TradeMe looks set for long-term revenue growth

Lately, we are hearing many investors lament that it’s getting hard to find value in our market. Well, there are still pockets of value. And TradeMe (ASX:TME), New Zealand’s largest online auction and classifieds website, could be one of them.

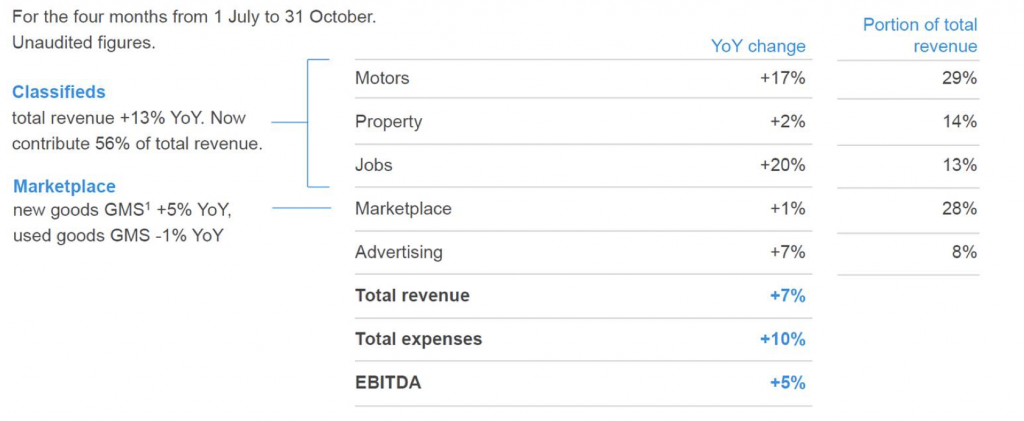

At the recent Annual General Meeting, the CEO, Jon Macdonald, released the following slide detailing TME’s trading performance in the first four months of FY2018.

While the overall results were roughly in line with market expectations, the composition was slightly different.

On the positive side of the equation, classified revenue growth continued to gain momentum. As the Chairman pointed out in his address, while the company started as a marketplace like eBay, it is the classifieds business that is the driver of growth.

The 13 per cent growth in revenue in the first four months of FY2018 relative to the prior year is stronger than the 11.7 per cent growth rate from the six months to 30 June 2017. This was despite very weak listing volumes in property classified during the period.

Both jobs and motors revenue growth were very strong in the first fourth months, driven by continued strong volume growth in jobs and yield improvement from growing premium ad penetration in motors.

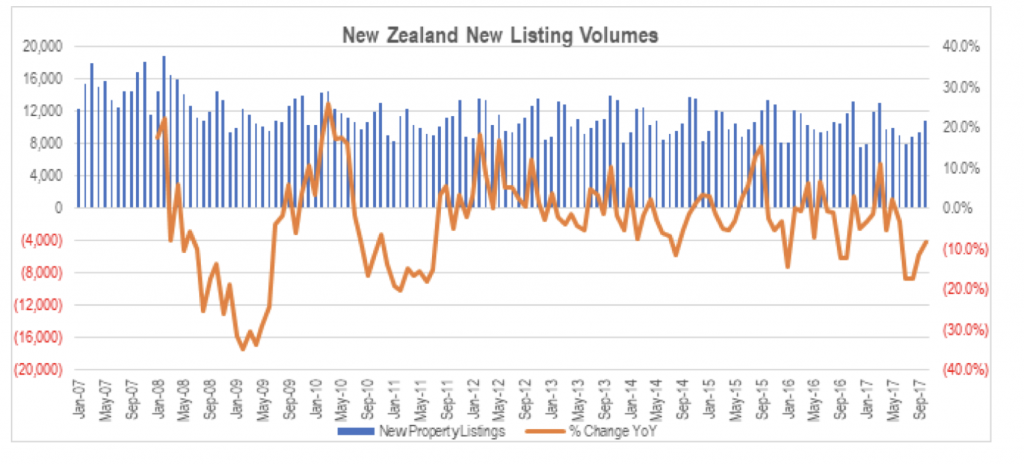

Property classifieds revenue growth was just 2 per cent in the first four months of FY2018. While yield growth has remained strong, property listing volumes in New Zealand have been very weak since June, as is highlighted by the chart below showing new property listing volumes according to TME’s main competitor in property classifieds, realestate.co.nz.

This is not an issue of TME’s position but merely the point in the cycle for the property market, with prices looking like they are hitting the turning point. Regulatory constraints imposed on the mortgage market have reduced demand and prices that buyers are able to pay. However, asking prices have not adjusted to the lower level of demand, resulting in a widening of the bid/offer spread in the property market. This reduces transaction volume until either buyers step back up, or sellers reduce their expectations.

It looks a bit like what happened in Australia about a year ago, with everyone panicking about REA. The New Zealand market was also negatively impacted by the uncertainty created by the recent Federal election, which had a lot of implications for the property market. Management indicated that there have been some signs of recovery post the election, but they weren’t sounding too upbeat just yet.

TME is still gaining listing share relative to realestate.co.nz, but overall market listing volumes are down double digits in the first four months of FY2018.

Other points of note were:

- Marketplace revenue growth of 1 per cent was slightly weaker than market expectations. Interestingly, the GMS figures for new and used goods are roughly in line with forecasts for 1H18, but revenue growth is weaker indicating that there has been some slippage in the average take rate since 2H17. On a positive note, used goods GMS growth went positive again in October as TME cycled the launch of Facebook’s marketplace product launch in the prior year. This should see used goods GMS growth improve over the rest of the year.

- Operating cost growth of 10 per cent was generally higher than market expectations as TME reinvests in its Marketplace product ahead of any potential market entrance by Amazon.

- EBITDA (Earnings before interest, taxes, depreciation, and amortization) growth of 5 per cent was slightly below consensus forecasts which imply 7.5 per cent growth for FY2018. However, the company has previously disclosed that there was downside risk to its guidance due to property listing volume weakness. The weakness in the company’s share price following the release of the FY2017 result in August would partially reflect this downside risk to guidance.

Overall the result is pretty much in line with market expectations, but the detail sees growth more skewed toward the high value parts of the business that are expected to drive earnings growth and returns longer term.

The Montgomery Funds own shares in Trade Me Group

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY