They’re back

On 16 July 2013 (during the first half of FY14), the Labor Government proposed changes to the Fringe Benefits Tax (FBT) treatment of novated leases, amid claims of “rorting”. These proposals shut down the car leasing and salary packaging industries. Even Ford blamed Kevin Rudd’s $1.8 billion FBT overhaul for halting production, forcing at least 750 workers to be stood down.

Customers of finance group McMillan Shakespeare Ltd (ASX: MMS) – as well as those of its competitors – delayed vehicle replacements and new lease arrangements. This resulted in the business experiencing a 32 per cent decline in earnings over the first 6 months of FY14.

Montgomery’s Head of Research, Tim Kelley, articulated our view regarding the probability of the proposed legislation succeeding and damaging the company in a three-part blog series. You can revisit each part here: Part 1, Part 2 and Part 3, but in essence – with the Liberal Party opposing the proposed changes and likely to win the Federal election, the chances of the legislation being implemented were slim.

As you know, we have long believed McMillan would quickly return to ‘business as usual’, and even suggested the negative press would work in the company’s favour by causing competitors to shed staff while simultaneously raising awareness about salary packaging. We doubled our position in the business, buying shares at approximately $7.25 on the day they relisted at a near 50 per cent discount to the then-recent highs.

So has business boomed?

Turning to today’s annual report, it appears that not only did the business fully recover, but it has already returned to growth.

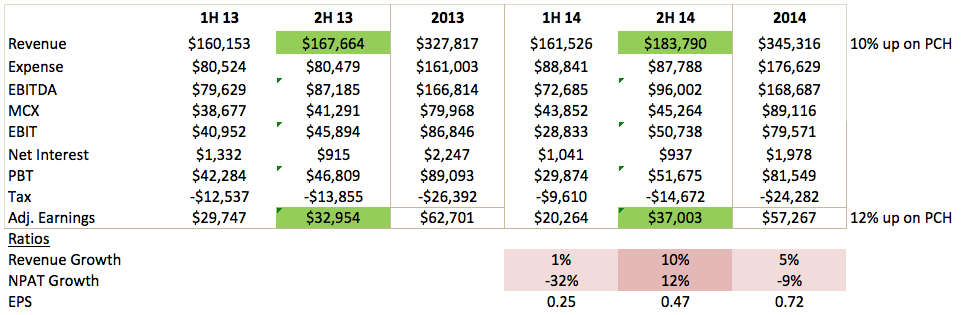

As we show in the table below, MMS enjoyed a very strong recovery in the second half of FY14, delivering a 10 per cent revenue growth from $167.7 million to $183.8 million over the previous half in FY13 (pre-FBT benchmark).

Profits, which had grown from $29.7 million to $32.95 million in the half immediately prior to Kevin Rudd’s ‘proposal’, slumped to $20.3 million during the six months after the announcement was made. Since then however, profits have not simply grown incrementally, but they have surged beyond even the record-high level achieved before Rudd’s proposal was mooted.

The tear-away speed of the company’s recovery has surprised even us, and it appears that the negative press surrounding the FBT changes has indeed acted as a valuable marketing tool. Importantly, MMS also grew NPAT by 12 per cent over the previous corresponding half in FY13 from $32.9 million to $37 million, after normalising for one-off expenses.

So, despite a significant disruption to business, where the industry was effectively shut down and in limbo at least until the election had passed, the company reported full-year earnings down just nine per cent.

PCH = Previous Corresponding Half

Looking forward, it’s probably not a stretch to annualise the second half’s $37 million of adjusted earnings, which would equate to an NPAT run-rate of $74 million in FY15. If we instead assume the growth continues into FY15, management might indeed be justified in their confidence that FY15 should see another year of profitable growth in all lines of business.

We reckon MMS could be looking at an NPAT in FY15 in the low $80 millions, versus current consensus of $72 million. It’s situations like these – where the market treats that which is temporary as permanent – which we believe to be the truly mouth-watering opportunities.

If we make the assumption that MMS can grow its earnings at 8 per cent CAGR over the next 3 years, we can quickly estimate the business to be worth approximately $1 billion on a discounted cash flow basis (which, on current diluted shares, equates to around $12.50).

