TUAS is calling! Should you answer?

TUAS (ASX:TUA) (pronounced ‘Too-as’) is a company we have written about on the blog several times. Back in April 2024 on a ‘Spark you F.I.R.E’ podcast with Jazz Sidana, I noted that it was difficult to establish a confident valuation on this company (which at the time held a share price of $3.84) given the lack of sufficient information available.

Without a clear picture on TUAS’ growth path, investors have defaulted to backing the executive chairman and founder, David Teoh, to repeat the same success seen with the mobile and internet service provider, TPG (now known as TPG Telecom Limited (ASX:TPG) following its merger with Vodafone in 2020).

TUAS is a mobile and internet service provider operating in Singapore. It was demerged from TPG following the TPG-Vodafone merger. Think of TUAS as TPG Telecom Limited’s Singapore business that was given to David Teoh after he sold TPG to Vodafone Australia. Remember, the global Vodafone business was already operating in Singapore.

At the time of writing, shares in TUAS are trading at $5.45.

One positive aspect of TUAS’s listed status, especially for investors who see the value of uncovering investment opportunities that other investors haven’t heard about, is that few brokers cover the stock. A lack of information about the company’s plans perhaps defines its briefings with fund managers, and that puts many of them offside. That lack of information also makes it a tough company for sell-side analysts to cover, as does the fact that David Teoh, Soul Patts (formerly known as Washington H. Soul Pattinson), Regal Funds Management, and Wilson Asset Management collectively command about 70 per cent of the share register.

The one broker that does cover TUAS, has valued the company almost 50 per cent higher than the current traded price.

Financial performance

TUAS continues to solidify its position as a rising force in the Singapore telecommunications market, with its first-half 2025 financial year results underscoring robust financial performance and operational momentum.

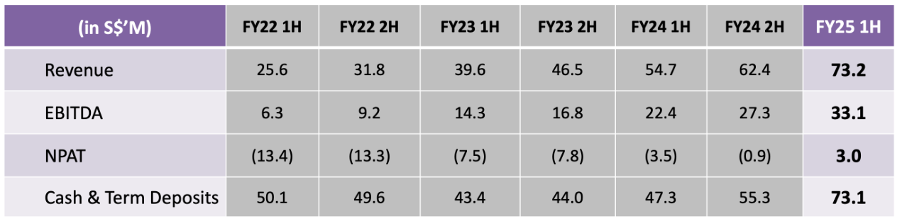

Revenue growth: TUAS reported a significant increase in revenue for the first-half 2025 financial year, driven by strong customer acquisition and higher average revenue per user (ARPU). Importantly, the results reflect an acceleration of revenue from the first quarter. Looking further back, in the first-half 2022 financial year, revenue was S$25.6 million. In the most recent half, revenue exceeded S$73 million, representing a tripling of revenue (albeit off a low base) in just three years.

EBITDA improvement: Earnings before interest, tax, depreciation, and amortization (EBITDA) showed marked improvement compared to the first-half of the 2024 financial year, underpinned by operational efficiencies and a growing subscriber base. Table 1., displays TUAS’ EBITDA progress.

Table 1. Tuas Group financial results

Source: Company presentation.

The acceleration in profitability highlights TUAS’s ability to scale effectively while managing costs.

Net profit: The company achieved a maiden net profit after tax, thanks ultimately to higher revenue and disciplined cost control.

Growth in EBITDA and net profit reflects an apparent acceleration in TUAS’ financial performance, outpacing expectations from financial year 2024. This is a standout area of improvement, showcasing operational leverage as the business scales.

Cash flow and balance sheet: With ongoing subscriber growth, operating cash flow remained strong and supports ongoing investments in network expansion and technology upgrades. The balance sheet also reflects a healthy liquidity position. The company’s cash reserves stand at S$73.1 million, bolstered by a 125 per cent cash conversion rate, and despite an uptick in FY25 capex guidance to $50–$55 million (from $45–$55 million) to accelerate 5G network expansion.

Operational highlights

Record gross margins hit just over 70 per cent, while EBITDA rose to $33.1 million, and achieved an impressive 45.2 per cent margin – the highest half-yearly EBITDA margin to date, and up from 43.9 per cent in the previous half. This profitability surge has been driven by cost optimisation and a low-cost provider strategy – not unlike TPG. The combination positions TUAS to further enhance margins in future periods.

Subscriber growth: Through its ‘Simba telecom Pte Ltd’ brand, TUAS experienced accelerated growth in its customer base, particularly in the postpaid mobile segment. Competitive pricing, enhanced network quality, and targeted marketing campaigns resulted in a record number of ‘net additions’ (new subscribers).

TUAS’ mobile segment subscribers reached 1.16 million by the first-half of the 2025 financial year, reflecting an average monthly net addition of 17,800. Growth remained strong despite a competitive market, with 15,700 net additions in the three months from January (versus 20,000 in the October quarter).

