The US Labour Market: Inflation not dead and buried

With US ten-year bonds range trading between 1.5 per cent and 3.0 per cent over the past two years, there is a view that US inflationary expectations are dead and buried.

However, the US labour market is tightening, with the unemployment rate down from 10 per cent in 2010 to nearly 6 per cent currently. This is starting to feed into wages growth – with average hourly earnings starting to pick up.

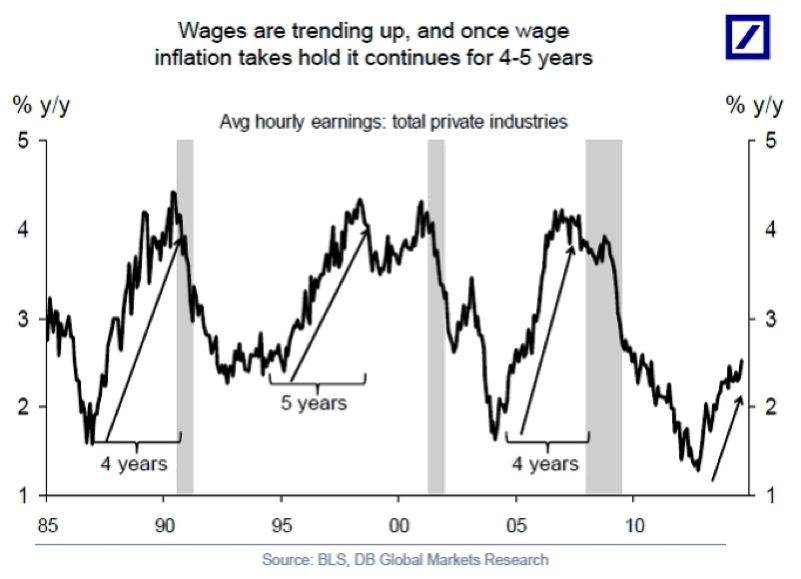

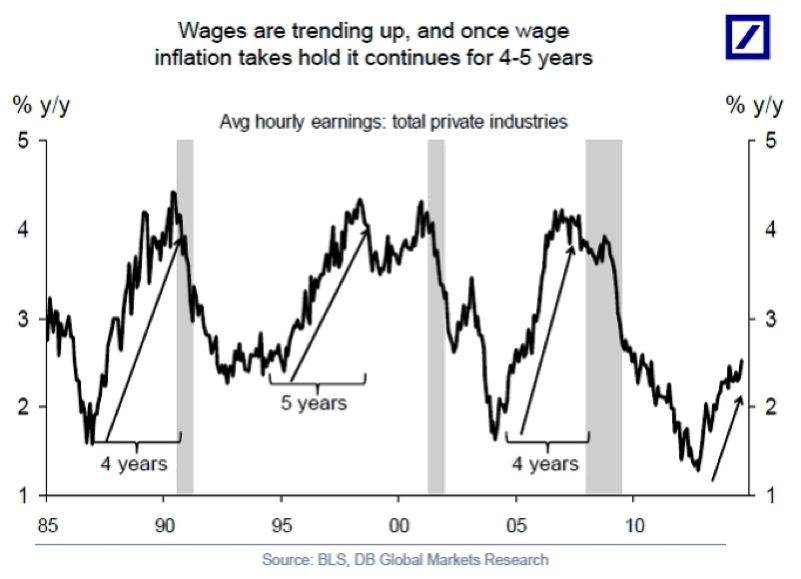

Using the accompanying graph, Torsten Slok from Deutsche Bank points out there were three periods in the 21 years to 2008 when wages were trending up; “…and once wage inflation takes hold, it continues for four to five years”.

It will certainly be interesting to see if we are in the early stages on one of those four to five year periods.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Lower company margins or increased consumer spending resulting in increased profits?