Tuas: Roaring ahead with strategic acquisition and growth potential

As we have previously reported, Tuas Ltd (ASX:TUA) is a rising star in the telecommunications sector. The company continues to solidify its position as a formidable player in Singapore’s competitive telecom market. Broker Peloton Capital has also been following the company closely and recently reported on a major acquisition.

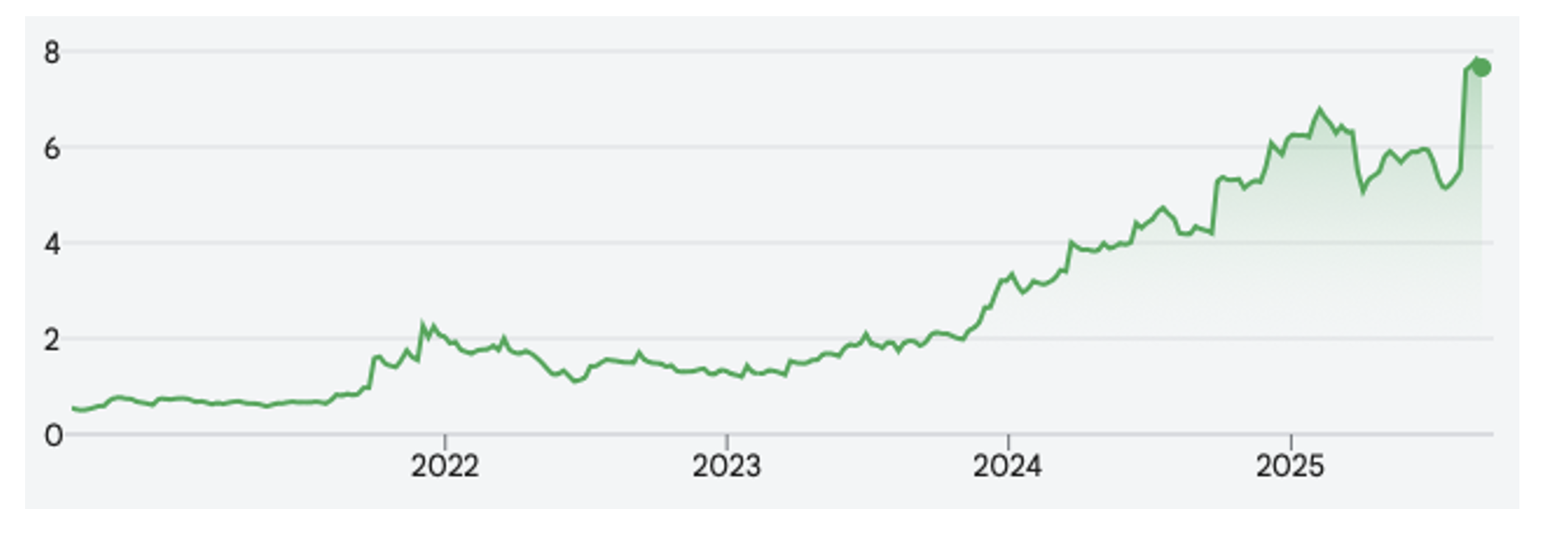

Figure 1. TUAS (ASX: TUA) Share Price

Strategic acquisition of M1

On August 11, 2025, Tuas announced its acquisition of M1 from Keppel for S$1.43 billion (S$1.1 billion in debt and S$330 million in cash), pending regulatory approval expected by November 2025. This transformative deal positions TUAS to become a full-service telecom provider. Within the first 100 days post-approval, management plans to implement cost-saving measures and set ambitious targets, with synergy benefits expected to materialise by the second half of 2026. Estimates project pro-forma revenues of S$949 million and earnings before interest, taxes, depreciation and amortisation (EBITDA) of S$256 million.

S&P/ASX 200 inclusion

A key short-term driver for Tuas’ share price is its potential inclusion in the S&P/ASX 200 Index, with the next index changes set to be announced on September 5, 2025. Inclusion could significantly boost the stock’s valuation and attract greater investor interest, making it a pivotal moment for the company. Of course, if it’s not included this time around, it won’t be long before it is, all things being equal.

Beyond synergies

While synergies from the M1 acquisition are significant – potentially reaching S$100 million annually (with a conservative estimate by Peloton of S$50 million) – TUAS’s growth story extends far beyond cost efficiencies. The company is well-positioned to capture substantial opportunities in:

- Consumer broadband: With a combined market share of just 16 per cent, there’s ample room for growth by offering the best-value plans to consumers.

- Enterprise market: TUAS aims to replicate its consumer market success by targeting enterprises with competitive plans. The enterprise market in Singapore is described as “ever-expanding,” presenting significant potential, though its size is challenging to quantify.

- Emerging opportunities: Additional growth avenues include Goose eSIM and machine-to-machine (M2M) services, which offer valuable optionality. The broker note also projects TUAS’s mobile market share could rise to approximately 40 per cent over time.

Operational efficiency and cost optimization

Tuas is expected to drive capital expenditure (capex) significantly below M1’s historical levels, with estimates around S$80 million per annum, including spectrum payments for the next three years. Both TUAS and M1 utilise Huawei equipment, enabling network optimisation at the software level to further reduce costs. It is expected this focus on efficiency strengthens Tuas’ competitive edge and outlook.

Investment case

As a defensive stock with strong growth prospects, Tuas is seen by Peloton and investors as well-positioned to deliver value. The combination of its M1 acquisition, potential index inclusion, and diverse growth opportunities in consumer and enterprise markets makes it a compelling candidate for further research. Peloton remains bullish, confident that Tuas’ journey over the next few years will be highly profitable for shareholders.

Tuas is not just a synergy-driven story but a dynamic telecom player with significant growth potential in Singapore’s consumer and enterprise markets, and perhaps beyond. With a strategic acquisition, cost optimisation, and a clear path to market leadership, Tuas is one to watch. The upcoming S&P/ASX 200 Index decision could serve as a near-term catalyst, while long-term investors might look forward to sustained growth and profitability.

You can read previous articles on Tuas: