TPG – Totally, Pretty Good

In what we believe is a company transforming event, TPG Telecom (TPM) has announced the acquisition of Telecom New Zealand Australia Pty Ltd and its subsidiaries, which include the AAPT and PowerTel businesses.

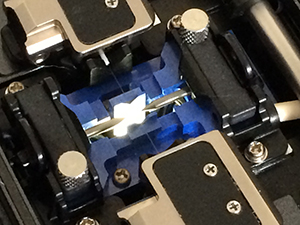

TPG’s current infrastructure includes 3,800km of optic fibre (see the pic of optic fibre being plasma arc-welded in our office), 411 DSLAM Exchanges (ADSL 2+ broadband infrastructure), and 1,600 buildings directly connected to the Group’s fibre network. Telecom NZ will add 11,000km of fibre, 254 Mid Band Ethernet exchanges, 1,500 direct premises and 15 data centers to the mix.

TPG’s significantly expanded infrastructure will come at a wholly debt funded cost of $450m. Whilst it appears to be a hefty price tag, we think it’s a small price to pay given TPG will become Australia’s second largest telecommunications business, behind Telstra. With one significant difference – it will have the lowest operating costs and will be better placed to continue winning market share.

TPG is currently capped at $3.5billion with fibre access to more than 50 per cent of NBN Co’s points of interconnection and 70 per cent of third party data centres. The estimated cost to build the NBN is $43billion. One should expect the spread to narrow.

TPG has proven that a privately and efficiently run business with highly scalable assets will generate returns on capital that the government could only dream of.

We are obviously delighted to have been holding a circa 4 per cent position in TPG at the time of the announcement yesterday.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Interested to hear how they can be classed as second largest telco when they do not have their own mobile network?

Indeed. Interesting.

Is it true that there is good quality optical fibre and cheap stuff that is prone to break downs? If so, which has TPG bought?

Hi Roger, not really a query specific to this recent post. I was just wondering whether you have published the formula for calculating the multiple on the assumption the company pays no dividends? Also, what are you views on Resmed, cheap after the decline since October or trading roughly around fair value now?

Cheers

Hi Kieran,

As you know there are many formulae for estimating Intrinsic value. I posit one possible version in Value.able. http://rogermontgomery.com/valueable-book/

Thanks for that Roger, I have read the book (very helpful by the way) but all I seemed to be able to find was the valuation mulitple tables. It was fairly simple to realise the formula when the company pays dividends but I have found it a bit more difficult to try and figure it out for when no dividends are being paid, sorry for being a pain.

Kieran. Others have nailed it so I’ll give you a bit more time…

Looks to have a bright future ahead.

What would you estimate its value to be?

A Morning Star report has raised its “fair value” from 4.10 to 4.50. If those calculations are correct, it has closed at about 4.54, seems its trading at full value today.

Scaffold rates it as A1, and values it at about 2.9something ?