.

- Dimson, Marsh and Staunton explore the relationship between current real interest rates and subsequent real returns for equities and bonds. They conclude that when real interest rates are low or negative, expected future risky-asset returns are also lower. Conversely, a large fall in real interest rates provides a significant boost to asset prices.

- Some of this potential pain from low real interest rates and high equity valuations has been reduced by the negative returns recorded from both equities and bond markets in 2022.

Cumulative returns on U.S. asset classes in nominal terms (left); real terms (right), 1900-2022

Source: Credit Suisse