Up up and away…?

It should come as no surprise. We have always shunned capital intensive businesses such as Qantas.

Industries or businesses that require a large portion of their capital – both upfront and on a continuing basis – to purchase, install and maintain expensive property, plants and equipment are very unattractive to us.

Investing in any such business is unlikely in our view to be a profitable outcome for your portfolio. Unless you get lucky with your timing.

Over a longer-term investment horizon, the returns you receive from being a part owner (shareholder) in a business, whether in the form of dividends or capital growth, are directly related to the amount of free cash flow generated. Then it depends on how competent management is at redeploying the incremental capital into making additional business-like investments such as organic and acquisitive growth.

Few capital intensive businesses we have come across over the years (apart from in boom-time conditions) meet these important investible characteristics.

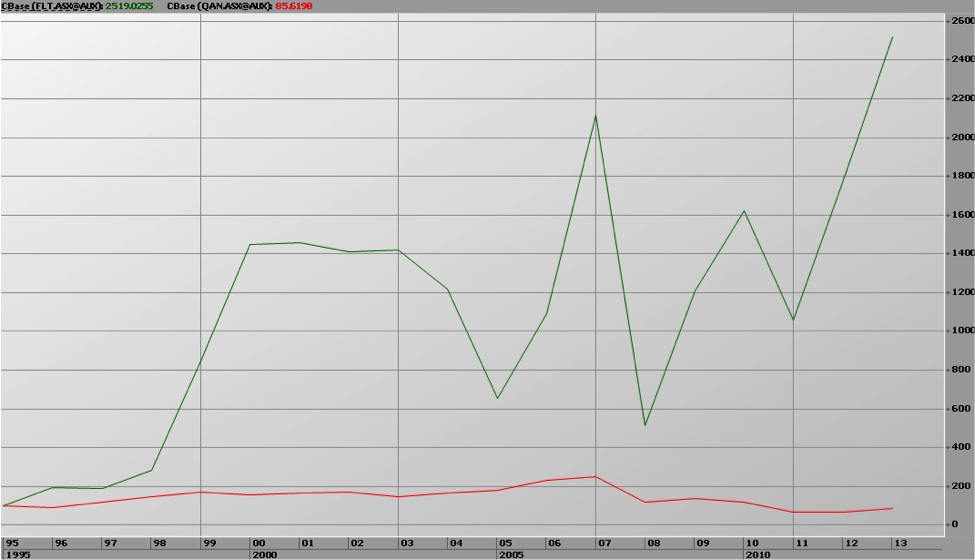

Qantas is the perfect example of a capital intensive business. It requires princely sums of capital on a continuing basis just to maintain their assets (planes) and remain productive and competitive. Because of this, the long term returns to shareholders have been also been poor.

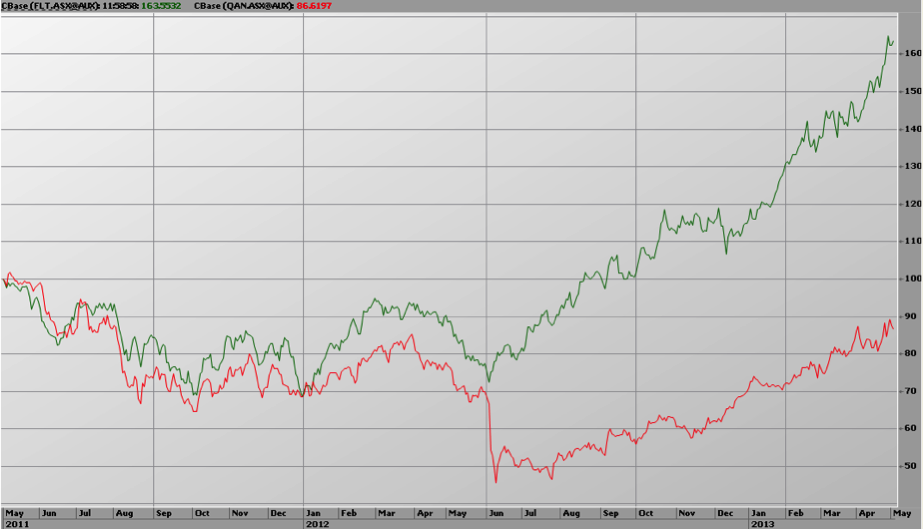

But don’t take my word for it: compare Qantas to Flight Centre, a business we do own. Over the past 2 years, an investment in ASX: FLT has turned $100 into $163. Conversely, an investment in Qantas over the same period has turned $100 into $88 despite its recent rally.

While this is a relatively short period of time, since 1995 an investment in ASX: FLT has turned $100 into $2,506; Qantas, $87. Worse after you take into account the level of inflation over this period.

We will always prefer a business that puts people on the plane over those that operate the plane.

Over time, we expect much more positive news will flow from the former, and Thursday this week was no exception. Flight Centre again upgraded their earnings guidance for the 2012/2013 financial year.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Alessandro Borges

:

Hi Roger. I’m a brazilian investor and tour fan. I’m interested in use some software tool for value investing. Scaffold software is amazing. My ask: this software is available to use in brazilian market? There’re a lot of people will pay to use this one. Is it possible bring this fantastic tool to brazilian market?

Thank you so much.

Alessandro Borges.

Roger Montgomery

:

Yes and Yes Alessandro. Give me a call +61 2 9692 5700

Eric Holliday

:

Roger

I agree with your statements above and exchanged my losing Qantas shares into winning Flight Centre after heeding your advise some time ago now. Very glad that I listened.

Roger Montgomery

:

Thanks Eric, but keep in mind we aren’t providing any advice. You MUTS seek and take personal professional advice first.

Eric Holliday

:

Roger

Appreciate that you are not providing advice but with Skaffold and your weekly video insights they provide me with a much better understanding an insight into future potential trends.

Skaffold is fantastic, easy to use and generates a lot of useful information very quickly and easily. I love it and glad that I decided to subscribe when it was launched.

Roger Montgomery

:

On behalf of the Skaffold team, thank you sincerely Eric. Feedback like yours makes all their hard work worthwhile. I will pass on your encouraging words.

Andrew Legget

:

Wow, i knew that on a buy and hold basis QAN was bad but that second graph paints an even worse picture than what i thought. To think some people didn’t want to sell their shares into the takeover.

I have always preferred the indirect route to certain industries.

In regards to FLT vs QAN i just look at it in the following way. You could probably fit about 100 FLT revenue and profit generating stores in one hangar QAN needs to house and maintain a plane and at the end of the day, if it is a QAN international flight, the customer probably came from one of those 100 FLT stores.