Treasury Wine Estates – Part 2

In the second part of my series on the investment case for Treasury Wine Estates (TWE) given its leverage to a falling Australian dollar (AUD), we look at what is already factored into the share price.

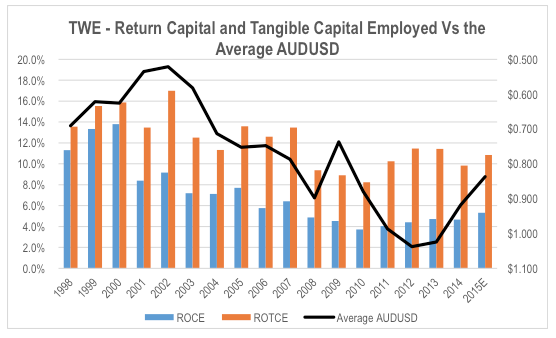

At A$6.71, the stock is currently trading at 2.1x tangible capital employed. This would suggest there is significant brand value in the business that would allow it to generate a large return on capital premium over its cost of capital. However, in the 2015 financial year (FY15) it generated a return on tangible capital employed of just 10.9 per cent pre-tax. This compares to a pre-tax weighted average cost of capital of around 12 per cent.

Additionally, on a proforma basis (adding the old Fosters and Southcorp wine business prior to the formation of TWE in 2011), ROTCE (return on tangible capital employed) has not exceeded its cost of capital since FY07, let alone generated the sort of premiums required to justify a valuation 2.1x tangible capital employed. Assuming a long term growth rate of 5 per cent a year, the company would need to generate a ROTCE of 17.5 per cent to justify the current share price, and it has only generated a ROTCE above this level once in the last 18 years. That was in FY02 when the AUD averaged US$0.521 and £0.361, 25 per cent below current levels.

Assuming a long term growth rate of 5 per cent a year, the company would need to generate a ROTCE of 17.5 per cent to justify the current share price, and it has only generated a ROTCE above this level once in the last 18 years. That was in FY02 when the AUD averaged US$0.521 and £0.361, 25 per cent below current levels.

However, a lot of the weakness in ROTCE through the last decade was driven by the appreciation of the AUD. If we recalculate the ROTCE in FY15 using the EBITS adjusted to current spot FX rates estimated in Part 1 of A$269 million, FY15 ROTCE increases to 12.6 per cent. This is still well short of the 17.5 per cent required to justify the share price.

In addition to generating a marginal ROTCE of 17.5 per cent going forward, the company would also need to increase its EBITS to circa A$380 million to justify the current share price. This is 41 per cent above the FY15 EBITS result adjusted to current spot rates.

So there is already a significant amount of upside priced into the stock. The current share price factors in more than just the earnings benefit that will result from the fall in the AUD to current spot rates.

This doesn’t rule TWE out as a potential investment, but it means that there would need to be earnings and return upside beyond just currency leverage to make the stock undervalued enough to present a compelling investment on the basis of the potential return relative to the risk.

In the next instalment, we will look at the industry structure and how this impacts the return and earnings outlook.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Methinks there are a lot of old Foster’s shareholders with this still in their portfolio who’ve held on just out of curiosity (myself included!) who are loving the recent run this stock has gone on :-)

Hopefully parts 2 to 4 of the series will provide an update to help you assess your investment