The US Federal Reserve and “Talk of Tapering”

The US Federal Reserve is using a variety of communications channels to indicate that it may be ready to start winding down the asset-purchasing arm of quantitative easing.

In one such example, talk of “tapering” has increased via the Federal governors’ public speeches.

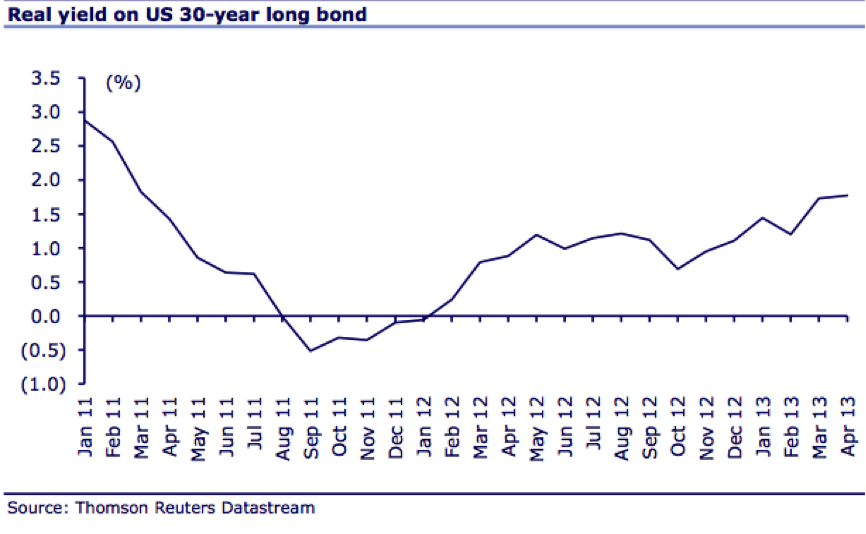

The debate is about the market clearing level for long-term “real” rates (or nominal interest rates minus inflationary expectations).

With declining inflationary expectations, and rising nominal yields, real US long bond yields have risen by over 2.0% since September 2011.

The MOVE index, which is essentially the credit-market equivalent of the VIX, tends to rise in conjunction with higher bond yields.

In the past ten months, we have seen a gentle increase in US Bond yields.

US Five Year Bonds are up 0.4% to above 1.0%, US Ten Year Bonds have risen 0.65% to 2.1%, and US Thirty Year Bonds are up 0.8% to 3.25%.

The MOVE Index has jumped as senior Federal Reserve officials introduce the term “tapering”.

Because the Federal Reserve has been buying so much Treasury paper over the past couple of years, artificially low real rates have not been allowed to seek their own “clearing” level.

“Clearing” theoretically means a level at which natural (non-Federal Reserve) demand and supply come into balance.

And “tapering” means that the market will increasingly set interest rates (rather than the Federal Reserve).

US stock market gains this year have largely come from P/E expansion. However, the more (real) bond yields and volatility rises, the more nervous equity investors will get.

http://www.newyorkfed.org/newsevents/speeches/2013/dud130521.html

William C. Dudley became the 10th president and chief executive officer of the Federal Reserve Bank of New York on January 27, 2009. In that capacity, he serves as the vice chairman and a permanent member of the Federal Open Market Committee (FOMC), the group responsible for formulating the nation’s monetary policy.

Extract from Speech

Of course, as we have learned, we have acted to rectify these shortcomings. For example, our asset purchases are now outcome based, tied to the goal of substantial improvement in the labor market outlook, and our forward guidance on short-term rates is tied to unemployment and inflation thresholds rather than to a calendar date.

( if i remember correctly 6.5% unemployment or inflation 2.5%).

In the U.S., in recent months we have communicated that short-term rates are likely to stay very low for a long time; our balance sheet is likely to increase further in size and then stay large for a long time; and that we will not be overly hasty in tightening monetary policy once the recovery gets well established.

To manage expectations well, both credibility and good communication is essential.

In this regard, a central bank’s credibility is crucial. Only if a central bank does what it promises to do will expectations be solidly anchored.

As you can see, there will be much more to learn as we go.

This is from May 21,2013

This is same old Alan Greenspan clap trap.

there is no exit strategy only inflation: start… stop… start… forever.

check data since 1913… bubbles are getting bigger not smaller.