Unemployed or underemployed?

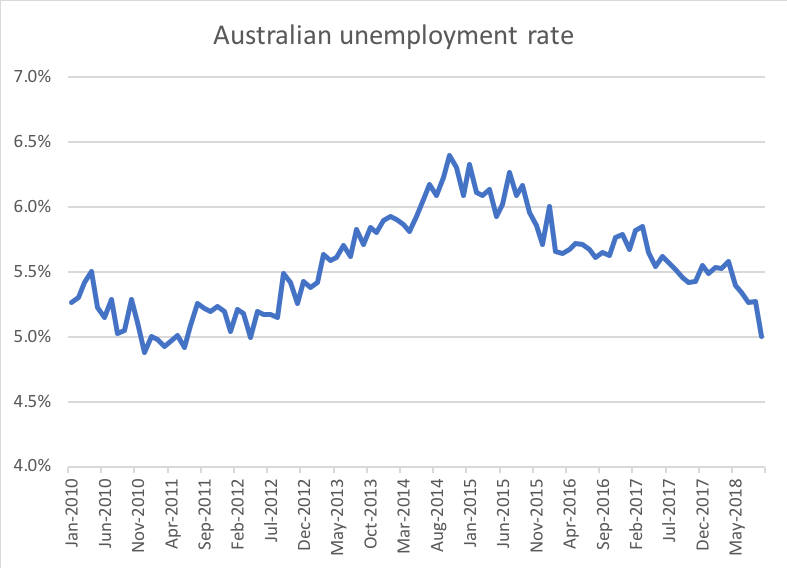

Australian Bureau of Statistics released their September labour force statistics on Thursday last week. As you might have seen in the newspaper, the headline number was positive showing a sharp drop in the unemployment rate which fell by 0.3% points from August to 5.0 per cent which is the lowest since before the mining industry downturn in 2012.

Politicians and many commentators celebrated this as a sign that everything is well with the economy and that things are going in the right direction. As always, it is worth digging a bit deeper into the numbers.

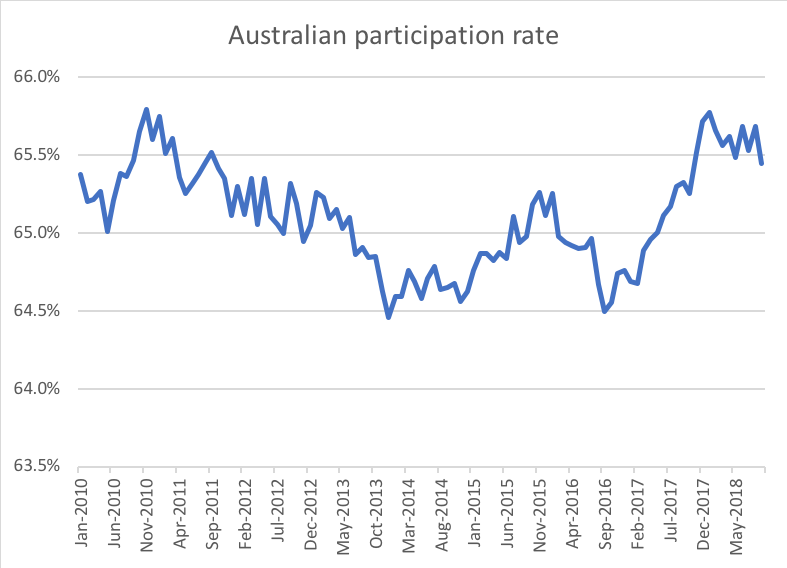

First, we can start with the participation rate (i.e. the number of people who are interested in participating in the workforce, either working or looking for work). The trend here has also been relatively positive over the last couple of years but in the September month, the participation rate fell steeply by 0.3% points which is exactly the amount that the unemployment rate fell by.

If we look at the absolute numbers, we can see that the total number of people employed did actually increase by a very limited amount and that virtually all of the improvement in the unemployment rate came from the total labour force shrinking by about 31,500 people. There can of course be very legitimate reasons that the total labour force is shrinking (retirement at certain times of year etc.) but I do not read this as a positive story for the overall economy, as after all, Australia has a very high level of population growth (about 1.8 per cent per year) and a shrinking labour force means less people producing to support a larger population.

0.00

| August 2018 | September 2018 | % | |

| Employed persons (‘000) | 12,603.7 | 12,636.3 | 0.00 |

| Unemployed persons (‘000) | 702.9 | 665.8 | -5.3 |

| Total labour force | 13,333.6 | 13,302.1 | -0.2 |

| Unemployment rate | 5.3% | 5.0% | -0.3 |

| Participation rate | 65.7% | 65.4% | -0.3 |

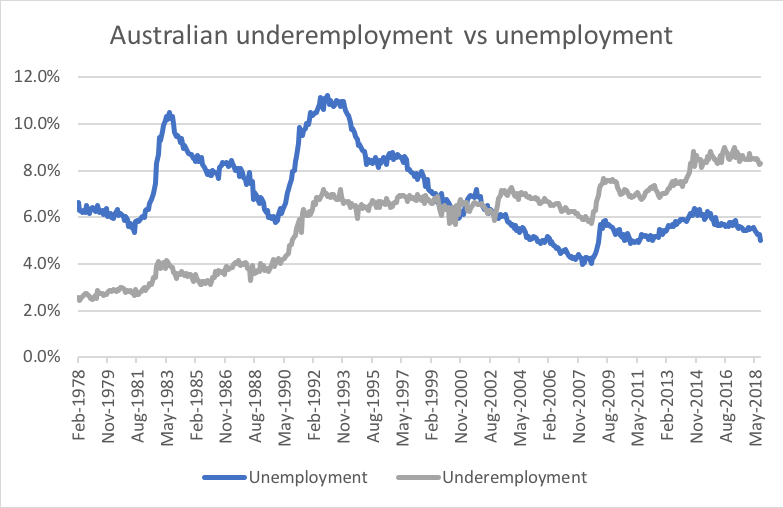

It is also worth looking at the underemployment rate (i.e. the people who are currently working but would like to work more). This number is particularly interesting to look at over the longer term and to compare to the unemployment rate as we have for the last 30 years seen a steady uptrend in underemployment to the current level of well over 8 per cent while the unemployment has gone the other way.

Overall, the labour market in Australia seems to be going reasonably well but it is not correct to celebrate a fall in unemployment caused by a shrinking total labour force as a very positive event, especially when the underemployment numbers are trending at a high level.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Andreas Lundberg

:

Thanks Peter, we try to do our best and tell it as we see it :-)!

Yes I am actually a bit surprised that we have not started to see unemployment creek up. We should though remember that what we have seen so far is really a drop in building approvals while there are still a lot of buildings still being constructed. What happens when these buildings are finished is another story. The high infrastructure spending has also helped but given the importance of stamp duty to fund states infrastructure spending, the outlook for this is not looking great given what is happening in the property market. The dropping savings rate is certainly helping the retail sector.

peter s

:

Thanks Andreas. I can always rely on the Monti crew to be the truth tellers. The most unbiased and trustworthy analysis can always be found on this blog. In an industry full of charlatans this for me is a very important resource.

When you say “Overall, the labour market in Australia seems to be going reasonably well” does this suprise you? The bad news for property and credit growth has been around for some time now and given the importance of these factors on our economy I would have expected to see some side effects in these numbers. I remember your article on the low savings rate boosting the economy. Maybe this has just delayed the inevitable.