These points, coupled with an extremely undemanding valuation, is likely to see the shares trade higher.

Some additional quick notes

It’s worth noting that the UK (start-up) joint venture loss is up from $41,000 in FY13 to $1.1 million in FY14, which was an additional ~$700k drag on earnings growth this year. However, in the UK, MMS appears to have built sufficient scale and an operational team ready to press the button on a decent sized acquisition. An acquisition of an Interleasing-sized business in prior years could provide a further meaningful catalyst.

Both The Montgomery [Private] Fund and The Montgomery Fund own shares in McMillan Shakespeare Limited.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Be interested to hear the Roger Montgomery estimation of current intrinsic value for MMS using the method outlined in Value.Able. I spent today working on these calculations for companies I have on my “list” and I’m not sure the numbers are right.

Using a book value (equity per share) of $3, ROE of 32.5 (avg of ’12 and ’13) and a payout ratio of 60%, my calculations give me an intrinsic value of $15.86. Could this be right?

Hi Roger,

Perhaps another blog watcher and Value.able graduate might like to give you a hand. Anyone? keep in mind ROE can sometimes be mean reverting. Its hard to sustain high rates of return on equity o ever increasing amounts of equity. read the section on implied growth rates…

Hi Roger,

Thank you for the reply.

I had a few emails with Russell and upon review amended a few of the numbers and my current intrinsic value for MMS came out to be $12.80 and next year’s forecast is $13.85. We agreed these seem far more reasonable.

Hi guys, looking forward to your detailed thoughts on the AGI result today. Surely the strong US growth numbers point to bright prospects for continued double digit growth. The hammering of the share price today was completely illogical to me.

All the best

Scott T

A very good result for MMS.

“It’s situations like these – where the market treats that which is temporary as permanent…”

I’d have some concerns that you might be being guilty of this yourself in assuming the $37m HY result represents permanent growth and can be annualised, rather than thinking that a sizable portion of that figure is a one-time catchup from business that was delayed out of the previous half by the FBT uncertainties.

That said, I hope you’re right as I continue to hold MMS :)

Growth did not just produce earnings above the previous low point however, but above the previous HIGH point!

Thoughts on Ainsworth Game figures?

We’re working on it now. Market might be acting very short term as US business can be much bigger than local…but P/E was high in a market that doesn’t tolerate disappointment…

Looking forward to your teams thoughts on the AGI result. Surely strong US growth points to bright prospects, and future double digit earnings growth. Today’s share price hammering may represent an opportunity .

All the best

Scott T

Hmmm.. market reaction to Ainsworth Gaming results surprising.

The FY figures look good, but if you dig up the 1H results from Feb then you can see that all the good results were then, 2H is a backwards step from 1H – EBITDA & NPAT both fell in 2H relative to 1H.

Is gaming very seasonal? I wouldn’t have thought so but maybe it is based on holiday periods? If so, then maybe the market is over-correcting, but if revenue should be steady then this is an unimpressive result.

note the increased expenses due to the US expansion…perhaps its inadequate, perhaps its timing. We’ll know more after our meeting with the CEO and CFO.

Thanks for the post, Russell. I was also of the opinion that MMS would come out of this better than it went in, and thus it would appear. They’re still susceptible to government whim and who knows what silly things governments will continue to come up with, but given the brouhaha about Rudd’s FBT changes last year, I reckon it will be a while before anyone tries that one again. In the meantime, things look promising.

– Car manufacturers due to pull out of Australia 2017

– next election due late 2016

– Libs previously stated they would address tax reform in 2nd term after 1st term of ‘no surprises boring government’

A few timelines might align against FBT in ~2-4years from now…obviously highly speculative, but govt will need $ and subsidies for car companies who will at that point employ zero Australians may be an easy target.

If Janet Yellen keeps her foot on the accelerator we might have bigger problems before then!

Hi Roger

How many doves can you fit in a hole?

Jackson Hole that is.

Even super Mario (Draghi) has turned dovish.

Regarding AGI EPS 19c instead of 21c but punished big,I think

Next yrs EPS 23c/24c which is 24% increase on this year.PE doesn’t look so bad if my figures are correct.

Cheers