Treasury Wine Estates – Part 4

As set out in the previous parts of this series (here, here and here), Treasury Wine Estate’s (TWE) performance has to improve significantly on an underlying basis to justify the current share price. The fall in the currency is not enough to justify the share price by itself.

The new management team has enunciated a strategy of reinvestment in brand equity building and a refocusing of the business on selling higher priced wines (RRP A$15+ per bottle) and reducing its exposure to the lower end of the premium (RRP of A$10-15) and sub premium markets (RRP A$5-10). The shift in volume mix toward higher margin products at higher prices should result in an improvement in overall margins for the company.

However, I would note that this was the same strategy set out by the management team installed at predecessor firm Southcorp by the Oatley family in 2001, by Jamie Odell at Fosters in 2004 and 2007 as well as by David Dearie upon the formation of TWE in 2011.

The difficulties in dealing with the long dated production cycle and the impact of incorrect forecasting of consumer demand detailed in part 3 of this series highlights the main failure in executing the strategy to sell an increased proportion of higher priced wine in the past.

By reallocating spend from promotional activity (ie. discounting) to marketing in order to refocus the business on brand building, volumes inevitably fall in the short term. This results in rising inventory levels as production was set a number of years prior and was based on demand forecasts that would not have incorporated a cut in promotional activity.

Inventory builds pressure on management over time. Eventually management gives in, shifts spend back to promotional activity from marketing to try to clear the excess stock levels. Eventually it forces the company to write down/off stock, take provisions to exit supply contracts and more than likely, management is changed.

The difficulty in executing this strategy goes to the heart of the fundamental economic difficulties of the wine industry.

The one major difference in the current strategy under new CEO Michael Clarke is that the increase in marketing spend is not being funded by a reduction in promotional spend, but from cost reductions.

There are two main components to the cost reduction story. The company announced that it expects to reduce overheads by over A$50 million. The first A$35 million of benefits flowed through in FY15 with the residual A$15 million expected to flow through in FY16.

The company has also set out its supply chain optimisation strategy. This is expected to deliver around A$80 million of savings by FY20 in two phases. The company has taken an aggressive stance in realigning its production and supply chain to ensure its production facilities are fully utilised, and the right products are produced in the right locations.

We note that a similar realignment of the supply chain occurred in the 2004 financial year under Jamie Odell. The problem is that the inflexible nature of the supply chain means that over time as consumer preferences change, the supply chain inevitably moves back out of alignment. This requires readjustment on a regular basis, which can be costly.

So, over the next 5 years, TWE is expected to realise benefits from the falling Australian dollar as well as significant cost reductions.

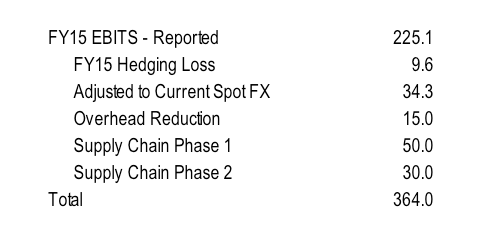

If we add all of these drivers to the results reported in the 2015 financial year, the resulting EBITS including all of these factors is A$364 million. In this context, the updated guidance from management at the AGM for FY16 EBITS of A$270-290 million implies underlying (ie. non-currency driven) growth of 2-10 per cent excluding the impact of the Diageo acquisition.

In this context, the updated guidance from management at the AGM for FY16 EBITS of A$270-290 million implies underlying (ie. non-currency driven) growth of 2-10 per cent excluding the impact of the Diageo acquisition.

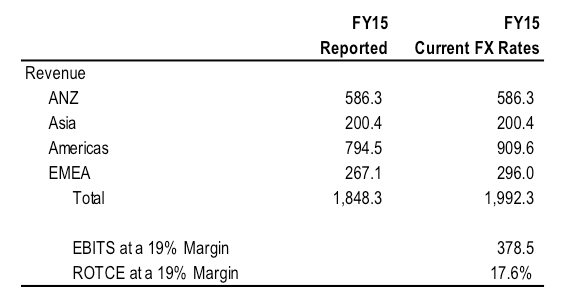

We note that the company is targeting ‘high teens’ EBITS margins by FY20. Applying a 19 per cent EBITS margin to FY15 revenue rebased to current exchange rates would generate an EBITS of circa A$380 million and ROTCE of 17.6 per cent. This is broadly consistent with the figure above. The 17.6 per cent ROTCE (return on tangible capital employed) and A$380 million EBITS that results from the ‘high teens’ margin target is roughly in line with the estimated ROTCE and level of EBITS required to justify the share price from part 2 of this series.

The 17.6 per cent ROTCE (return on tangible capital employed) and A$380 million EBITS that results from the ‘high teens’ margin target is roughly in line with the estimated ROTCE and level of EBITS required to justify the share price from part 2 of this series.

To achieve this outcome, assuming no further fall in the Australian dollar, TWE would need to retain all of the benefit from the depreciation of the Australian dollar to date as well as all of the benefit from the targeted cost reductions.

The share price has also increased around 10 per cent since the announcement of the acquisition of a number of Diageo’s brands in the US for a total consideration of US$662 million (A$905 million). At present, this business generates EBITS of around US$65 million. TWE expects to realise US$25 million of synergies by FY20, implying a ROCE of around 13.5 per cent.

This is above the cost of capital, so a tick for that. Although we would acknowledge that the acquisition does not come without risk. Diageo’s premium and luxury portfolio in the US has been declining in volume for the last 5 years, and the Blossom Hill brand gives TWE material transaction exposure to the USDGBP exchange rate (not great given the outlook for the USD). Additionally the sourcing for the business is from leased rather than owned vineyards, meaning there is risk around the security of scarce luxury grape supply in the very long term.

Adding these two sources of earnings and return together results in a total EBITS target of around A$500 million and ROTCE of around 17.5 per cent.

Assuming these returns are sustainable with a long term growth rate of 4 per cent would result in an enterprise value for TWE of around A$5.25 billion. Deducting the proforma debt post the acquisition of A$700 million yields an equity value of A$4.55 billion or A$6.16 per share. This valuation assumes all of the currency benefits, synergies and cost savings indicated by management are retained with the business achieving the long term goals announced by management.

Given the issues regarding the industry structure as well as the need to reinvest some of the savings in lifting brand markets and support, this is an optimistic assumption.

Consequently, to generate a sufficiently positive investment case, we would need to assume a significant further depreciation of the Australian dollar and/or further upside from cost reductions.

The limited valuation support based on the current initiatives and currency devaluation combined with inherently difficult nature of the wine industry means that at the current share price we conclude that there isn’t sufficient upside to produce a positive investment case.

*EBITS – earnings before interest, tax and the accounting revaluation of vines and grapes known as SGARA.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY