Three key themes from the banks’ results

Australia’s four major banks have now reported their interim results. Common to all of them were three key themes, which are presenting both challenges and opportunities.

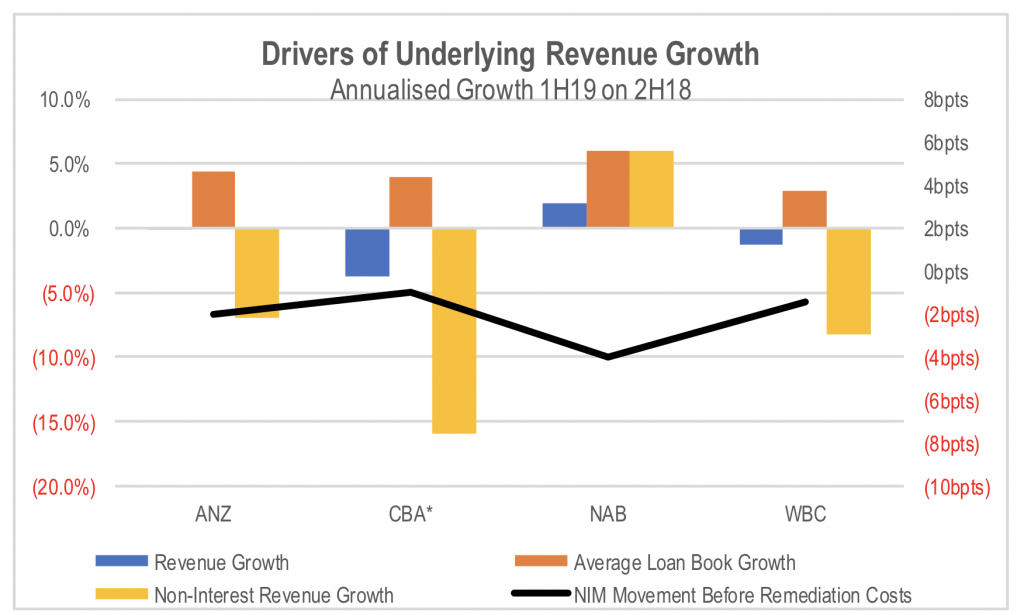

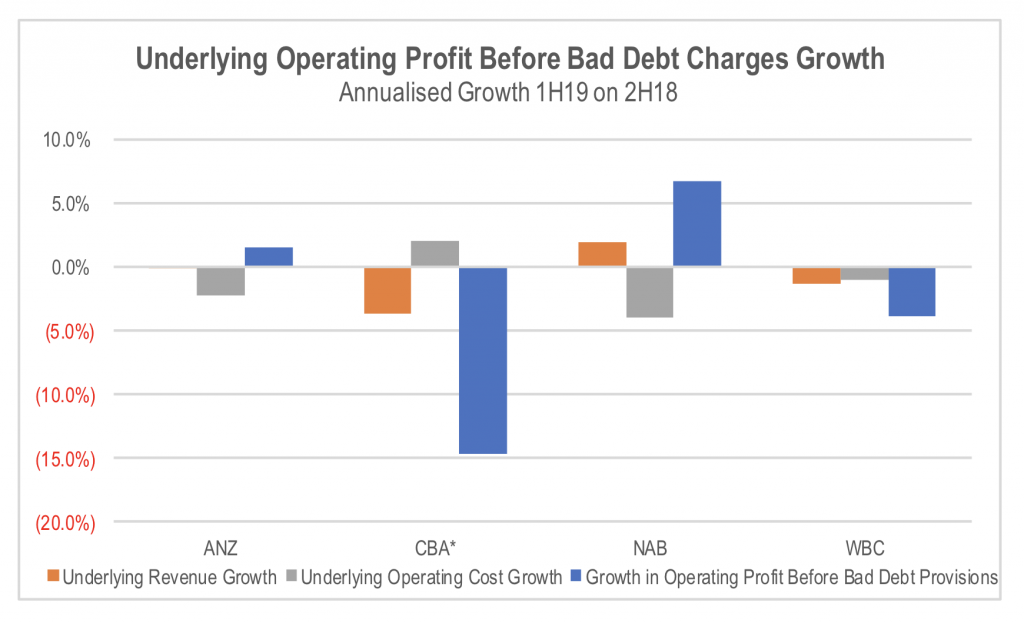

Generating any revenue growth is becoming increasingly challenging

Once one-off remediation and profits on sale of businesses are stripped out, revenue growth for Australia New Zealand Bankng Group (ASX:ANZ), National Australia Bank (ASX:NAB) and Westpac Banking Corp (ASX:WBC) was almost non-existent and down for Commonwealth Bank of Australia (ASX:CBA). Slowing growth in the average loan book was offset by continued net interest margin contraction.

*CBA March quarter data

Source: Companies

Net interest margin compression, combined with fee reductions in wealth (WBC) and banking were combined with poor loss outcomes in general insurance for ANZ, CBA and WBC. This more than offset growth, albeit slowing growth, in loans books.

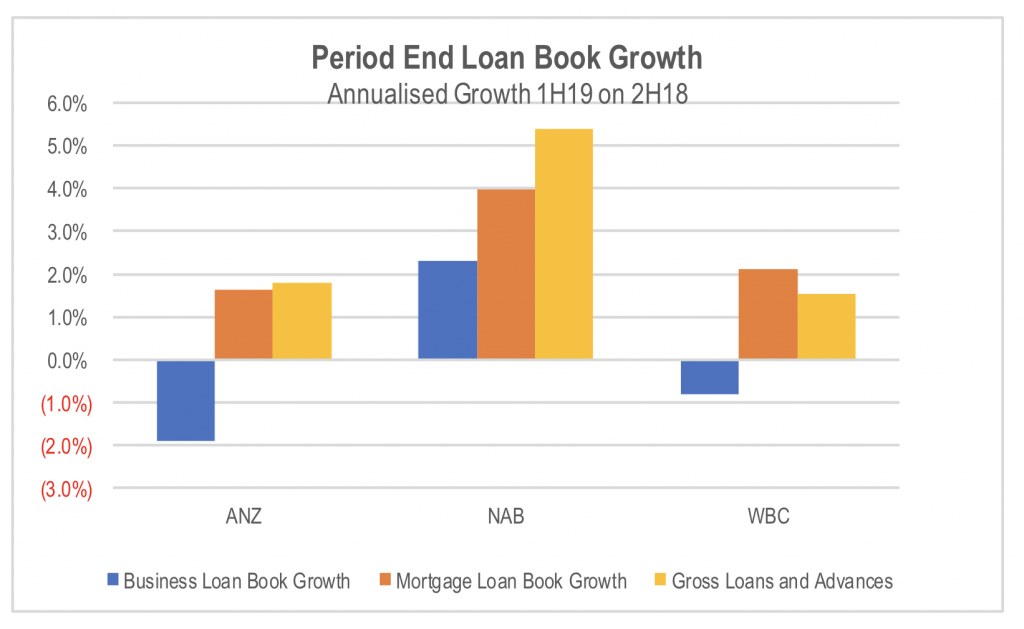

What was interesting was the slowing of not only mortgage book growth, but also business lending outside of lending to large institutional clients.

Source: Companies, UBS estimates

Net interest margins fell despite the out of cycle standard variable mortgage increases put through by three of the four majors early in the period. More importantly, the outlook for net interest margins wasn’t as positive as expected with the banks flagging that the benefit from the recent contraction in the Bank Bill Swap Rate (BBSW) to Overnight Index Swap (OIS) spread will be offset by ongoing pressure on front book mortgage rates as banks focus on gaining market share to offset the impact of slowing system growth.

Non-interest income remains under pressure, with fee revenue generally falling, while trading performance was mixed across the banks. WBC and CBA faced a further headwind in an elevated claims cost period due to more storm costs than normal. This should be expected to mean revert in future periods.

Overall, the results highlighted the difficulties the banks face going forward in growing revenue.

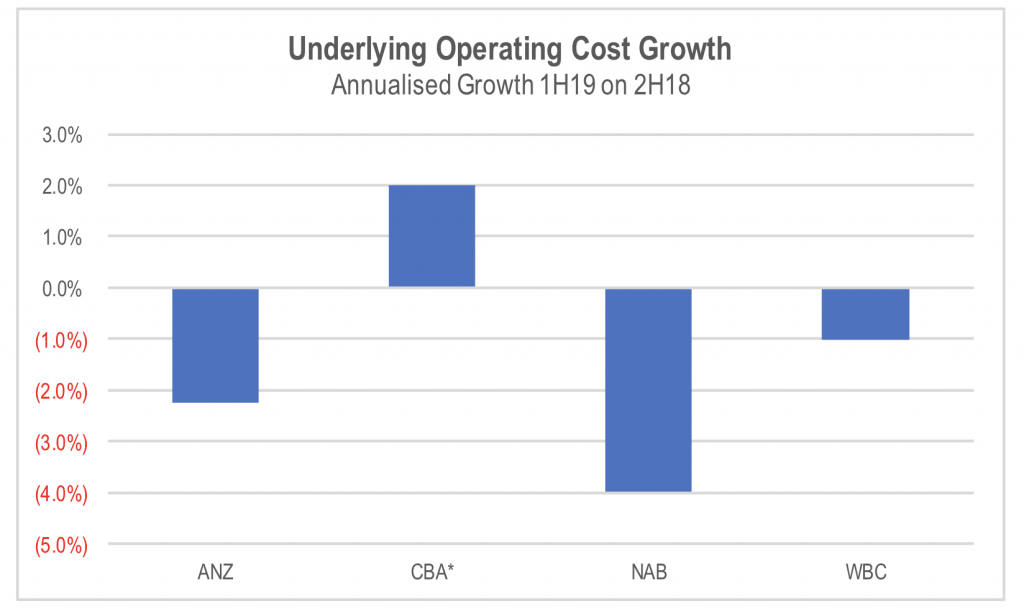

Cost reductions are becoming the last option for earnings growth

Three of the four major banks managed to reduce their absolute amount of operating costs before remediation, divestments, and other one-off items in the period relative to the previous reporting period. CBA was the exception, increasing its underlying operating costs by 2 per cent on an annualised basis.

*CBA March quarter data

Source: Companies

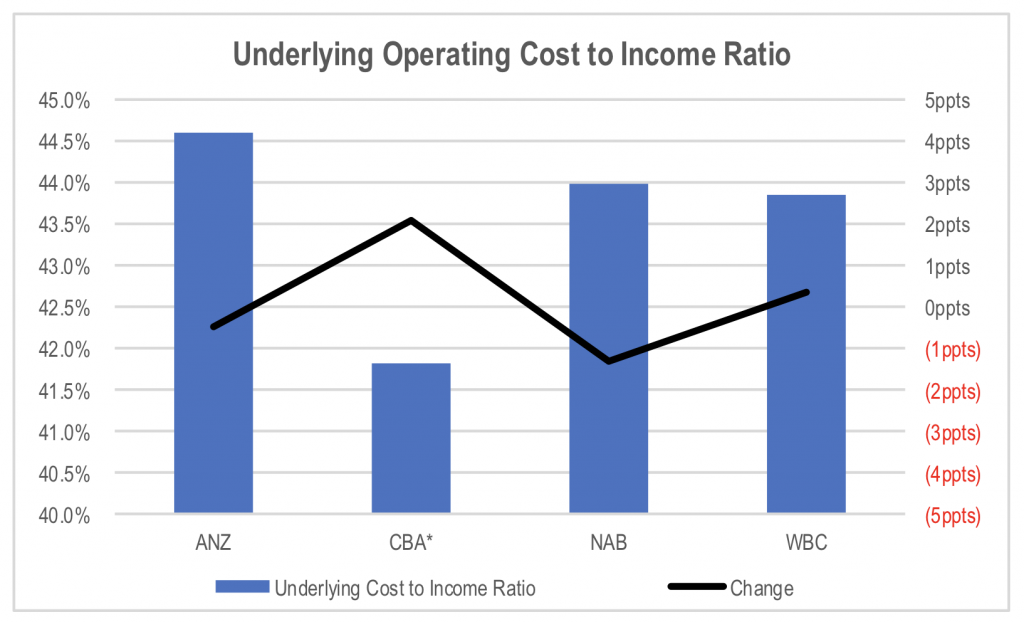

Similarly, two of the banks managed to reduce their underlying cost to income ratio despite the weak revenue growth with the exceptions being CBA and WBC.

*CBA March quarter data

Source: Companies

Despite what was a reasonably good operating cost performance, operating profits before bad debt charges based on underlying continuing business revenue and operating costs were essentially flat to down. The only bank producing meaningful underlying operating profit growth was NAB.

*CBA March quarter data

Source: Companies

This highlights how hard it will be for the banks to generate material profit growth purely through operating cost reductions. Revenue growth will need to re-emerge, but it is difficult to see where this will come from given the high level of debt in the household sector, which will limit loan book growth, the banks that are more exposed to mortgages, combined with the competitive pressure on front book rates.

