Understanding insurance broking

You may not be too familiar with Steadfast Group (ASX: SDF) and AUB Group (ASX: AUB), but these insurance brokers are high quality businesses in an industry with high barriers to entry. Which is why we are very happy to hold them in our funds.

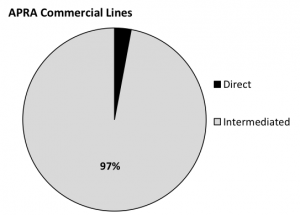

Both companies focus on broking general insurance for small to medium size enterprises, this is known as commercial lines. Commercial line insurance can be a lot more complicated than personal lines (e.g. health insurance or life insurance). So much so, that 97 per cent of commercial lines are done through an intermediary (such as a broker). This creates an important role for commercial line brokers.

Source: Macquarie Bank Research

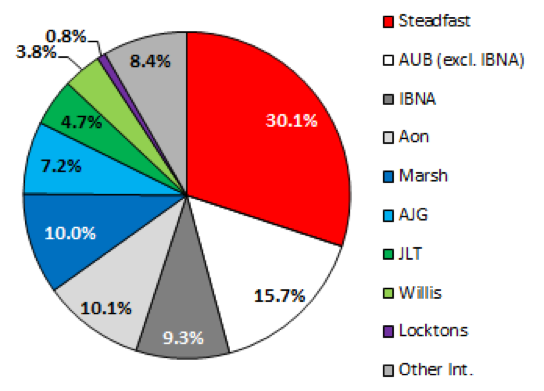

Steadfast is Australia’s largest network of such insurance brokers (about 30 per cent market share), and AUB Group the second largest (25 per cent inc IBNA). They hold equity positions in commercial insurance brokers and provide them with shared services. They grow when (1) their underlying broker businesses grow and (2) they acquire more brokers. They earn revenue from a baseline fee and a commission linked to the insurance rate. For Steadfast, this makes up 84 per cent of earnings, with underwriting fees making up the remainder. AUB Group makes 65 per cent of their profits from Australian broking, 18 per cent from underwriting, 10 per cent from risk services and the remainder from NZ broking.

AU – APRA Regulated – Commercial Lines GWP market Share

Source: Macquarie Bank Research

Both are leveraged to the commercial lines cycle. Increasing commercial insurance rates drives a higher commission revenue with no additional cost base. This means both companies can grow their topline revenue and expand their EBITDA margin driving higher shareholder returns. In recent years, rates have been declining to the point of stressing insurance companies and underwriters (stressing supply). We are now beginning to see the first signs of rate stabilisation and indeed increases. These rate increases go straight through to the bottom-line and increase value for shareholders.

Barriers to entry for insurance brokers are high – an established track record is required from insurers before they are permitted to broke products. These businesses can leverage scale advantages from buying as a group. Many smaller groups of insurance brokers often team up for purchases. However, it takes time to build a significant scale and network coverage. Steadfast was established in 1996 and AUB in 1985.

The Montgomery Fund and The Montgomery Private Fund are holders of both Steadfast Group and AUB Group. This article was prepared 20 April 2018 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade either of these stocks, you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Given the feedback in the current Financial Services Royal Commission regarding percentage based commissions and the potential for them to be replaced by a fee structure.

How do you think Steadfast’s business model would cope it if it had to rely on a fee revenue model?I’m guessing not that well.

Hi Simon,

A very interesting question. Two things to note here (1) the Royal Commission is targeting lending brokers with that statement due to the intrinsic conflicts of interest created. I would regard it as a very low probability that Steadfast’s business segment is targeted i.e. insurance for small to medium sized businesses. (2) if this were the case I would expect the fees to rise. This would remove leverage to the insurance cycle but could still be maintained at a profitable base.