As there’s only one broker covering TUAS (Peloton Capital), we can’t describe their estimates as ‘consensus’, however we can say ‘the market’ projects TUAS will surpass 1.2 million subscribers by July 31, 2025, targeting over a 20 per cent mobile market share. TUAS innovations such as a “Data Only” products (catering to devices such as remote cameras, electric vehicles (EVs), and vending machines), GOOSE (Generic Object Oriented System-wide Events) eSIM options, and seniors plans, have helped to diversify their subscriber base beyond migrant workers.

In terms of trading conditions in the first weeks of the second-half of the 2025 financial year, TUAS noted, “As of 31 January 2025, Simba had monthly paid mobile active services of approximately 1,160,000, up from approximately 1,053,000 as of 31 July 2024, with growth achieved month on month throughout the period. Simba also recorded more than 14,000 active Fibre Broadband Subscribers at the end of the half year.”

Network expansion: Significant progress was made in rolling out 5G infrastructure, with a notable increase in coverage and capacity. This investment will result in improved customer satisfaction and retention rates.

ARPU uplift: Average revenue per user (ARPU) rose due to the successful upselling of premium plans and value-added services. This acceleration in ARPU underscores TUAS’ ability to extract greater value from its existing customers.

Strategic progress

TUAS continues to strengthen its position in the telecommunications market. As it progresses from a challenger brand to an established brand, it should leverage greater awareness, resulting in winning market share and continued growth beyond early adopters.

Peloton notes that in consumer broadband, which launched in 1H 25, TUAS has rapidly scaled to 14,347 subscribers by January 31, 2025. Ten thousand subscribers were reportedly added in November 2024 alone. The company is targeting 1.6 million residential premises with a fully upgraded 10Gbps fibre product. Broadband revenue hit S$1.5 million in the first half of 2025, with an annualised run rate of S$5.2 million.

TUAS’ competitive edge lies in its best-value pricing and short 12-month contracts, supported by a S$100 million government grant (to be disbursed in financial year 2025) for 10Gbps adoption.

Customer experience: Investments in digital platforms and customer service enhancements have improved Net Promoter Scores (NPS).

Customer acquisition: The record subscriber growth in the first-half of the 2025 financial year represents a significant acceleration compared to prior periods, driven by both organic growth and successful marketing initiatives.

5G rollout: The pace of 5G deployment has accelerated, with a broader footprint achieved ahead of schedule. This positions TUAS to capitalise on the growing demand for high-speed connectivity, a key competitive advantage.

Outlook

TUAS remains optimistic about its full-year 2025 performance, with guidance suggesting continued revenue and EBITDA growth. The company is well-positioned to benefit from increasing demand for data services and its ongoing network investments. Management emphasised a focus on maintaining cost discipline while pursuing strategic opportunities to enhance market penetration further.

Notably, covering broker, Peleton Capital, anticipates a clearer growth trajectory by the second-half of the 2025 financial year as sales cycles mature and add-on products emerge. This will be important to broaden the company’s appeal among small-cap fund managers.

TUAS’s first-half 2025 financial year results demonstrate another period of strong financial and operational progress, with notable improvements in profitability, subscriber growth, and network capabilities. Any ongoing acceleration in key metrics such as EBITDA, ARPU, and 5G rollout highlights is worth watching closely.

Although TUAS’ A$2.5 billion market cap (over 15 times its estimated revenue of approximately S$160 million) seems expensive, the recent 20 per cent drop in share price could intrigue investors with longer-term perspectives. Those who believe in management’s ability to replicate past success may be further encouraged by plans to roll out full-service products to corporate and government clients.

* The Tuas Group consists of Tuas Limited (Tuas, ASX: TUA) and its wholly owned subsidiaries Simba Telecom Pte Limited (“Simba”) (incorporated in Singapore, July 2016), Tuas Solutions Sdn Bhd (incorporated in Malaysia, May 2020), Simba 5G Pte Ltd (incorporated in Singapore, February 2022), Netco East Pte Ltd (incorporated in Singapore, April 2022), Netco West Pte Ltd (incorporated in Singapore, April 2022) and Goose eSIM Pte Ltd (incorporated in Singapore, October 2024).

Simba owns and operates a modern telecommunications infrastructure that provides both national mobile coverage and high-speed broadband services. Simba first acquired a portfolio of wireless spectrum at the New Entrant Spectrum Auction in December 2016 (paired 10 MHz of 900MHz spectrum and 40 MHz of 2.3GHz spectrum), with subsequent additions in 2017 of one 10 MHz lot of 2.5GHz spectrum and allocation of 800 MHz of 5G mmwave spectrum in 2020. Simba further acquired two lots of 5G 2.1GHz spectrum in December 2021. During 2023 and 2024, Simba constructed a fixed line network to facilitate the supply of 10Gbps broadband services.

The Tuas Group’s primary operations are those of Simba with other companies providing some support activities to Simba. This interim report includes the 6 months’ results of the operations for the half-year period 1 August 2024 to 31 January 2025.