The world according to Munger

Daily Journal Corporation (DJC) publishes newspapers and websites covering California and Arizona, as well as the California Lawyer magazine, and produces several specialised information services. Sustain Technologies, Inc. (Sustain), a wholly owned subsidiary, supplies case management software systems and related products to courts and other justice agencies, including administrative law organisations. These courts and agencies use the Sustain family of products to help manage cases and information electronically and to interface with other critical justice partners.

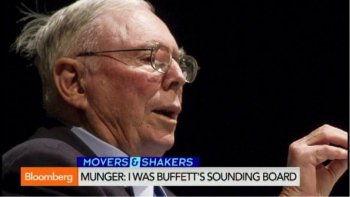

The company’s Chairman is none other than Charles T. Munger. Here’s a transcript of his comments from last week’s DJCO Shareholders meeting.

We’ve copied it here raw and unedited, but there are many pearls. It’s long, so print it off and enjoy.

“Welcome to the largest DJCO shareholder meeting not counting shareholders. We have a few shareholders and lots of groupies.”

“I welcome all of you including the groupies.”

“Our independent accounting firm, BDO, that’s our new accounting firm, is here. We prefer you to our old accountants. You remind me of something someone once asked me – what is my largest source of felicity? My wife’s first husband, that’s easy. You have a lovely position.”

“If anyone has any desire to look at the old minutes, Jerry has them. We don’t have any lunatics here who want to see the minutes?”

“Who in the hell are the 864 who abstained from the vote to hire the audit firm? You know, after the Japanese bombed Pearl Harbor, there was 1 vote against war. There’s always some nut.”

“I am going to talk very briefly on accounting and then not anymore on the subject. To be as late in filing is absolutely unheard of – you wouldn’t have an audit so late if the mafia was running it. Our ‘lack of internal control problems’ are trivial and of no consequence to anyone with any sense. They were like the doctor who wanted to cure the nosebleed by fishing around in the groin. They were confused and fishing around the groin charging for it by the hour. They did us an enormous damage the way an elephant would storming a barnyard stomping chickens. You can always use a useful bad example…” It is an example of a way to never to do something to one’s customers since DJCO is in the software sales business. “The auditor was feeding our main competitor lots of red meat and billing us for it.” It didn’t hurt in financial community due to reservoir of trust but did hurt them with customers. No feeling that EY was any worse than any other of Big 4. Business situation would’ve confused any auditor. Turning the other cheek didn’t start with Jesus – the real guy was Aristotle – suck it up and continue and have paid all the invoices. “Part of our trouble is that our business situation was complicated, and I’m sure we didn’t draw the top talent.” DJCO is large relative to other clients of new auditor. Charlie and Jerry are good at getting along with people they trust and admire but not good at disguising it when they’re around people they don’t admire, and that’s a fault of theirs. “Hopefully the new auditors will be more admirable – hard to imagine it could be worse.” Auditor did it “utterly unwittingly – turning the other cheek like Aristotle.”

DJCO is a declining business as have said time and again, and the golden revenues from publishing foreclosure notices in recent years was like being part of a big event like the Black Death – still have 90% share in public notices of foreclosure but there practically aren’t any left; “if you take the whole history of businesses that make surplus but go to hell due to technology, the result is lousy like Kodak. Technological obsolescence. Thomson Reuters is an exception, which is really rare. BRK is the other rarity – out of 3 failing businesses (New England textiles, Baltimore department store certain to go broke, trading stamp) came BRK – out of that little nothing, the excess capital we took out did better than anyone else – BRK just passed GE in market cap as a matter of fact; Kodak actually invented most of the stuff that others made money off of; GM towered over the economy when I was young – technology is hard; our declining business will last a while but at really modest profits”

Future is the software business and really like that – info should be in the cloud

“Most big software companies hate dealing with the government other than IBM but we like the agony as fewer people will come into it; trying to do something that people haven’t done” – odds are better than even that they pull it off

“As to surplus money, thank god we have it – all this extra money on the balance here and using it to create a software business; people are honest and cheerful about what is ahead; I actually kinda like the new model we have even though I don’t understand it” – not many new entrants – would buy his product over competitor’s and that’s his true test