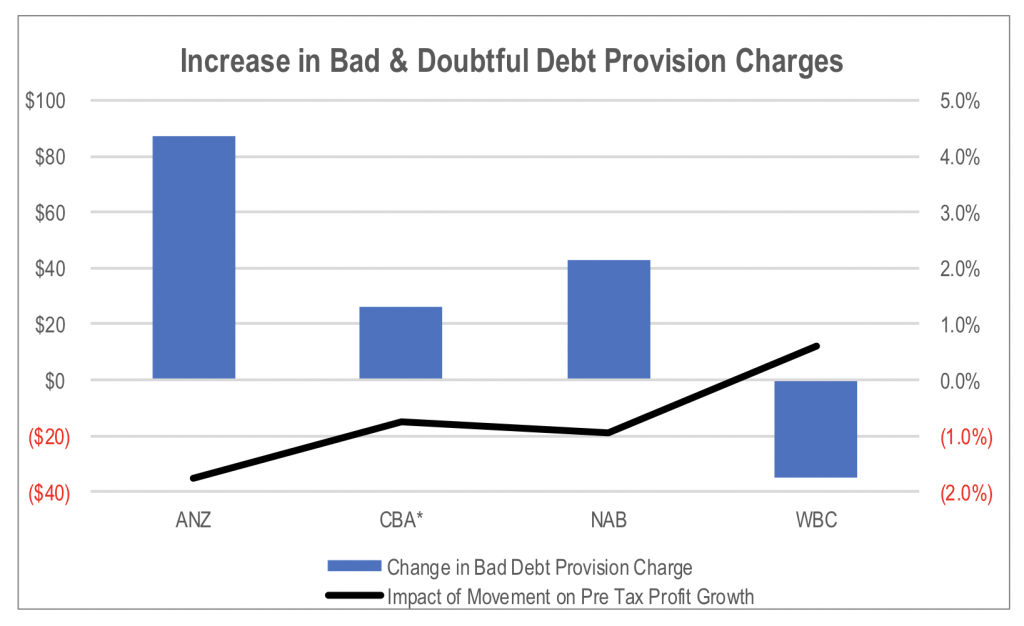

Bad debt provisions remained low but the underlying credit trends are deteriorating at an accelerating rate

While net bad debt provisions had a continued benign impact on earnings growth, the trends below the surface continue to deteriorate.

The increase in charges relative to underlying operating profits were small, and for WBC, the charge actually reduced relative to 2H18.

*CBA March quarter data

Source: Companies

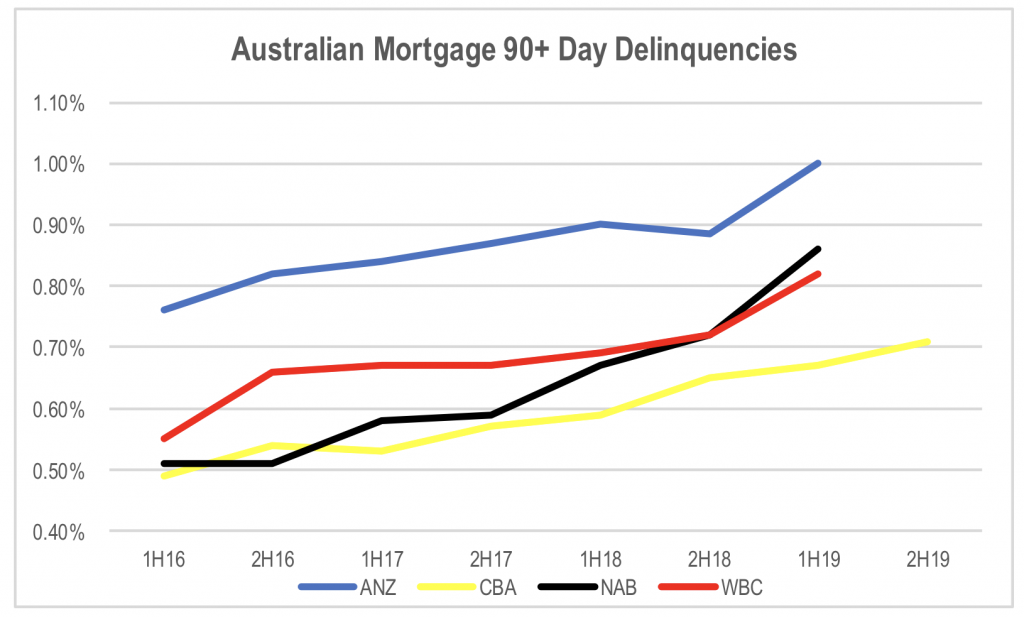

While the increase in charges was fairly benign for earnings growth, 90+ delinquencies in the Australian mortgage books not only continued to rise, but they appear to have jumped more significantly in the latest period.

*CBA March quarter data in 2H19

Source: Companies

A large component of the increase continues to be the WA property markets, but the increase in NSW during the latest period was noticeable as well. NSW and the ACT have had much lower levels of delinquencies than the other states. But NSW delinquencies have increased in the last 6 months such that they are now inline or slightly above VIC.

Delinquencies do not necessarily turn into impaired loans, but they do act as an early indicator of potential future problems and building stress in the system.

Overall the results showed the headwinds that face the banks at present, and the challenges to their ability to generate earnings growth in the medium term.

The Montgomery Funds own shares in Westpac and National Australia Bank. This article was prepared 15 May with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

With the banks recently reporting their results, Stuart takes a closer look at three key themes which were present during the results. Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY