Four months can be a long time in the share market

“While the outlook for Blue Sky is easy to articulate, the execution is always more challenging…Our business is well placed to meet the inevitable challenges that lie ahead” quoted the 2017 Annual Report.

Blue Sky Alternative Investments (ASX: BLA) might have been celebrating New Years’ Eve with gusto. With the BLA share price doubling to $14.50 over 2017, some investors controlled $75m worth of shares in a company that then had a market capitalisation of $1 billion, or 25 per cent of Assets Under Management, and in addition, unlisted outstanding options were worth nearly $50m above their strike price.

The year to June 2018 was looking exceptional. Fee-earning assets were forecast to hit $4.5 billion, more than double the $2.1 billion recorded at 30 June 2016. Over the two years, underlying net earnings were forecast to grow from $16m to around $35m, 76 of the 80 separate funds were closed-ended (meaning the money was very sticky), and the Company now had sixteen institutions, including eleven international institutions, as investors.

Four months is a long time in the share market and Blue Sky Alternative Investment’s share price has fallen 75 per cent in that time to $3.70. A reportedly scathing 67-page report by Glaucus Research – which is “not available to Australian residents” – in conjunction with the recent 36 per cent downgrade to underlying net earnings (to a $22.5m mid-point) has weighed heavily on the company’s shares. Despite the $100m capital raising in March 2018 – at $11.50 per share – BLA’s current market capitalisation is now just $287m (28% of its previous $1bn market valuation). Its statutory net asset backing is estimated at $220m or $2.83 per share.

And despite giving a divisional breakdown which comprises Private Equity, Private Real Estate, Real Assets and Hedge Funds, it has now been revealed that the property assets accounts for $2.4 billion or 60 per cent of the $4 billion of assets under management.

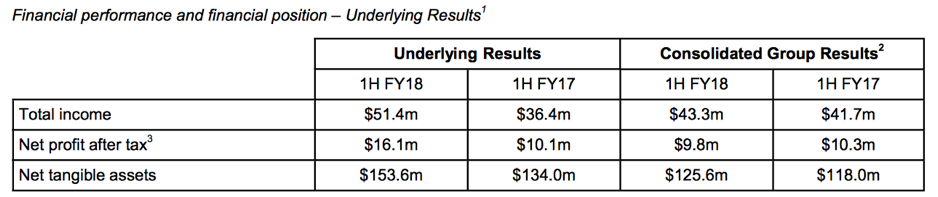

One area the press hasn’t focused much of their attention on is BLA’s accounts under AASB 10 Consolidated Financial Statements and AASB 128 Investments in Associates and Joint Ventures. In accordance with AASB 10, four funds are consolidated into the Group’s December 2017 half-year report and a further 22 funds and two joint ventures are accounted for using the equity method in accordance with AASB 128. The table below details the difference between “Underlying” and “Consolidated.”

This seems negative but far from terminal given BLA had $45m of net cash on hand at December 2017, raised $100m of fresh capital at March 2018, and is forecasting a positive underlying net earnings of around $6.5m in the June 2018 half-year. But, as one analyst asked in a recent conference call “if deal flow has ground to a halt thus leaving co-investment capital unallocated, why doesn’t the board consider a buy-back?”

(1). Blue Sky Alternative Investments Limited 2017 Annual Report

Nigel Stemson

:

because the board knows it’s not even worth $3.70,

if I had bought at $11.50 I’d be looking at launching a class action

ho hum

David Buckland

:

Hi Nigel, the problem is the Company have actually tried to do a half decent job in their various releases. For example, the information that accompanied their interim report on 19 February 2018 was reasonably extensive.

tom k

:

Hi David,

when observing the above table between underlying vs consolidated, does this mean that Blue Sky may be just buying and selling between themselves using their own closed ended funds/joint ventures?

David Buckland

:

Hi Tom, the Consolidated Group results reflect the statutory results and includes investments “in a range of Blue Sky managed funds and fund related entities that have been consolidated or equity accounted in accordance with AASB 10 Consolidated Financial Statements”. Interestingly, if we just focus on cashflow using the “Underlying results” – the cashflow conversion declined from 92% ($9.3m/$10.1m) to 64% ($10.3m/ $16.1m) over the December 2017 half year relative to the previous corresponding period. It will be interesting to see these “relativities” when the 2018 audited results are released in August.