Question about what he looks forward to and what he doesn’t look forward to in the next year. Munger starts his answer addressing the questioner – “spoken like a true groupie.” Had a very favored life and wonderful associates; problems his abilities could solve; luckily selected easy problems his whole life and has a good batting average; thankful to be alive; easy to be discouraged by what’s wrong and forget what’s right; doesn’t like vast growth of legalized gambling including that run by Wall St (derivatives); one legal drug is enough – liquor – 5% of alcohol drinkers ruin it for the other 95% – at least 1 of 20 descends into total alcoholism and those who recover have to be cultists to save their life – one more drug is a bad idea; doesn’t like tendency of governments to pay off fraud – bad for people to learn to lie to get money from the government – don’t do anything for injuries that can be faked – “it is appalling that you can buy all these diagnoses to create a big fraud puddle – the government is paying people to be crooks”

It is fabulous what’s been solved over last 100 years and how much better off the average person is. Harvard thinks they’ll soon create pancreatic cells from stem cells – will be unbelievable for diabetes; take the cars we drive – clever engineering and safety – a lot being done right; “hard sciences people make you feel good about your country”; “liberal arts people at the bottom of the pit are not welcome at my dinner table – if you’re gonna have an orgy, hold it somewhere else”

Not as optimistic as Warren – faith in long term – no one can be as optimistic. No achievement on this scale in entire history of the world like what China has done – prevented 450mm births (right thing to do), redoing agricultural system while lending to US and creating biggest economic achievement adjusted for scale in the world; reasonable peace with China – trade helps. “Mr. Piketty is daft. Of course free trade will reduce some high paid jobs here. The rest of us can be mature enough to adjust instead of bitching that things are tougher than we would’ve chosen; not a malevolent outcome done by plutocrats – is just a new world – sitting around for 36 hours a week static while rest of the world grows is the clear answer to the situation; I hope no Pikettys marry into my family.”

Believes DJCO products and business methods are better and won’t win every customer, but that is adult life – no easy bonanza ahead

“Anyone thinking the use of surplus cash as a permanent occurrence to create a mini-BRK with a chairman who’s 90 is living in fantasy land – you must believe in the tooth fairy.”

Re: the surplus cash from DJCO generated in recent years: “Our opportunity here was once in 40 yrs. We were the only game in town to report on the plague. In the whole history of BRK, we have had 1 new business started by ourselves at headquarters, which was reinsurance. We bought everything else – so it isn’t so damned easy to create a new business, but we don’t need a huge lot of achievements, just a few.”

Re: diversification fluff: “Why in the world should people pay a lot for being told to divide their investments in 200 pieces? It is weird. There is more dementia about finance than about sex.”

Re: inversions: “Horton’s is bigger than Burger King and Canada is practically part of the US – people are stark raving mad. This is a nonevent, and the press goes berserk. In world of free trade where corporations are mobile, a country pays a penalty for a tax system higher than average. If I were running the world, I would probably have low corporate taxes and get at the well-to-do people in some other way, like consumption taxes. I don’t care if someone makes a lot of money and holds it like a miser (most have a vast propensity to spend to buy spouses, children, in laws and helpers); we can get at equality in some other way like consumption tax. Singapore and Hong Kong, where people have done best, they have a low tax rate. It really is left-wing envy fighting with reality. What good is envy? Inequality of the rich isn’t a big problem, but it is a huge mistake to let people get rich by gambling and managing money; it would take me a week to write new laws for Wall Street, and the result would totally change the NYC real estate market (as in derivative profits would shrink and so would cash bonused to traders for them to spend on properties).”

“If the rest of world wasn’t so stupid, none of us would be rich – same people who see stupidity acting counterproductively want to keep the benefits but eliminate stupidity and can’t – if you stay rational, stupidity can help you unless you’re fighting a war. This room is filled with people whose comfort has come from the stupidity of other people.”

Terrible misbehavior by mortgage lenders – gross, horrible, abusive – “people got the idea they were perfect and they’re excrement didn’t stink – ‘every man is straight in his own eyes’ (Maimonides)” – was deplorable – if behavior is bad enough, have to have to some failure to change behavior of others – need more penalties against individuals for ghastly behavior; reaction was to have the corrective legislation as weak as possible – equivalent of giving alcohol to 14 yr olds on Indian reservation due to Native Americans’ susceptibility to alcoholism – taking people with bad credit and abusing their stupidity is a deeply immoral way to make money

Won’t ever see BRK buy casino – regards it as dirty money; use all kinds of tricks to lure people in; ought to be a standard of things in corporate America that things are legal but beneath us but prevailing behavior is to get away with as much as possible; “if all these crooks and promoters knew how much money there was in being honest, they’d all be in it .

8 large reinsurance transfers over $1b in world and all done by BRK because people trust them

“Everyone rushes into every god damn scummy activity and it seems to work; all these little people on pensions with 1 chair and 1 tv go lose 100% of their income a month at the casino;” not an honorable way to make a lot of money; “Would you want your son in law to do it? Maybe some of them already are. It is a big crowd.”

“To combat envy, just don’t care if someone else does better because someone always does, it is demented all this biggest house and boat” – envy is the only one of the 7 sins that is never fun – “You can’t envy your neighbor’s donkey, his wife, etc. Those old Jews were right to put all those laws in the Old Testament. It is a pernicious thing and we are better off without it. Everyone at some firms I see is overpaid by 150% and then someone goes berserk over $10k. Human beings actually behave this way; well, there’s child prostitution in Indonesia – should we all compete? No, let them win.”

Someone claims Charlie bet on a young Ron Burkle in Stater Brothers LBO – Charlie interrupts and says the guy is bungling his facts

Have been lucky or wise in trusting the right people; a guy he once knew in LA who was very successful financier and was a drunken playboy with $10mm illicitly earned; when questioned about his lifestyle, he said “my municipal bonds don’t drink” so, while Charlie may not be around forever, DJCO and BRK have a lot of assets that won’t go away

People have bid up DJCO to a price he wouldn’t pay – can’t do anything about it – “Groupies, sigh. People like you have bid our stock up to a price I wouldn’t pay.”

Likes us (groupies) because we remind him of himself and who doesn’t like his own image looking back at him?

“If you intelligently trade derivatives, it is a license to steal;” given a very easy hand to make a lot of money – get carried away by excess easily; doesn’t do the country any good to have a huge gambling market; lived in a world with low gambling for decades and liked it better; consuming to get something for nothing doesn’t do any good – probably quite a few professional poker players – “what the hell good are they doing for anybody?”

“If I were running a major bank, it would have less blow-up risk, but I wouldn’t be in the business at all, because I regard it as beneath me”

Like banks when they extend credit to good people – most noble a business out there – but crazy borrowing, no – Germany seems to avoid it, and they are fine – “they slept with the devil to encourage this massive credit boom” – all this maxing out credit cards shouldn’t be encouraged – owned a bank at BRK in Rockford, IL for 10 years – don’t have to go crazy, but a lot of people do.

BYD is getting widely recognized as being in a sweet spot of Chinese electric cars and buses – longevity of Beijing is 10 yrs less due to emissions – will stop burning gasoline soon; China recognizes that it must change this behavior that is killing tons of people; iron phosphate solution to lithium fire problem is good even though it is heavy; “Even engineers go crazy – a customer says ‘I want the last 2 pounds,’ which will kill you; you can’t take any more steel out of the bridge or make a battery any lighter. BYD is in a privileged position but it is not like the company has a first lien on the passage of time.”

If you’re as old as he is, you have seen a lot of inflation – but after inflation the country has done wonderfully – all the Jeremiahs of that age proven wrong – he disagrees with Paul Krugman who is smartest leftist he has read and uses the King’s English quite well – he is more fearful than Krugman – “Avoiding the German currency collapse could have prevented Hitler.”

“I have a peculiar attitude for a Republican – Fannie and Freddie are serving country well if we don’t go crazy. The fact that we came into it by accident doesn’t make it a bad solution. Considering the crisis, the result was not awful; politicians aided the crisis due to envy – do not go crazy when everyone else is which is what happened during subprime, and lax standards caused lots of problems – extending lousy credit is a dirty business, and we skirted disaster by a hair’s breadth because the leaders during the crisis made the right decisions – those who caused the crisis belong in the lowest circles of hell, but they didn’t ask me. “

“If someone asks you to do something that is bad enough, you can give up your damn job – Fannie was run by cavers looking to sell out for personal gain – they should have told their bosses to get a different errand boy – no man is fit to hold office unless he is willing to leave it at any time .”

“I know practically nothing about Alibaba except that it is powerful; I really don’t know what the hell … Not a field in which I am trying to be expert.”

Will integrate DJCO units as fast as is reasonably practicable

Most of Munger money (“I don’t count DJCO – that’s just a little asterisk”) – BRK, Costco and an Asian fund [Himalayan] – “it is totally unthinkable, I must not know what the hell I am doing with only three holdings, but I am right and they’re wrong. If someone is shrewd enough, 3 holdings held in perpetuity are more than enough security. I never had any interest in all this crazy merry-go-round – all my holdings are at all-time highs each day – am I doing it wrong?”

Would sell DJCO to someone they like and admire, and they run it so that any intelligent person would want to buy it – “Google would be out of its mind not to buy it, but it will take years for them to figure it out.”

Belridge Oil was a pink sheets company with liquidation value of 3x the share price and had a fee simple interest in the field – owned it all – “it is rare for a company to own the whole damn field; why in the hell I turned down buying a second block of shares, I had my head up my ass and it cost me $300-400mm. It didn’t take due diligence, I just had to take my head out of a place where it shouldn’t be. I have done it both ways and prefer to have my head working.” Was a mistake of omission – “An idiot could’ve sold the company for 3x the share price, and it happened to sell for 30x, which makes my mistake a lollapalooza.”

Scrambled around when he was young looking for anything that worked; was chasing inefficiencies in the pink sheets but when made enough money drifted into the “good people, good company” phase and returns haven’t declined – this area of investing is more comfortable for him

WSJ is very convenient for him – someone in the crowd said he doesn’t read it and Charlie asked what planet he is on – “I live in Marina del Rey.” “That may explain it.” It is a must-read publication and hasn’t lost integrity – “editorials were a little nuts – so right wing and pure in the past, but now they’re more sane, and the standards are relaxed.”

Re: building at University of Michigan: Wanted to get all the grad students from numerous disciplines in a conveniently located building with visiting professors and fellows – could only get that many people on that site by taking windows out of bedrooms – mocked up a model to prove it could work – that’s how they got so many on the site – “I saw that $100 more per room was being charged in rent for rooms in Ann Arbor with windows versus without, and I am capable of learning, but the architectural profession is usually bad at that, particularly the universities. Somehow the university agreed with me, so they’re smart.”

He has a torrent of books coming his way so he is a charity case – most of the books he gets he likes – is very selective – sometimes skims, reads 1 chapter or reads it twice. “People like you give me so many books I don’t have time to read any of my own choice.”

“If you just keep thinking and reading, you don’t have to work.”

Loves the Ron Chernow book on Rockefeller – may’ve been tough on competitors but as a partner was one of most admirable people in history and same for him as a philanthropist – Rockefeller was a simple Baptist – over 4,000 yrs of intense farming caused the Chinese soil to lose a nutrient which resulted in women dying – he funded them to put it back in the soil; totally revolutionized medical education in US and world with just $50mm; would carry his partners along in deals and take the blame for the losses and let them buy him at cost if it succeeded – usually the partners would then say “ok I am in” and fund their part after hearing Rockefeller’s good-hearted offer since he was the richest of them but still loyal to his guys – at BRK a Mormon who owned a furniture store wanted to close on Sundays in Vegas against BRK’s wishes offered the same deal, but BRK declined – couldn’t outdo Rockefeller’s generosity so they had to decline (laughter)

“In markets as big as this, a shrewd guy who can search out places where he has a true advantage will always do well because he is smarter and more diligent – there won’t be a universal or easy solution – the American market is tough to outperform if you’re buying big names in big quantities – I would hate the job personally of investing in $1B positions in 200 stocks trying to outperform – I would shrink from that with horror.”

Warren will deal extensively in annual report of “why did it happen, and will it continue?” re: how they built what they have with same number of shares outstanding now as when came from 3 failed businesses – reason they have a decent record is they picked things that were easy – have to be shrewd and very patient to wait until what you buy comes along at a price that makes the decision easy – contrary to human nature – sitting 5 years doing nothing makes you do something stupid because don’t feel active or useful; read an article by a man they he really liked and sent him the highest money he could without paying gift tax (~$20k) – article was about “if it is that easy, there must be something wrong” – well, maybe Warren plays bridge too much.

Elon Musk is a genius and doesn’t use that lightly – also one of the boldest men to ever come down the pike – but a problem when a man had an IQ of 175 and thinks it is 250.

People don’t pay enough attention to the fact that Charlie never succeeded in things in which he wasn’t interested – deep interest is part of the game “even if your only interest is Chinese calligraphy.”

BRK is very intelligently organized by accident – a portfolio of marketable securities taxed at 35% – (laugh) – somehow made it work – almost shouldn’t have happened – bumblebee shouldn’t have flown so well – float plus buying things they’ve held so no gains taxes – vast tax liability on balance sheet that they aren’t paying – insane to be structured as a corporation – correct system is private partnership – “such an easy question I am surprised he asked it.”

$120k from some retirement floated into his account yesterday – didn’t know what to do with it – had no “no brainer” to buy in today’s market – hard in the big securities now – take Costco – may be worth 25x earnings and won’t sell but doesn’t necessarily want to buy it at that price – likes it better than 90% of mkt at that price, but so spoiled he doesn’t want to buy anything at 25x – he is allowed to have crotchets and not be rational so cut him some slack.

Reluctance to teaching financial literacy in schools – “to expect total rationality in humans or human institutions won’t happen – how stupid academia can be is surprising when they have an IQ of 160 – the capital asset pricing model being taught as the gospel is twaddle – there’s lots of that stuff in academia – if you’re gonna teach gospel, teach Jeremiah to fundamentalist Christians;” economics has silliness too – too much trying to solve problems in the narrow construct they were taught – Economists failing to understand Japan’s struggle is silly – if competition in exporting increases, it is logical – “open up your mind.” “”They’ve got so much stimulus you can’t find a pothole on a side of a mountain anywhere in the country.”

Number of companies to own in a portfolio when can’t just hold 3 securities – depends – probably index funds who deserve the success they have had because have outperformed managers; talked to a smart money manager (“who agreed with me about everything, so he’s very smart”) and normally doesn’t talk to managers – he just indexes US equities and plays inefficiencies in the rest of the world with active managers

Tesco troubles – Lou Simpson bought it and Buffett bought more – formula worked for so long but stopped working well due to hubris such as ventures like Fresh and Easy and also got in trouble with competition from Aldi and others; how many companies can stay on top forever other than Wrigley’s gum? Aldi is a ruthlessly low cost and private label competitor that is terribly efficient – someone is always doing something that is eating your lunch – natural course of competition is that it gets tough.

“People don’t ordinarily get a divorce after being married for 50 years – usually they have adjusted to it” re: relationship with Buffett – “Einstein needed someone to talk to” – has been useful as a talking foil for Warren – don’t want to sit in a small room alone and make decisions – Einstein’s wife was a physicist but wasn’t very good so he needed confidants too.

“I can’t unravel the mysteries of Obamacare – but an old, rich man can say impolitic things” – wants single payer medicine with people being able to opt out and buy their own care – system causes a lot of unnecessary treatment that wastes a lot of money and causes lots of death and discomfort – existing system is crazy.

Increases in standard of living in US in future will get harder – free trade in rising countries in the world will make things harder – politicians are exploiting the angst of people who are struggling but this is the flux of life and necessary – can’t just stop the rise of China and Vietnam to save the New England textile union – flux in total makes the whole boat go up but it is inevitable that no group goes up at exactly the same time and rate – “not too worried by a lot of this modern claptrap.”

“The interesting thing about BRK is that the results are prodigious, and the people getting the results aren’t prodigies” – answer is they have a little better methods – knowing the edges of one’s competency makes up for a lot of IQ points – gets the no-brainers off his desk immediately and eliminates clutter – no one better at that than Jerry Salzman – huge trick to master – if problem is really hard and important, they rag it and keep coming back to it and have time to do it, because they avoid so much of the clutter – some people are imprisoned by the organizations they work for limiting or restricting what they do.

DJCO has already developed all the real estate that they own – business is shrinking – have more than what they need – “contact Jerry after the meeting if you’d like to rent some space.”

As long as BRK is doing as well as it is, they buy other companies or capital spend on utilities – perfectly happy to buy their own stock if the price gets lower; will have biggest utility business in US in 2 yrs – will be ok to make 9-10% returns on it with 0% float money with interest rates at 0, they’ll live that it isn’t 12%.

BRK has consciously avoided rapid technological obsolescence. “We had a printing press here at the DJCO for years here. They changed the god damn technology!”

DJCO had a huge moat and advantage but the internet has made it easy for lawyers to get information but not too worried about railroads, utilities and insurers; even where look technical like in carbide cutting business, BRK will only go into the space it when it is dominant player – he says he failed us at DJCO and at BRK with textiles and jewelers who won’t set records – just avoid technology – don’t jump over 7 ft fences – just hop over puddles with gold at the other side – not many of those but just enough for them.

“Wells Fargo was too cheap not to buy.”

Bought DJCO for $2.7mm and made it back in 3 years – pretty good record for a failing business.

“I am being told to leave the stage.”

“Last thing. It is easy to react to expectations that are way over-met –low expectations are much more fun – the secret is not fast ambition, it is low expectations – you really need it with a spouse.”

Actually Buffett (in the Buffett Partnership) was still getting over 30% returns on cigar butt companies and Graham style investing before Munger told Buffett it is worth paying more for good quality companies. This was I think 1959-69. It was a sort of private equity partnership. Buffett had the advantage and brains of getting to the board of these small companies he invested in and either getting his own way or having a big say in things. He would strip down the company if it was the best thing to do for him. He bought Berkshire Hathaway then as a struggling textile company.

After 1969 he closed down the Buffett Partnership because the market was overheated.

Munger was faster at picking up on buying great companies because of the success they had with See’s Candy. Other investors like Templeton and Keynes also realised that good companies were worth paying extra for. So Buffett was a tiny bit slower at picking up on this. But some investors didn’t combine both the Graham approach (quantitative) and the qualitative approach of looking at the market dynamics.

As Buffett’s ex-classmate put it, Buffett combined the Old Testament with the New Testament.

Roger,

And that is exactly what I was alluding to in my other, recent post on BRK.

For something that is as serious as an AGM, I think that any shareholder has the right to (a) abstain from a vote or vote against and (b) read the minutes without fear of being openly ridiculed (unless you are being a serial pest or just deliberately wasting time).

A year is a long time between AGMs and I am sure that some companies would prefer it if shareholders didn’t draw attention to previous minutes that might have things (such as questions on notice) that never got answered.

It is no wonder that with such an attitude from one of the executive, David Witt was reluctant to raise the ‘controversial’ issue of paying a dividend at the AGM this year. I would have been too, and it would be intimidating to be in a small town and a big room of thousands of other shareholders who consider “you” as the problem because you questioned the wisdom of the CEO.

Yes, how dare we, as mere shareholders !

Good points Chris…

Charlie Munger’s best bit of advice to Buffett was ‘some companies are worth paying a premium for’. Prior to meeting Munger, Buffett wasn’t that successful as an investor following the Benjamin Graham philosophy. I guess he means Best Businesses (growth stocks) e.g Ramsay, CSL, Flight Centre

Thank you for this Roger. It is much appreciated.